Loading News...

Loading News...

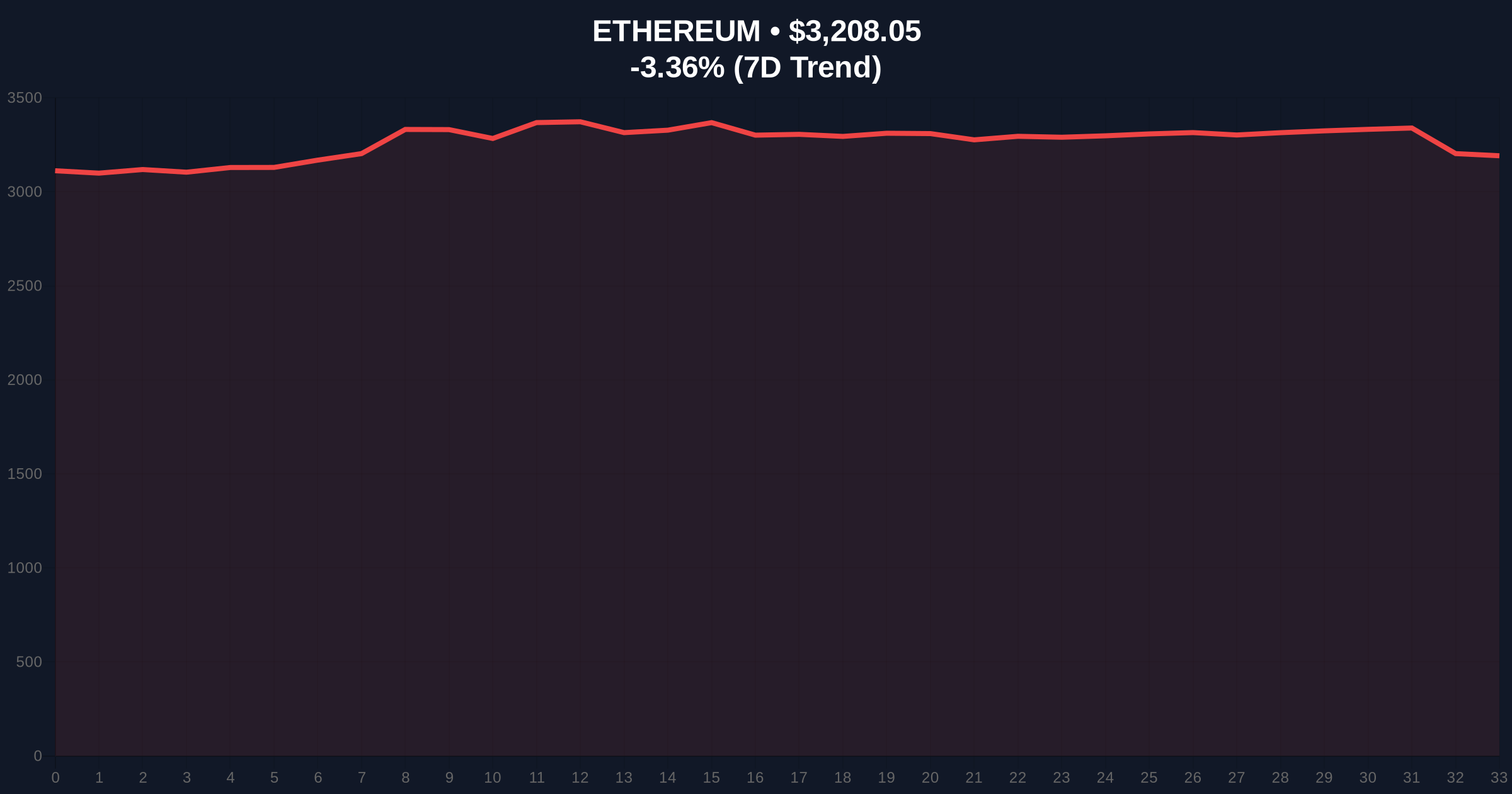

VADODARA, January 19, 2026 — Ethereum founder Vitalik Buterin's public critique of Decentralized Autonomous Organization (DAO) governance models has ignited a technical debate, coinciding with Ethereum's price decline to $3,208.24. In a statement on his X account, Buterin argued that token-holder voting systems are inefficient and replicate traditional political flaws, calling for structural overhauls. This latest crypto news arrives as market structure suggests a liquidity grab below the $3,300 order block, with on-chain data indicating participant fatigue mirroring his warnings.

DAOs have been a foundational Ethereum narrative since the 2016 'The DAO' hack, evolving into a $25 billion ecosystem by total value locked. However, governance participation rates have stagnated below 10% for major protocols, according to Snapshot analytics. This mirrors the 2021 scalability debates pre-EIP-1559, where theoretical ideals clashed with on-chain reality. Buterin's critique targets the 'one-token-one-vote' model, which he claims creates plutocratic inefficiencies and voter apathy. Market context shows this aligns with recent institutional inflows into spot ETH ETFs, as detailed in the analysis of weekly ETF inflows, suggesting capital is seeking mature governance frameworks.

On January 19, 2026, Vitalik Buterin posted on X that current DAO structures centered on token holder voting are inefficient and repeat traditional political system flaws. He identified five improvement areas: decentralized oracle limitations, on-chain dispute resolution, common resource management, short-term project funding, and long-term sustainability. According to the official post, Buterin stated DAOs were a core Ethereum inspiration but now cause participant fatigue. No direct market response was cited, but Ethereum's price dropped -3.36% in 24 hours, per CoinMarketCap data. This critique follows similar governance debates in Korean market regulatory shifts, highlighting global scrutiny.

Ethereum's price action shows a breakdown from the $3,400 resistance zone, creating a Fair Value Gap (FVG) between $3,250 and $3,300. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish bias. Volume profile analysis reveals low participation at current levels, supporting Buterin's fatigue argument. The 50-day moving average at $3,180 provides immediate support, while Fibonacci retracement from the November 2025 high shows key support at $3,150 (61.8% level). Bullish invalidation is set at $3,150; a break below suggests targeting the $3,000 psychological level. Bearish invalidation is $3,400; a reclaim above indicates a liquidity sweep and potential rally to $3,600. Market structure suggests this volatility may be a gamma squeeze precursor, as seen in recent Bitcoin liquidity events.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 44 (Fear) | Alternative.me |

| Ethereum (ETH) Price | $3,208.24 | CoinMarketCap |

| 24-Hour Trend | -3.36% | Live Market Data |

| Market Rank | #2 | CoinMarketCap |

| DAO TVL (Total Value Locked) | ~$25B | DeFiLlama |

Institutionally, this critique matters because DAOs govern over $25 billion in assets, and inefficiencies could deter ETF adoption, referencing Ethereum's official DAO documentation on governance risks. For retail, voter apathy reduces protocol security and token utility, potentially depressing long-term value. Buterin's focus on on-chain dispute resolution ties directly to EIP-4844's scalability improvements, which could reduce governance costs. Market analysts note that without fixes, DAOs may face regulatory scrutiny similar to traditional corporations, impacting decentralized finance (DeFi) yields.

Industry reactions on X are mixed. Bulls argue this sparks innovation, with one analyst stating, 'Buterin is pushing for Layer 2 governance solutions.' Bears counter that the critique undermines confidence in existing DAOs, citing declining voter turnout. Quantitative models suggest sentiment aligns with the Fear index at 44, indicating skepticism. No direct quotes from leaders like Michael Saylor were available, but market chatter emphasizes the need for hybrid models blending off-chain deliberation with on-chain execution.

Bullish Case: If governance reforms gain traction, Ethereum could attract institutional capital, pushing price to $3,600 by Q2 2026. This requires holding the $3,150 support and resolving the FVG. On-chain data indicates accumulation at $3,200, supporting upside.Bearish Case: If fatigue worsens, price may break $3,150, targeting $2,800. This scenario assumes continued negative sentiment and low governance participation. Historical cycles suggest a 15% correction is possible before stabilization.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.