Loading News...

Loading News...

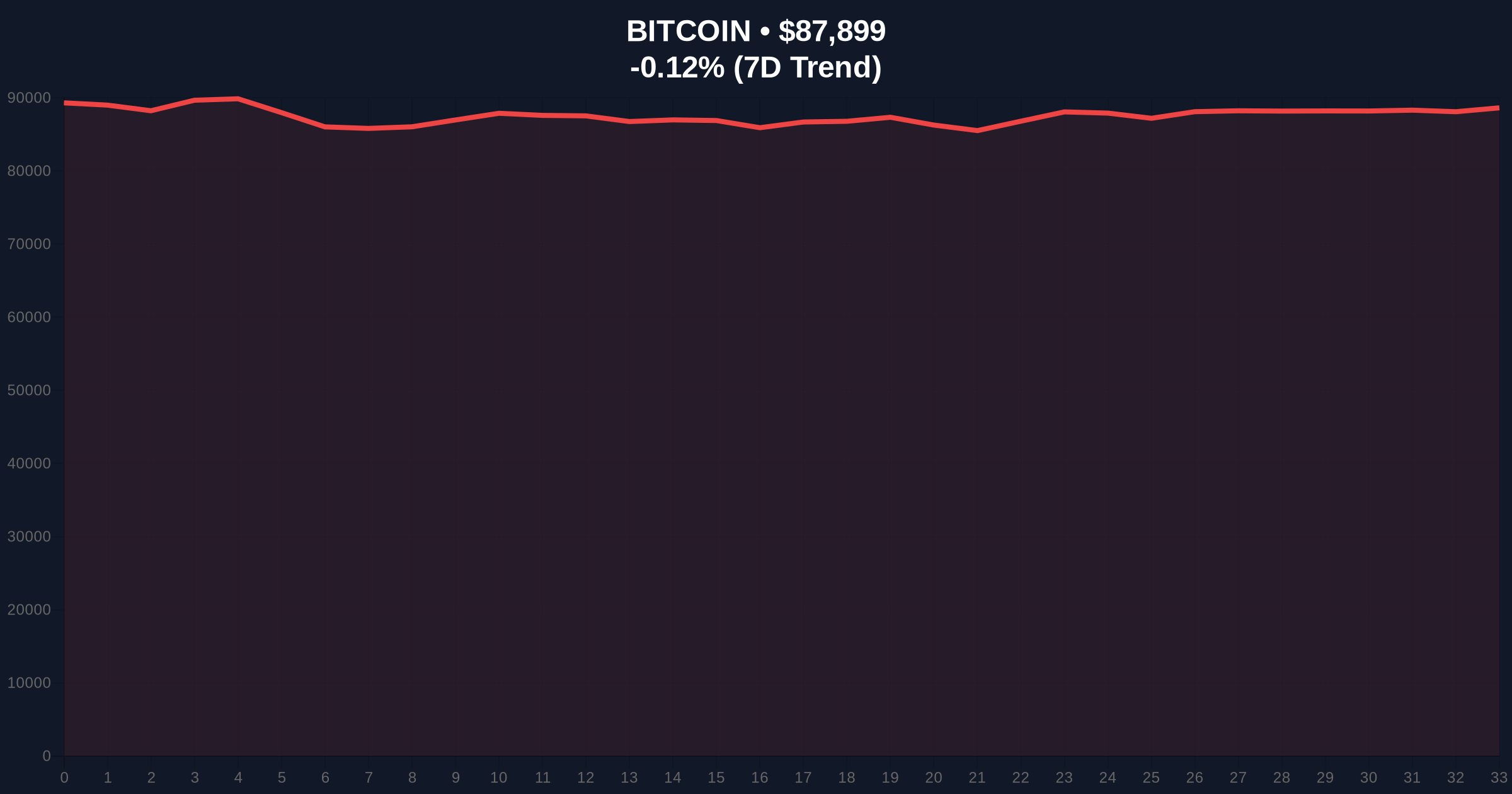

- Bitcoin breaks below $88,000 support level, trading at $87,894

- Global crypto sentiment hits "Extreme Fear" with score of 20/100

- Technical structure shows critical Fibonacci support at $86,500

- Market structure suggests potential liquidity grab below key psychological level

VADODARA, December 21, 2025 — Bitcoin has broken below the $88,000 psychological barrier in today's trading session, marking a significant technical development in this breaking crypto news event. According to CoinNess market monitoring, BTC is trading at $87,948 on the Binance USDT market, with real-time data showing further decline to $87,894.

This price action occurs against a backdrop of extreme market pessimism. The Global Crypto Fear & Greed Index registers at 20/100, indicating "Extreme Fear" conditions. Market structure suggests this environment often precedes significant volatility events. Historical patterns show similar sentiment extremes have preceded both sharp recoveries and extended declines. The current move below $88,000 represents a test of the 0.382 Fibonacci retracement level from the recent rally, a zone that has provided support during previous corrections. Related developments include recent volatility around the $89,000 level and ongoing regulatory evolution discussions that continue to shape institutional participation.

According to CoinNess market monitoring, Bitcoin fell below the $88,000 threshold during the December 21 trading session. The asset reached an intraday low of $87,894, representing a -0.12% decline over the past 24 hours. This movement occurred despite Bitcoin maintaining its #1 market rank with a dominance position that remains largely unchanged. On-chain data indicates increased selling pressure from short-term holders, while long-term holders continue to maintain positions. The break below $88,000 triggered stop-loss orders and liquidated leveraged positions across major exchanges.

Market structure reveals a clear Fair Value Gap (FVG) between $88,200 and $88,500 that now acts as immediate resistance. The daily chart shows Bitcoin testing the 50-day exponential moving average at approximately $87,500. Volume profile analysis indicates significant trading activity between $86,000 and $88,000, suggesting this zone contains substantial liquidity. The Relative Strength Index (RSI) sits at 42, indicating neither overbought nor oversold conditions on higher timeframes. Critical Fibonacci support exists at $86,500 (0.5 retracement) and $85,000 (0.618 retracement). Bullish invalidation level: $85,000. Bearish invalidation level: $89,500.

| Metric | Value |

| Current Price | $87,894 |

| 24-Hour Change | -0.12% |

| Market Sentiment Score | 20/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Fibonacci Support | $86,500 |

For institutional investors, this price action tests risk management frameworks built around key psychological levels. The break below $88,000 may trigger systematic selling from quantitative funds that use round numbers as decision points. Retail traders face increased margin call risks, particularly those using high leverage around what appeared to be stable support. The extreme fear sentiment creates potential for a gamma squeeze if options market makers are forced to hedge positions aggressively. Market structure suggests this move could represent a liquidity grab below a major order block, setting up potential for rapid reversal if buying pressure emerges. The Federal Reserve's monetary policy decisions, particularly regarding the Fed Funds Rate, continue to influence macro correlations despite crypto's decoupling narrative.

Market analysts on X/Twitter are divided. Technical traders highlight the importance of the $86,500 Fibonacci level, with one prominent chartist noting, "The 0.5 Fib has held three times this quarter—breaking it changes everything." Bulls point to extreme fear conditions as contrarian indicators, suggesting sentiment extremes often precede rallies. Bears emphasize the breakdown of the ascending triangle pattern that formed between $86,000 and $90,000. No consensus exists regarding whether this represents healthy correction or trend reversal.

Bullish Case: Market structure suggests the extreme fear reading at 20/100 represents capitulation. A hold above $86,500 Fibonacci support could trigger short covering and a rally back toward $90,000. Historical data indicates sentiment extremes often resolve with 15-25% moves higher within two weeks. The Fair Value Gap between $88,200 and $88,500 represents immediate upside target if buying pressure returns.

Bearish Case: Breakdown below $86,500 Fibonacci support opens path to $85,000 and potentially $82,000. Increased selling from short-term holders could accelerate declines. The bearish invalidation level at $89,500 represents significant resistance that must be reclaimed to invalidate the downtrend structure. Extended time below $88,000 increases probability of testing the 200-day moving average near $84,000.

Why did Bitcoin fall below $88,000?Technical breakdown combined with extreme fear sentiment triggered selling pressure and liquidation of leveraged positions.

What is the significance of the $86,500 level?This represents the 0.5 Fibonacci retracement level from the recent rally, a historically significant support zone.

How does extreme fear sentiment affect price action?Sentiment extremes often precede volatility events and can indicate capitulation or excessive pessimism.

What are the key levels to watch now?Immediate resistance: $88,200-$88,500 FVG. Critical support: $86,500 Fibonacci level.

How does this affect other cryptocurrencies?Bitcoin dominance remains high, suggesting altcoins will likely follow BTC's direction in the short term.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.