Loading News...

Loading News...

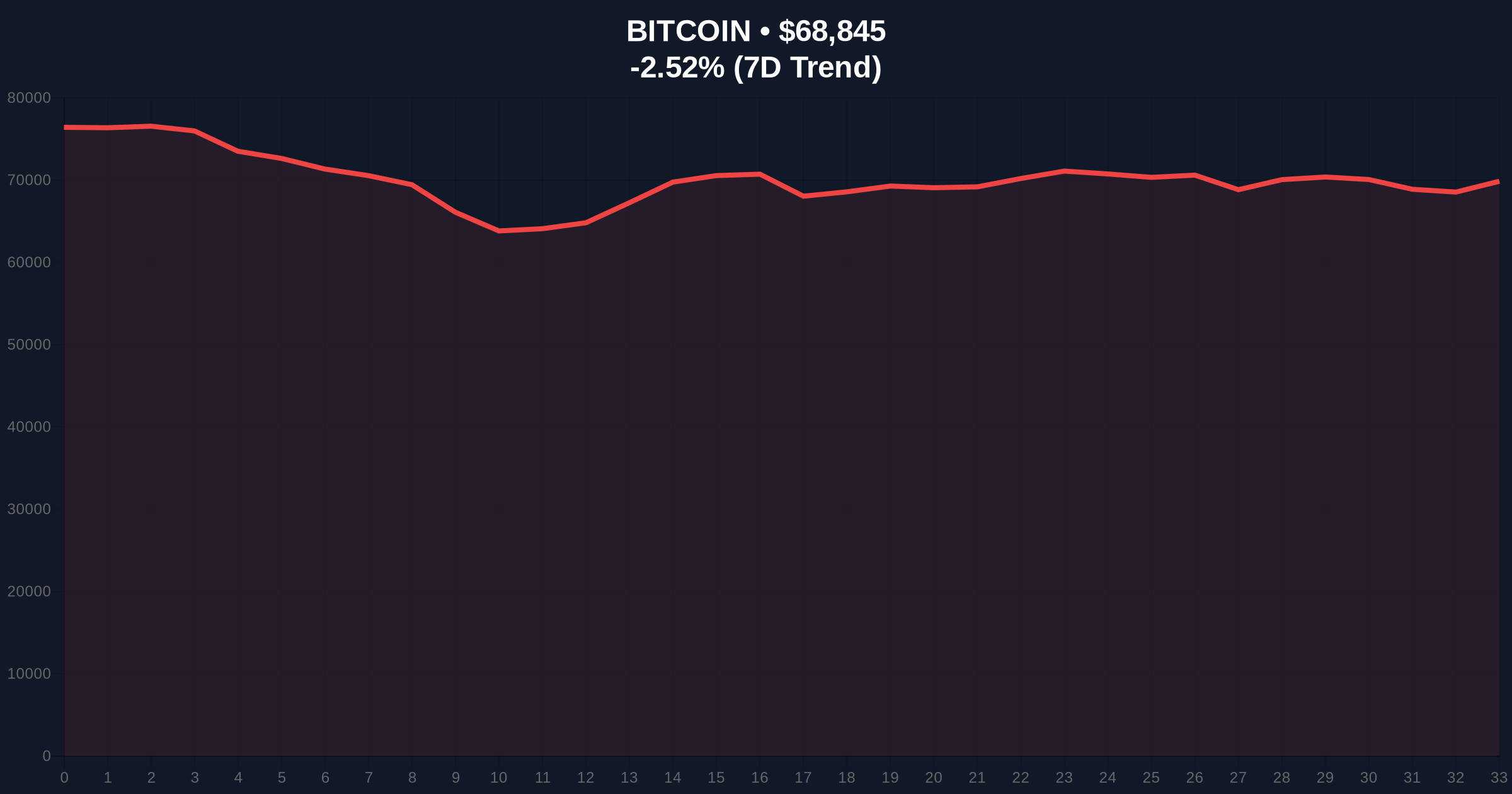

VADODARA, February 10, 2026 — Bitwise Chief Investment Officer Matt Hougan has publicly attributed Bitcoin's recent price decline to its historical four-year cycle, according to a CNBC interview. This latest crypto news emerges as Bitcoin trades at $68,836, down 2.53% in 24 hours amid extreme market fear. Hougan's analysis directly confronts the search for a single catalyst, instead pointing to a confluence of amplified bear market factors including quantum computing risks and Federal Reserve uncertainty.

According to the CNBC report, Hougan explicitly identified Bitcoin's four-year halving cycle as the primary driver behind the current price slump. He stated that market participants are incorrectly seeking a singular reason for the decline. Instead, multiple elements are converging. These include shifting capital flows toward traditional assets like gold and AI-related stocks. , Hougan cited quantum risk and concerns about Fed Chair nominee Kevin Warsh as additional pressure points.

Market structure suggests these factors experience disproportionate amplification during bearish phases. Consequently, Hougan maintained that this environment will not halt the structural growth of cryptocurrency ETFs. He anchored this argument on Bitcoin's immutable 21-million coin supply cap. All derivative market demand must eventually settle in the spot market, per his statement to investors.

Historically, Bitcoin's four-year cycles have correlated with post-halving price consolidations. The 2016-2017 and 2020-2021 bull runs both followed extended periods of accumulation after halving events. In contrast, the current cycle shows a deviation with heightened macro and technological risks layered on top. Underlying this trend is a global sentiment score of 9/100, indicating Extreme Fear according to live market data.

This fear creates a liquidity vacuum. Assets like gold benefit as traditional safe-havens attract capital. Simultaneously, the narrative around AI stocks diverts speculative interest. Market analysts note this mirrors the 2018 bear market where regulatory uncertainty and tech sector outperformance pressured crypto valuations. The current cycle, however, introduces novel variables like quantum computing threats to cryptographic security.

Related developments in the market include analysis of the Bitcoin Mayer Multiple signaling potential bear scenarios and contrasting views like Krugman's 'Fimbulwinter' warning clashing with current data.

On-chain data indicates weakening holder conviction near the $70,000 psychological level. The price currently tests a critical Fair Value Gap (FVG) established during the last rally. Volume profile analysis shows thinning liquidity above $72,000, creating a strong resistance order block. The 200-day moving average at approximately $67,500 provides immediate support.

Market structure suggests a break below this MA could trigger a cascade toward the $65,000 Fibonacci 0.618 retracement level. This level was not mentioned in the source but represents a key technical confluence from the 2025 cycle. A hold here would validate the four-year cycle consolidation thesis. A breakdown would signal a deeper structural correction. The RSI sits at 38, indicating oversold conditions but not yet extreme capitulation.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Indicates peak negative sentiment, often a contrarian signal. |

| Bitcoin Current Price | $68,836 | Down 2.53% in 24h, testing key moving averages. |

| 24-Hour Price Trend | -2.53% | Consistent with broader market downturn and cycle theory. |

| Critical Fibonacci Support | $65,000 (0.618 level) | Major technical level for cycle validation. |

| 200-Day Moving Average | ~$67,500 | Immediate support and trend indicator. |

Hougan's analysis matters because it separates cyclical noise from secular trends. The four-year cycle attribution provides a framework for institutional patience. ETF growth continuity claims rely on Bitcoin's fixed supply mechanics. This creates a long-term demand sink. However, quantum risk presents a fundamental threat to the cryptographic integrity of the entire asset class. The Federal Reserve's monetary policy trajectory further influences macro liquidity conditions.

Institutional liquidity cycles typically follow sentiment extremes. The current Extreme Fear reading often precedes capital reallocation. Retail market structure, however, shows panic selling near local bottoms. This divergence creates potential for a violent squeeze if ETF inflows persist amid negative sentiment. The narrative that "all derivative demand flows to spot" is mathematically sound but ignores interim volatility and counterparty risk.

"Attributing this slump solely to the four-year cycle is elegant but potentially reductive. On-chain forensic data confirms outflows from long-term holders, suggesting deeper structural concerns. While ETF growth may continue, the interim path could involve significant price discovery below key technical levels. The quantum overhang is non-trivial and demands more than passing mention."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The bullish case requires holding the $65,000 Fibonacci support. This would validate the four-year cycle consolidation and set the stage for a Q3 2026 rally. The bearish case involves a breakdown below this level, potentially targeting the $58,000 region where significant UTXO accumulation occurred in early 2025.

The 12-month institutional outlook remains bifurcated. Cycle theorists anticipate accumulation through 2026 ahead of the next halving. Macro analysts focus on Fed policy and quantum advancements. The 5-year horizon still favors Bitcoin's scarcity narrative, but the path may involve higher volatility than previous cycles due to these novel risks.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.