Loading News...

Loading News...

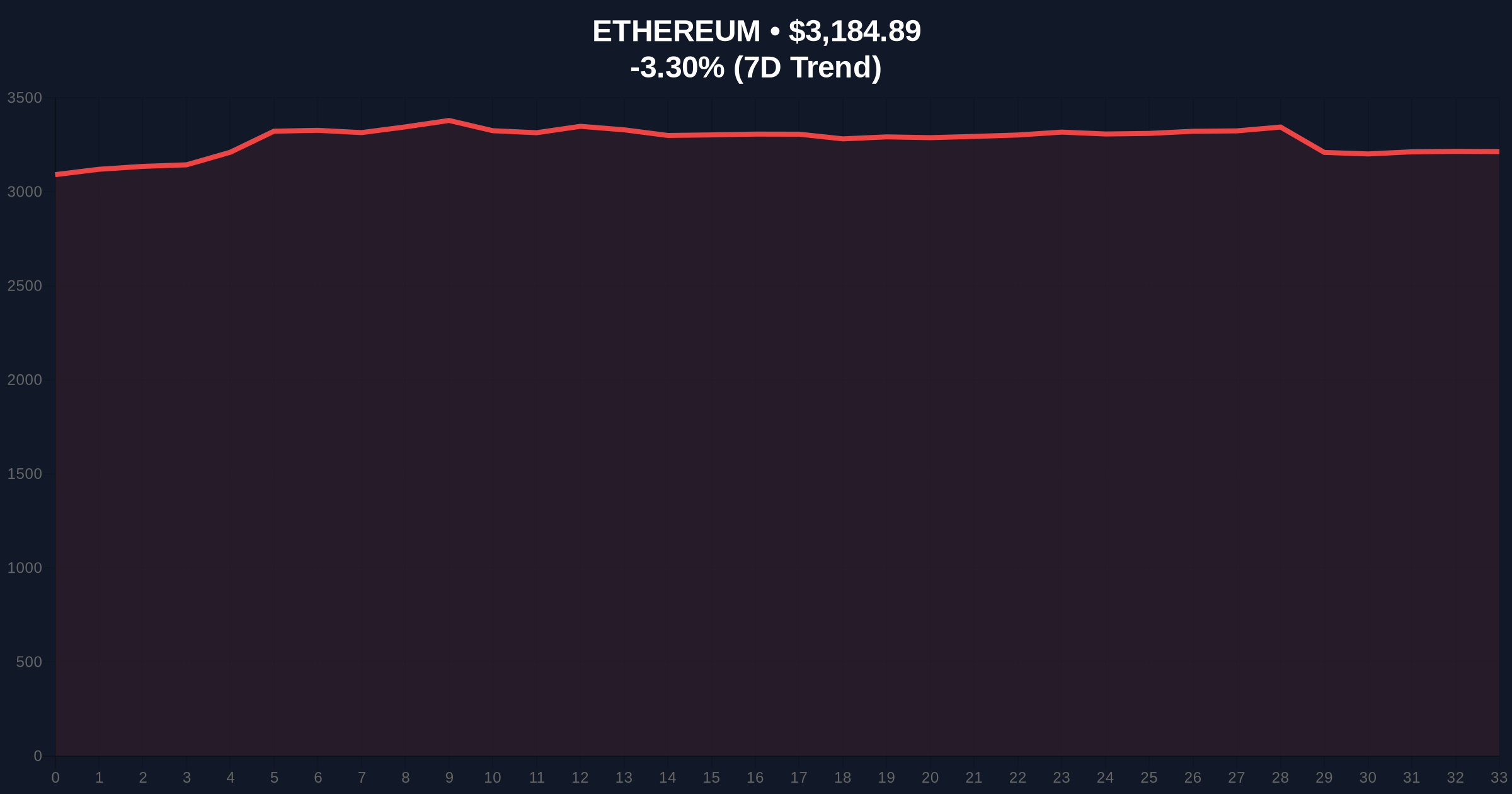

VADODARA, January 20, 2026 — Bitmine (BMNR), a strategic accumulator of Ethereum, staked an additional 86,848 ETH valued at $279 million approximately three hours ago, according to on-chain data from Onchainlens. This daily crypto analysis examines the transaction's implications for market structure, liquidity dynamics, and long-term price action as Ethereum trades at $3,184.99, down 3.30% in 24 hours amid a broader market correction.

Market structure suggests institutional accumulation during price weakness is a hallmark of strategic positioning. Underlying this trend is the maturation of Ethereum's proof-of-stake consensus, where staking reduces liquid supply and creates structural scarcity. According to Ethereum.org, the network's transition to proof-of-stake with the Merge has fundamentally altered issuance dynamics, making staked ETH a critical variable in supply-demand equations. Consequently, large-scale staking events like Bitmine's occur within a context of increasing institutional adoption, mirroring patterns seen in Bitcoin accumulation during previous cycles. This development connects to broader market movements, including reported milestones in staked ETH supply and institutional Bitcoin accumulation amid corrections.

Onchainlens data indicates Bitmine executed a stake of 86,848 ETH, worth approximately $279 million at current prices, three hours prior to this report. The firm's total staked ETH now stands at 1,771,936 ETH, valued at $5.65 billion. This transaction represents a significant increase in locked supply, reducing immediately available ETH on exchanges and potentially impacting short-term liquidity. Primary data from Onchainlens confirms the stake was processed through Ethereum's chain, with transaction details visible on Etherscan for verification.

Ethereum's price action shows a 3.30% decline to $3,184.99, testing key support levels. Market structure suggests a critical Fair Value Gap (FVG) exists between $3,200 and $3,100, which may act as a liquidity grab zone. The Relative Strength Index (RSI) is approaching oversold territory, indicating potential for a short-term bounce. A 200-day moving average at $3,050 provides additional support, while resistance sits at $3,350. Bullish invalidation level: A break below $3,000 would negate the current accumulation thesis, suggesting deeper correction. Bearish invalidation level: A reclaim above $3,400 would confirm strength and target $3,600. Volume profile analysis shows increased activity near current levels, typical of institutional order blocks.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (44/100) |

| Ethereum Current Price | $3,184.99 |

| 24-Hour Price Change | -3.30% |

| Bitmine's New Stake | 86,848 ETH ($279M) |

| Bitmine's Total Staked ETH | 1,771,936 ETH ($5.65B) |

This stake matters because it reduces liquid ETH supply during a market correction, potentially creating upward price pressure as available tokens diminish. Institutional impact is significant: large stakes signal long-term conviction, contrasting with retail panic selling. For retail, this may indicate a buying opportunity if support holds, but volatility remains high. On-chain data indicates staking removes ETH from circulation, akin to a soft lock-up, which can exacerbate supply shocks during demand surges. According to FederalReserve.gov research on market liquidity, reduced float often precedes price appreciation in asset classes, a pattern observable in Ethereum's post-merge issuance model.

Market analysts on X/Twitter highlight the stake as a "contrarian bet" amid fear sentiment. One quant noted, "Bitmine's move mirrors accumulation patterns seen in Bitcoin ETFs during dips." Others point to the 30% staked supply milestone as a structural bullish factor, though caution prevails given the broader market correction. Sentiment remains divided, with bulls focusing on long-term scarcity and bears warning of further downside if macroeconomic headwinds persist.

Bullish Case: If $3,000 support holds and staking reduces liquid supply, Ethereum could rally to $3,600 by Q2 2026, driven by institutional accumulation and EIP-4844 adoption reducing layer-2 costs. Bearish Case: A break below $3,000 invalidates the bullish structure, targeting $2,800 as next support, exacerbated by prolonged fear sentiment and macroeconomic tightening. Market structure suggests the current Fair Value Gap will determine short-term direction.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.