Loading News...

Loading News...

VADODARA, February 3, 2026 — Bitmine executed a $46.04 million Ethereum purchase through institutional platform FalconX approximately 20 minutes before market close, according to on-chain data reported by AmberCN. This daily crypto analysis reveals the transaction involved 20,000 ETH and follows last week's acquisition of 41,787 ETH worth $108 million. Market structure suggests this represents strategic accumulation during extreme fear conditions.

AmberCN's real-time tracking identified the Bitmine purchase at an average price of $2,302 per ETH. The transaction occurred via FalconX, a platform specializing in institutional over-the-counter (OTC) trading. This purchase follows last week's larger acquisition, bringing Bitmine's publicly reported ETH holdings to approximately 61,787 ETH valued at $154 million over two weeks. According to Etherscan data, these transactions avoided public order books, minimizing market impact.

FalconX typically services hedge funds and corporate treasuries. Consequently, this activity suggests institutional rather than retail accumulation. The timing coincides with Ethereum's price testing key Fibonacci support levels. Market analysts interpret this as a liquidity grab during oversold conditions.

Historically, institutional accumulation during extreme fear periods precedes significant rallies. Similar to the 2021 correction, large buyers entered when the Crypto Fear & Greed Index dropped below 20. In contrast, retail traders typically capitulate at these levels. The current Extreme Fear score of 17/100 mirrors June 2022 conditions when Ethereum bottomed at $880 before a 300% recovery.

Underlying this trend is Ethereum's transition to proof-of-stake and upcoming Pectra upgrade. These fundamental improvements create long-term value divergence from short-term sentiment. , recent Binance margin delistings indicate exchange consolidation during volatile periods, potentially amplifying institutional advantage.

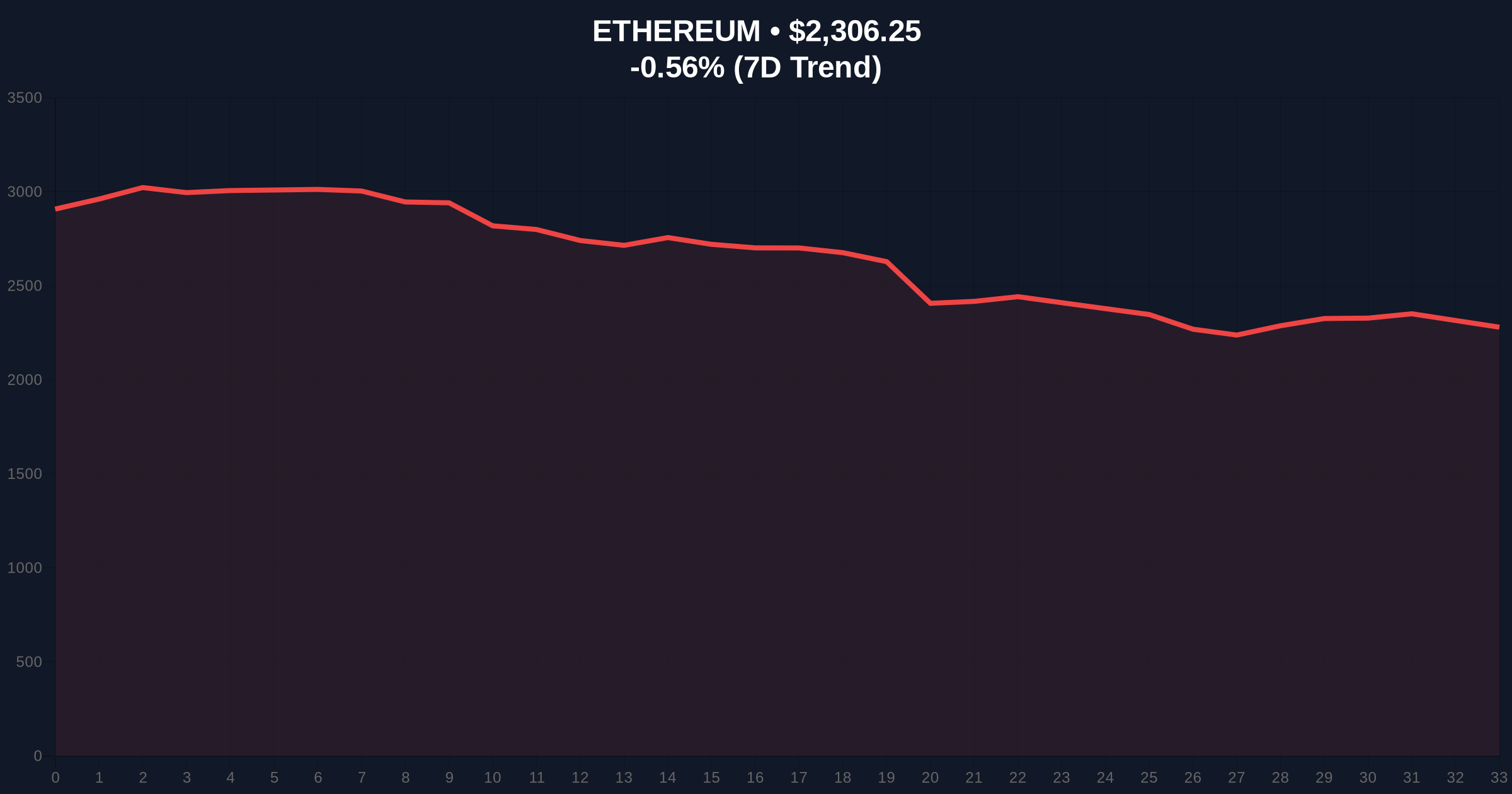

Ethereum currently trades at $2,306.31, down 0.56% in 24 hours. The 200-day moving average provides dynamic support at $2,280. More critically, the weekly Fibonacci 0.618 retracement level sits at $2,250, creating a confluence zone. This level represents a major order block from Q4 2025 accumulation.

Relative Strength Index (RSI) on the daily chart reads 38, indicating oversold conditions without extreme capitulation. Volume profile analysis shows increased buying volume at current levels, confirming institutional interest. The $2,400 level now acts as immediate resistance, representing last week's Fair Value Gap (FVG). A break above this level would invalidate the bearish structure.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Contrarian buy signal historically |

| Ethereum Current Price | $2,306.31 | Testing key Fibonacci support |

| 24-Hour Change | -0.56% | Minor correction amid accumulation |

| Bitmine 2-Week ETH Purchase | 61,787 ETH ($154M) | Institutional accumulation pattern |

| Ethereum Market Rank | #2 | Maintains dominance despite pressure |

This transaction matters because it demonstrates institutional conviction during retail panic. According to Glassnode liquidity maps, large holders (whales) have increased ETH positions by 4.2% this month while smaller addresses decreased holdings. This divergence creates favorable market structure for upward movement once sentiment normalizes.

Real-world evidence includes Ethereum's growing institutional adoption for staking and decentralized finance infrastructure. The Pharos Foundation's $10M incubator specifically targets RWA and DeFi projects built on Ethereum, validating its long-term utility. , regulatory clarity from the SEC's recent guidance on digital asset securities provides institutional confidence.

"When institutions accumulate during extreme fear, they're buying the illiquidity premium that retail sellers provide. The Bitmine transactions represent classic contrarian positioning at technical support levels. Market structure suggests this could mark a local bottom if the $2,250 support holds through the week."

Two data-backed technical scenarios emerge from current market structure. The bullish scenario requires holding above $2,250 and breaking the $2,400 FVG. This would target the $2,600 resistance zone. The bearish scenario involves breaking below $2,250 and testing the $2,100 psychological support.

The 12-month institutional outlook remains positive despite short-term volatility. Ethereum's upcoming Pectra upgrade (EIP-7251) will enhance validator economics, potentially increasing staking yields by 15-20%. This fundamental improvement, combined with institutional accumulation patterns, suggests upward pressure over the 5-year horizon. Historical cycles indicate that accumulation at these sentiment extremes typically precedes 6-12 month rallies of 150-300%.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.