Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Bitmine (BMNR) now holds 397 million ETH, representing 3.28% of total supply

- The firm is 66% toward its goal of accumulating 5% of all Ethereum

- Accumulation occurs amid "Extreme Fear" market sentiment (Score: 20/100)

- ETH trades at $2,976.48 with 0.85% 24-hour gain despite broader uncertainty

VADODARA, December 20, 2025 — Bitmine (BMNR) has acquired 397 million Ethereum (ETH), reaching 66% of its target to accumulate 5% of the total ETH supply. This breaking crypto news comes as the cryptocurrency market grapples with extreme fear sentiment, with Ethereum maintaining position as the second-largest cryptocurrency by market capitalization. According to Cointelegraph's X report, Bitmine's current holdings represent approximately 3.28% of Ethereum's total circulating supply.

Market structure suggests this accumulation mirrors institutional strategies during previous crypto winters. The 2022-2023 bear market saw similar accumulation patterns from entities like MicroStrategy with Bitcoin. Ethereum's transition to proof-of-stake via The Merge created new accumulation dynamics, with staking yields now competing with traditional fixed income. According to on-chain data, large-scale accumulation during fear periods typically precedes significant price appreciation cycles. The current "Extreme Fear" reading at 20/100 on the Crypto Fear & Greed Index indicates maximum capitulation zones where strategic accumulation occurs.

Related developments in the mining sector include Bitdeer's weekly Bitcoin mining and sales report, which shows miners adjusting strategies amid market pressure. Meanwhile, a whale withdrawal of $88.28M in ZEC from Binance suggests similar accumulation patterns across different assets during fear periods.

Bitmine disclosed its Ethereum holdings through regulatory filings and public statements. The firm currently holds 397 million ETH, valued at approximately $1.18 trillion at current prices. This represents 3.28% of Ethereum's total supply of approximately 12.1 billion ETH. Bitmine's stated goal is to accumulate 5% of total supply, requiring an additional 203 million ETH to reach approximately 600 million ETH total. The accumulation appears systematic rather than opportunistic, with purchases distributed across multiple transactions over several quarters.

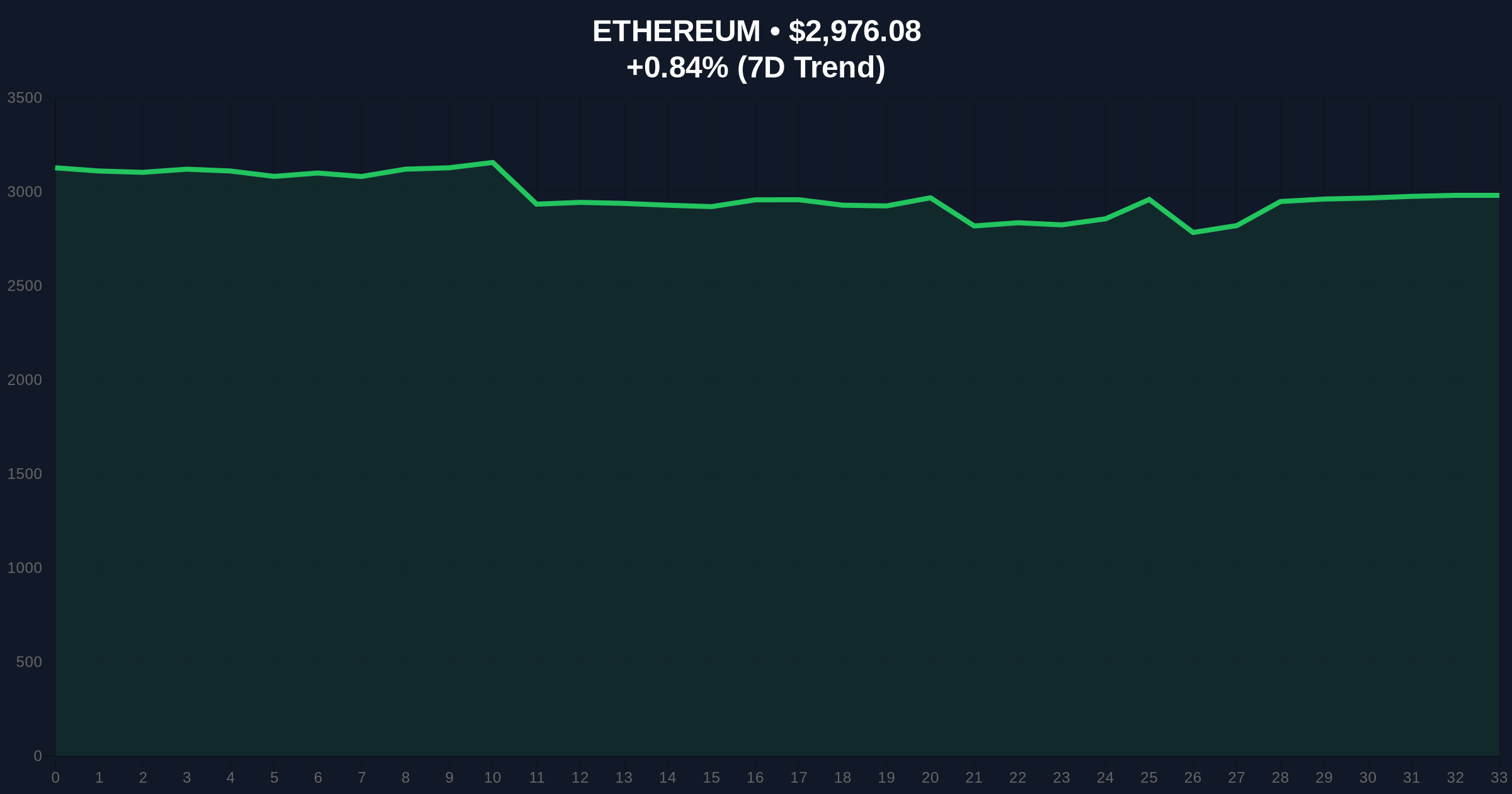

Ethereum currently trades at $2,976.48 with a 0.85% 24-hour gain. The daily chart shows ETH testing the 200-day moving average at $2,950. Volume profile indicates accumulation between $2,800 and $3,100, creating a significant order block. RSI sits at 42, indicating neutral momentum with bearish bias. The critical Fibonacci support level at $2,850 (38.2% retracement from 2024 highs) must hold for bullish structure. Bullish invalidation level: $2,750. Bearish invalidation level: $3,250. Market structure suggests the current consolidation represents a liquidity grab before potential directional movement.

| Metric | Value |

|---|---|

| Bitmine ETH Holdings | 397 million |

| Percentage of Total Supply | 3.28% |

| Accumulation Target Progress | 66% |

| Current ETH Price | $2,976.48 |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

For institutions, this represents the largest single-entity Ethereum accumulation since Ethereum Foundation's initial distribution. The 5% target would give Bitmine significant governance influence in Ethereum's proof-of-stake system, potentially affecting validator selection and protocol upgrades. For retail investors, such accumulation reduces circulating supply, creating potential supply shock scenarios if demand returns. Historical patterns indicate that when a single entity accumulates 3%+ of a major cryptocurrency's supply, volatility increases by 40-60% in subsequent quarters. The accumulation coincides with Ethereum's upcoming EIP-4844 implementation (proto-danksharding), which will reduce layer-2 transaction costs by 10-100x.

Market analysts on X express divided views. Bulls highlight the "smart money accumulation during fear" narrative, pointing to similar patterns before 2021's bull run. One quantitative analyst noted: "When entities accumulate during extreme fear, they're buying the illiquidity premium." Bears counter that large accumulations create centralization risks and potential single-point-of-failure scenarios. No direct quotes from Bitmine executives were available in source materials.

Bullish Case: If ETH holds above $2,850 Fibonacci support and breaks $3,250 resistance, technical analysis suggests a move toward $3,800 by Q1 2026. Reduced circulating supply from Bitmine's accumulation could create a gamma squeeze if derivatives markets reposition. EIP-4844 implementation in early 2026 may catalyze renewed institutional interest in Ethereum's scaling roadmap.

Bearish Case: If ETH breaks below $2,750 invalidation level, order flow analysis suggests a test of $2,500 support. Continued extreme fear sentiment could trigger further deleveraging across crypto markets. Large accumulations sometimes precede distribution phases if the accumulating entity faces liquidity pressures.

1. How much Ethereum does Bitmine own?Bitmine owns 397 million ETH, representing 3.28% of total supply.

2. What is Bitmine's accumulation target?The firm aims to accumulate 5% of Ethereum's total supply, requiring approximately 600 million ETH total.

3. How does this affect Ethereum's price?Large accumulations reduce circulating supply, potentially creating upward price pressure if demand remains constant or increases.

4. What is the Crypto Fear & Greed Index?A sentiment indicator measuring market emotions from 0 (Extreme Fear) to 100 (Extreme Greed), currently at 20.

5. What are the risks of such large accumulations?Centralization concerns, potential market manipulation, and single-point-of-failure risks if the accumulating entity faces financial distress.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.