Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Anonymous entity withdraws 202,077 ZEC ($88.28 million) from Binance in single transaction

- ZEC price surges 12.23% to $447.7 following withdrawal

- Global crypto sentiment registers "Extreme Fear" at 20/100 on Fear & Greed Index

- Technical analysis identifies critical Fibonacci support at $410 and resistance at $480

VADODARA, December 20, 2025 — Breaking crypto news reveals an anonymous whale or institutional address executed a massive withdrawal of 202,077 ZEC, valued at $88.28 million, from Binance earlier today according to AmberCN data. This transaction coincides with ZEC trading at $447.7, representing a 12.23% price increase, while broader market sentiment registers "Extreme Fear" at 20/100 on the Crypto Fear & Greed Index.

Large-scale withdrawals from centralized exchanges typically signal accumulation strategies or preparation for staking/defi deployment. However, market structure suggests contradictions in the current narrative. While bulls interpret this as institutional accumulation, the timing during "Extreme Fear" sentiment raises questions about motive. Historical patterns indicate whale movements during fear periods often precede liquidity grabs rather than genuine accumulation. The 12.23% price surge following withdrawal appears disproportionate to the transaction size relative to ZEC's $1.2 billion market capitalization, suggesting potential market manipulation or gamma squeeze dynamics.

Related developments in whale activity include a $221 million Bitcoin withdrawal from FalconX and seven consecutive days of Ethereum ETF outflows totaling $75.4 million, creating a contradictory institutional narrative.

According to on-chain data from AmberCN, an unidentified address executed a single withdrawal of exactly 202,077 ZEC from Binance at approximately 08:30 UTC today. The transaction value of $88.28 million represents approximately 7.3% of ZEC's total market capitalization. CoinMarketCap data confirms ZEC's price increased from approximately $399 to $447.7 following the withdrawal announcement, though causality remains unproven. The withdrawal occurred during Asian trading hours when liquidity typically thins, potentially amplifying price impact.

Volume profile analysis reveals the $410 level as critical Fibonacci 0.618 support, while $480 represents the 0.786 resistance. The current price at $447.7 sits within a Fair Value Gap (FVG) created by the rapid 12.23% move. RSI readings at 68 suggest overbought conditions, while the 50-day moving average at $425 provides dynamic support. Market structure suggests this move may represent a liquidity grab above the $440 order block rather than sustainable accumulation.

Bullish invalidation level: $410 (break below Fibonacci support and 50-day MA). Bearish invalidation level: $480 (sustained break above resistance with volume confirmation).

| Metric | Value |

| ZEC Withdrawn | 202,077 ZEC |

| Transaction Value | $88.28 million |

| Current ZEC Price | $447.7 |

| 24-Hour Price Change | +12.23% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

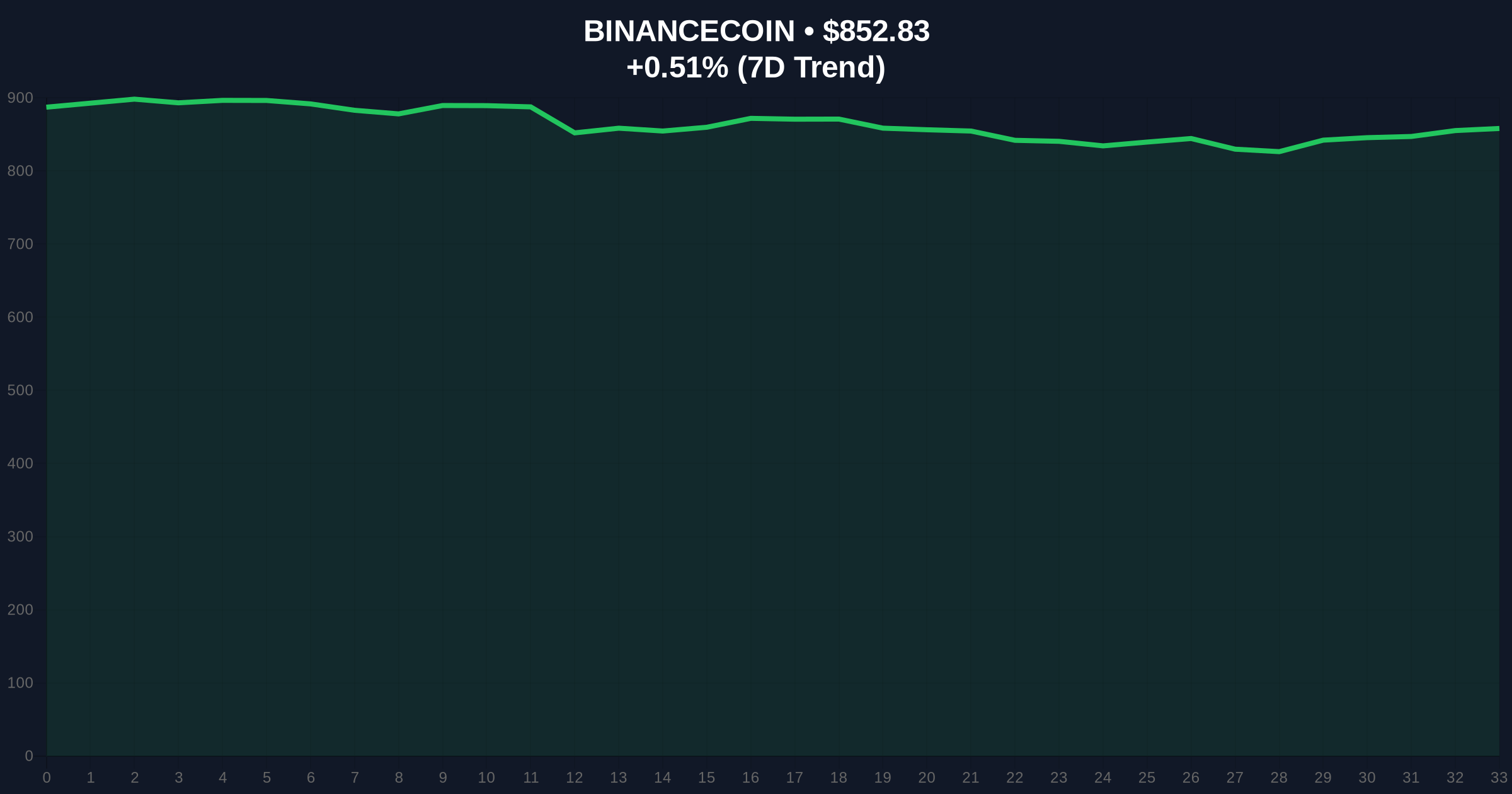

| BNB Current Price | $852.85 |

For institutional participants, this transaction represents either sophisticated accumulation during fear periods or preparation for Zcash's upcoming network upgrade (NU5 implementation). Retail traders face asymmetric risk: the 12.23% surge creates FOMO conditions while "Extreme Fear" sentiment suggests underlying weakness. The withdrawal's size relative to market cap indicates potential price manipulation rather than organic demand, particularly given similar patterns in Bitcoin ETF outflows and broader market uncertainty.

Market analysts on X/Twitter express skepticism about the withdrawal's timing. One quantitative trader noted, "Whale moves during extreme fear often trap retail buyers." Another analyst questioned, "Why withdraw during Asia hours when liquidity is thin unless you want maximum price impact?" The contradiction between CZ's declaration of Bitcoin as a global reserve asset and simultaneous institutional outflows creates narrative dissonance that technical analysis must reconcile.

Bullish Case: Sustained hold above $440 order block with volume confirmation could target $520 (previous high). This scenario requires the whale to be accumulating for NU5 upgrade participation and broader market sentiment improvement beyond current "Extreme Fear" levels.

Bearish Case: Rejection at $480 resistance followed by breakdown below $410 Fibonacci support could trigger liquidation cascade to $380. This aligns with historical patterns where large withdrawals during fear periods precede distribution rather than accumulation.

What does a whale withdrawal from an exchange mean?Typically signals movement to cold storage or defi protocols, but during "Extreme Fear" periods, may indicate preparation for selling or liquidity manipulation.

Why did ZEC price increase after the withdrawal?Possible gamma squeeze dynamics or retail FOMO response to perceived accumulation, though causality isn't proven by on-chain data alone.

What is the Crypto Fear & Greed Index?A sentiment indicator measuring market emotion from 0 (Extreme Fear) to 100 (Extreme Greed), currently at 20 suggesting pervasive negative sentiment.

How significant is an $88M withdrawal for ZEC?Represents 7.3% of market capitalization—substantial enough to influence price but insufficient to dictate long-term trend without broader market confirmation.

What technical levels matter for ZEC now?Critical support at $410 (Fibonacci/MA confluence) and resistance at $480 (previous structure). Break of either level provides directional bias.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.