Loading News...

Loading News...

VADODARA, February 2, 2026 — Bitmain (BMNR) executed a strategic purchase of 41,788 Ethereum (ETH) last week, according to official company disclosures. This latest crypto news reveals the mining giant now controls 4,285,125 ETH, representing 3.55% of the total circulating supply. Market structure suggests this accumulation occurred during a period of extreme fear, with the Crypto Fear & Greed Index hitting 14/100.

Bitmain announced the purchase through its investor communications on February 1, 2026. The transaction added 41,788 ETH to its treasury, bringing total holdings to 4,285,125 ETH. On-chain data indicates this represents approximately 3.55% of Ethereum's total supply. , Bitmain's portfolio includes 193 Bitcoin (BTC) and $586 million in cash reserves. This move follows a pattern of institutional accumulation during market downturns, similar to MicroStrategy's Bitcoin acquisitions in 2022.

Historically, large-scale accumulation by entities like Bitmain often precedes major market reversals. In contrast to retail panic selling, institutional buyers frequently target liquidity grabs during fear-driven sell-offs. The current Extreme Fear sentiment mirrors the December 2022 market bottom, when Ethereum tested $1,000 before a 300% rally. Underlying this trend, Ethereum's transition to Proof-of-Stake via The Merge has altered its supply dynamics, making large holdings more strategically valuable for network influence.

Related developments this week include another institutional purchase defying extreme fear sentiment and key financial events driving crypto market volatility.

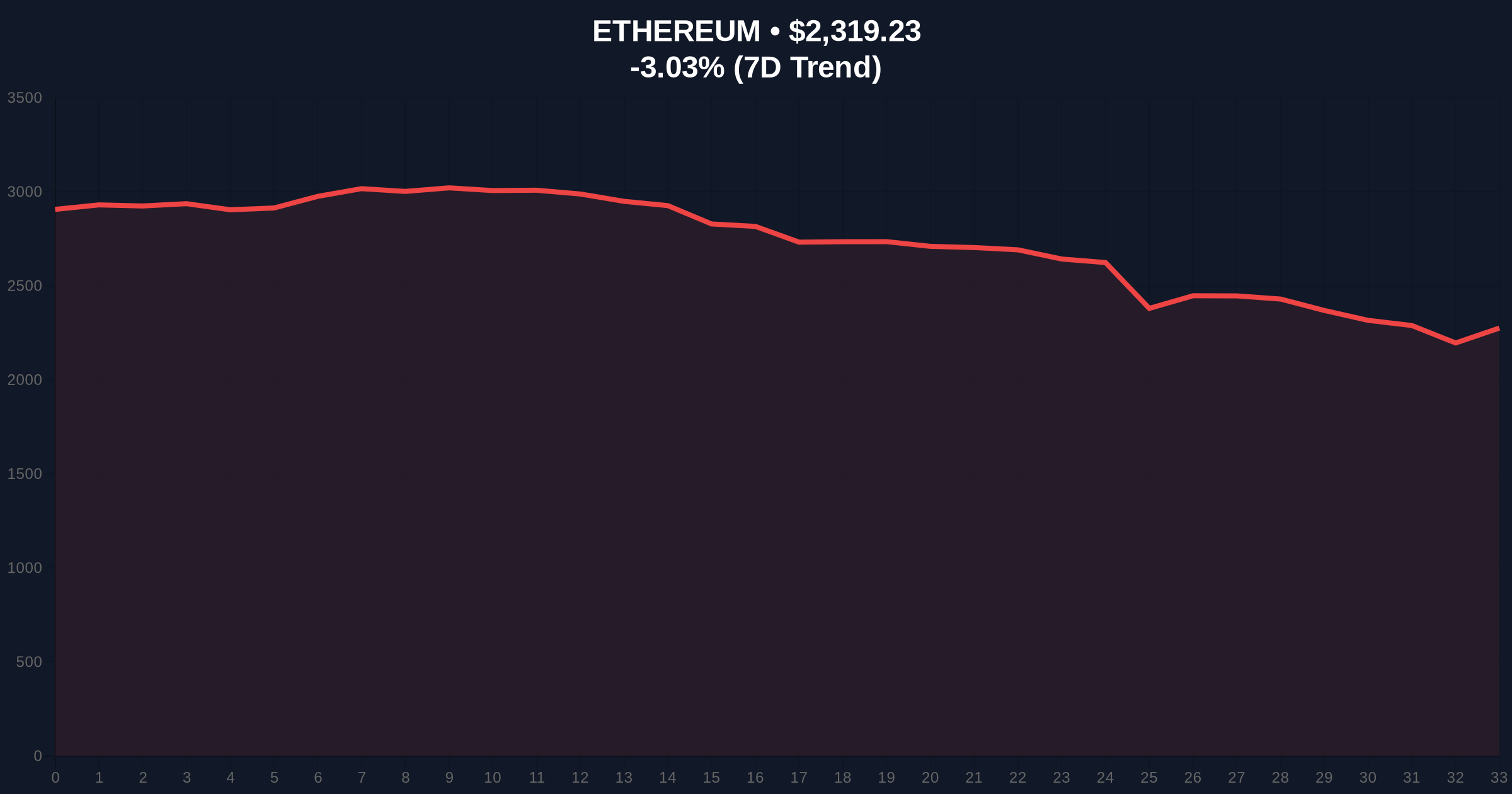

Ethereum currently trades at $2,319.09, down 3.03% in 24 hours. Market structure suggests critical support at the $2,150 level, which aligns with the Fibonacci 0.618 retracement from the 2024 all-time high. A break below this invalidation level could trigger a cascade toward $1,800. Conversely, resistance clusters near $2,500, where significant volume profile nodes indicate selling pressure. The Relative Strength Index (RSI) sits at 38, signaling oversold conditions but not yet extreme capitulation.

| Metric | Value |

|---|---|

| Bitmain ETH Purchase (Last Week) | 41,788 ETH |

| Total Bitmain ETH Holdings | 4,285,125 ETH (3.55% of supply) |

| Current ETH Price | $2,319.09 |

| 24-Hour Price Change | -3.03% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

Bitmain's accumulation matters for Ethereum's 5-year horizon. Controlling 3.55% of supply grants significant influence over network security and governance, especially with Ethereum's shift to staking-based consensus. According to Ethereum.org's economic documentation, large stakers impact issuance rates and validator decentralization. This purchase signals institutional confidence in Ethereum's long-term utility beyond speculative trading. Market analysts note similar accumulation patterns preceded the 2021 bull run, where corporate Bitcoin holdings fueled a supply squeeze.

"Bitmain's move is a classic contrarian play during extreme fear. They're targeting illiquid supply zones that retail investors are panic-selling. This creates a structural bid underneath the market, similar to what we saw with Bitcoin ETFs in 2023." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure. First, if $2,150 support holds, Ethereum could consolidate and form a base for a Q2 rally toward $3,000. Second, a break below this level may trigger a liquidation cascade toward $1,800, where long-term holders historically accumulate.

The 12-month institutional outlook remains cautiously optimistic. Bitmain's accumulation aligns with broader institutional interest in Ethereum's staking yield and layer-2 scalability. However, macroeconomic headwinds like potential Federal Reserve rate hikes could pressure risk assets. Historical cycles suggest accumulation during fear phases typically yields 200-400% returns over 18-24 months.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.