Loading News...

Loading News...

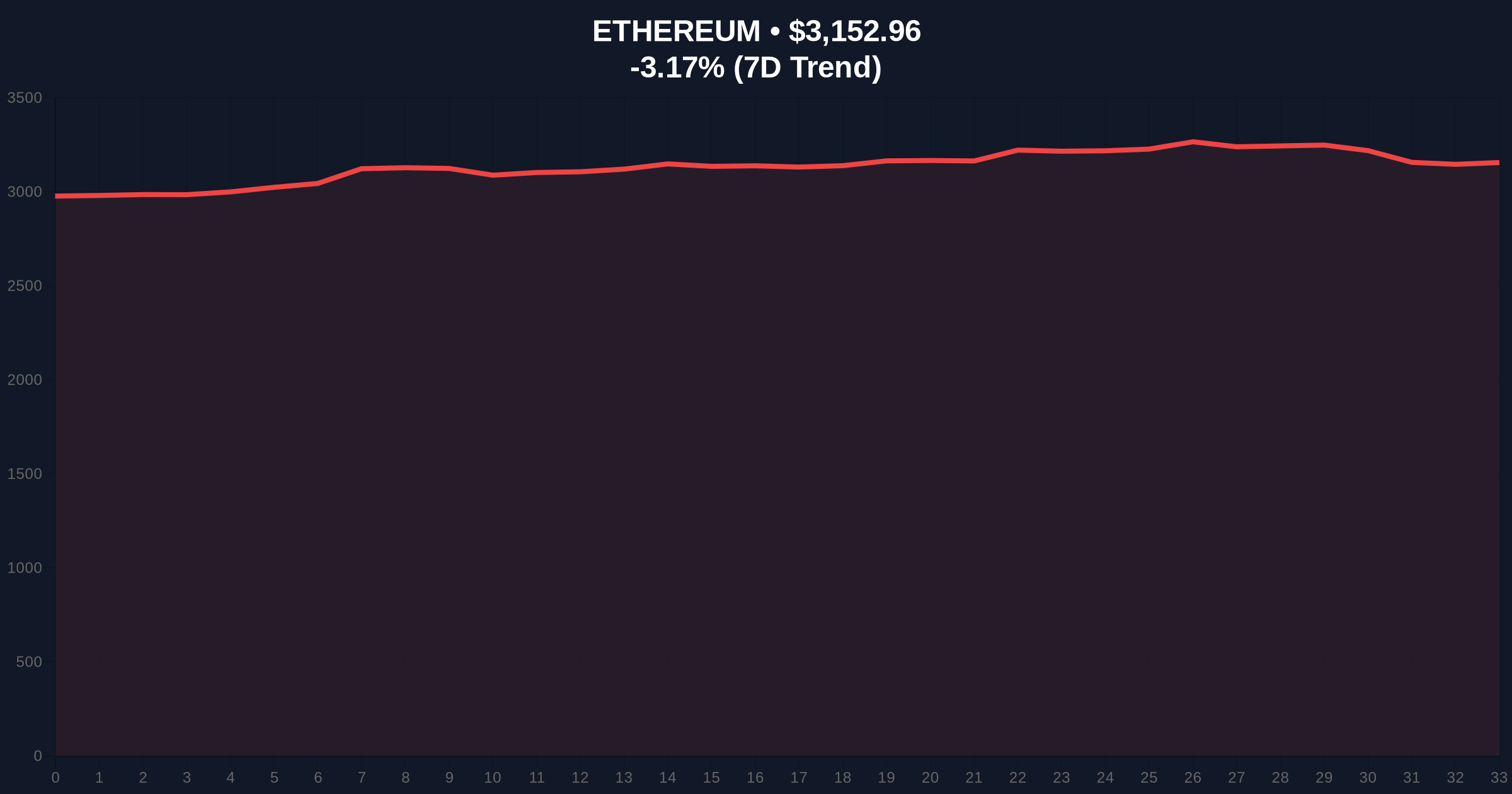

VADODARA, January 8, 2026 — Bitmain (BMNR) executed a $344.44 million Ethereum stake in a two-hour window, according to Onchain Lens data. This daily crypto analysis examines the structural implications as ETH tests critical support at $3,150 amid global fear sentiment.

Ethereum's post-merge issuance model has transformed staking into a primary yield mechanism. Large-scale validator deposits create liquidity sinks that stabilize price action. Historical cycles suggest accumulation at key Fibonacci levels precedes structural shifts. This mirrors the 2021 institutional buildup before the London hard fork. Related developments include recent ETF outflows and regulatory scrutiny impacting market structure.

According to data platform Onchain Lens, Bitmain staked 109,504 ETH valued at $344.44 million within two hours. The transaction timestamped January 8, 2026, increased their total staked assets to 908,192 ETH worth approximately $2.95 billion. As of January 5, Bitmain's total ETH holdings stood at around 4,143,502 ETH. Market structure suggests this represents a strategic accumulation rather than speculative positioning.

Ethereum currently trades at $3,152.86, down 3.17% in 24 hours. The price tests the 50-day moving average at $3,180. RSI reads 42, indicating neutral momentum with bearish bias. Critical support forms at the $3,150-$3,200 order block. A breakdown below $3,100 would invalidate the bullish structure. Resistance clusters at $3,350, aligning with the 0.618 Fibonacci retracement from recent highs. Volume profile shows accumulation between $3,100-$3,200, matching Bitmain's stake timing.

| Metric | Value |

|---|---|

| Bitmain Stake Amount | 109,504 ETH |

| Stake Value | $344.44M |

| Total Bitmain Staked ETH | 908,192 ETH |

| Current ETH Price | $3,152.86 |

| 24-Hour Change | -3.17% |

| Crypto Fear & Greed Index | 28/100 (Fear) |

Institutional impact: Large validator stakes reduce circulating supply, creating structural scarcity. According to Ethereum.org documentation, the Chain's proof-of-stake mechanism locks assets for extended periods. This affects liquidity dynamics and derivative markets. Retail impact: Reduced sell pressure from major holders supports price floors. However, concentrated staking raises centralization concerns for network security.

Market analysts note the timing coincides with ETF outflows. "Accumulation during fear signals long-term conviction," observed one quant trader. Others highlight the parallel Bitcoin SOPR signals suggesting broader accumulation. No official statement from Bitmain executives was available.

Bullish Case: Holding $3,150 support triggers a gamma squeeze toward $3,500. Bitmain's stake acts as a liquidity anchor. EIP-4844 implementation in the Pectra upgrade could boost network utility. Target: $3,800 by Q2 2026. Bullish invalidation: Break below $3,100.

Bearish Case: Failure at $3,150 opens a fair value gap toward $2,900. Continued ETF outflows and regulatory pressure from the SEC crypto task force exacerbate selling. Target: $2,850 retest. Bearish invalidation: Close above $3,350 resistance.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.