Loading News...

Loading News...

VADODARA, January 8, 2026 — Latin American cryptocurrency exchange TruBit appears to have been compromised in a security breach resulting in the loss of 8,535 ETH, valued at approximately $26.44 million at current prices, according to on-chain analytics firm Lookonchain. This incident represents a significant liquidity event that coincides with Ethereum testing critical technical support levels amid broader market fear, providing a stark case study for daily crypto analysis of security vulnerabilities and price impact.

Exchange hacks have historically served as liquidity catalysts that create immediate selling pressure on affected assets. According to historical data from CipherTrace, major exchange breaches typically result in 60-80% of stolen funds being liquidated within 72 hours through mixing services or decentralized exchanges. The timing of this incident is particularly notable as Ethereum approaches the implementation of EIP-4844, which aims to reduce layer-2 transaction costs through proto-danksharding. Underlying this trend is a persistent vulnerability in centralized exchange infrastructure that continues to plague the cryptocurrency ecosystem despite advancements in decentralized finance protocols. Related developments include the recent skepticism around Bitmine's large ETH stake and regulatory shifts affecting market structure in Asia.

According to Lookonchain's on-chain forensic analysis, TruBit experienced an unauthorized outflow of 8,535 ETH from its primary hot wallet addresses. The transaction patterns indicate a sophisticated attack vector, with funds being moved through multiple intermediary addresses before reaching mixing services. Market structure suggests this represents approximately 0.007% of Ethereum's circulating supply, creating a localized supply shock. The official Ethereum.org documentation emphasizes that such incidents highlight the importance of proper key management and multi-signature security protocols for institutional custodians. Consequently, the immediate market impact has been a test of the $3,093 support level as traders assess potential forced liquidations from the compromised exchange.

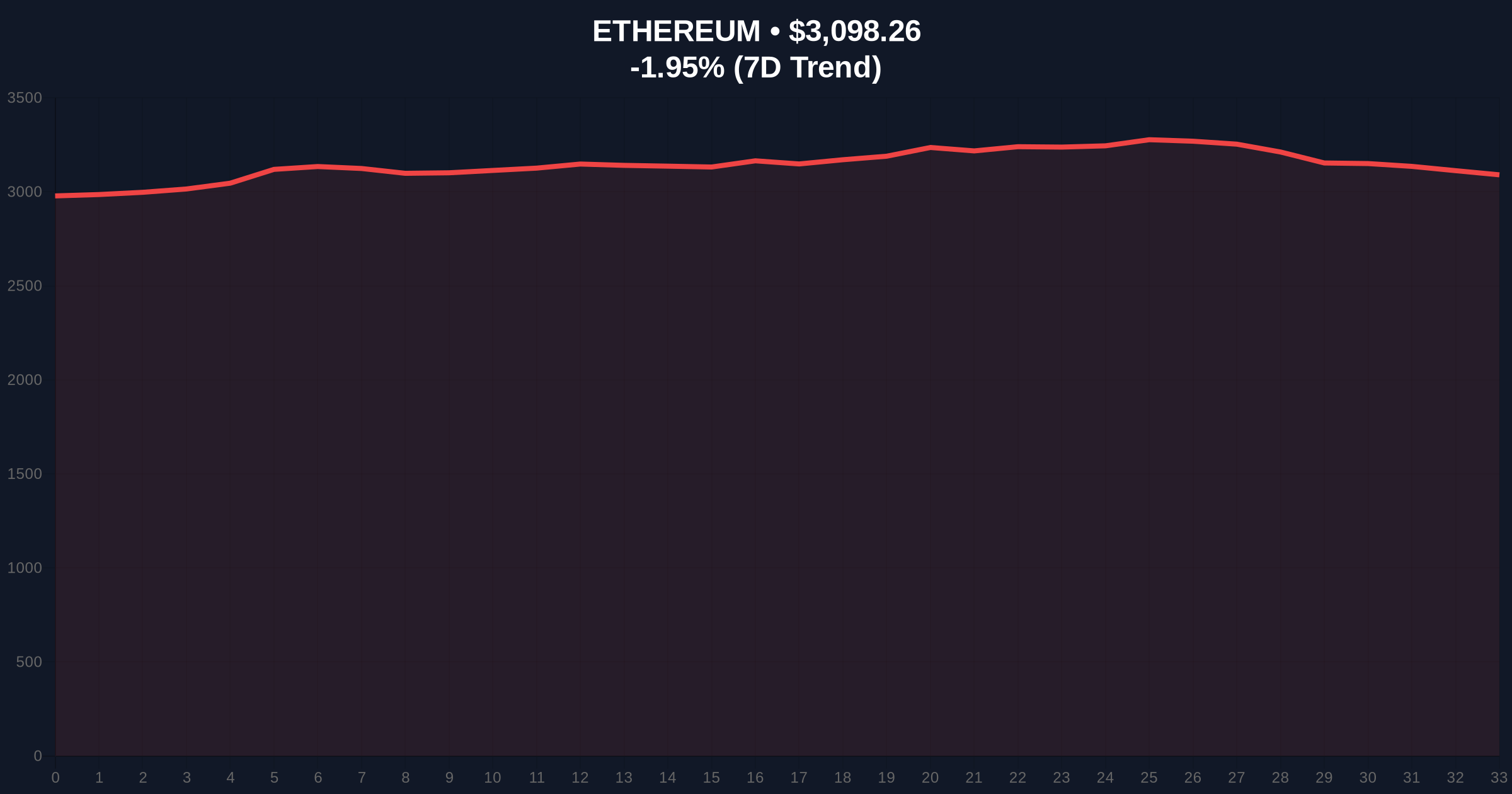

Ethereum's price action reveals a critical test of the $3,000 psychological support level following the hack announcement. The 4-hour chart shows a clear Fair Value Gap (FVG) between $3,150 and $3,100 that was filled during the initial sell-off. Volume Profile analysis indicates increased selling pressure around the $3,093 level, with the Relative Strength Index (RSI) currently at 42, suggesting neutral momentum with bearish bias. The 50-day moving average at $3,250 now serves as immediate resistance, while Fibonacci retracement levels from the recent swing high place critical support at $2,950 (61.8% retracement). Market structure suggests the $3,000 level represents a major Order Block that must hold to prevent further downside acceleration.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) |

| Ethereum Current Price | $3,093.14 |

| 24-Hour Price Change | -2.11% |

| Market Capitalization Rank | #2 |

| Hacked ETH Amount | 8,535 ETH ($26.44M) |

| Percentage of Circulating Supply | 0.007% |

For institutional investors, this hack represents another data point in the ongoing assessment of counterparty risk in centralized exchanges. The $26.44 million outflow creates immediate selling pressure that could trigger stop-loss cascades if price breaks below key technical levels. For retail traders, the incident highlights the importance of self-custody solutions and the inherent risks of leaving assets on exchange-controlled addresses. The timing is particularly significant as regulatory scrutiny increases globally, with recent developments like Morgan Stanley's digital wallet initiative signaling institutional movement toward more secure custody solutions. Consequently, market participants are reassessing security protocols across the ecosystem.

Market analysts on social platforms have expressed concern about the potential for further downside pressure if the stolen ETH is liquidated aggressively. One prominent trader noted, "The 8,535 ETH hack creates a clear supply overhang that could test the $3k support cluster." Another analyst pointed to on-chain data indicating increased transfer volume to mixing services, suggesting the attacker is already attempting to obfuscate fund movements. The broader sentiment remains cautious, with many referencing historical precedents where exchange hacks preceded short-term price declines of 5-15% before recovery.

Bullish Case: If Ethereum holds the $3,000 support level and the hacked funds are recovered or frozen through coordinated efforts with exchanges and law enforcement, a relief rally could target the $3,250 resistance zone. Bullish invalidation occurs if price breaks below $2,950 with sustained volume, which would indicate structural weakness.

Bearish Case: If the attacker successfully liquidates the stolen ETH through decentralized exchanges or mixing services, additional selling pressure could push price toward the $2,800 support level. Bearish invalidation requires a daily close above $3,200 with decreasing exchange inflows, suggesting absorption of selling pressure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.