Loading News...

Loading News...

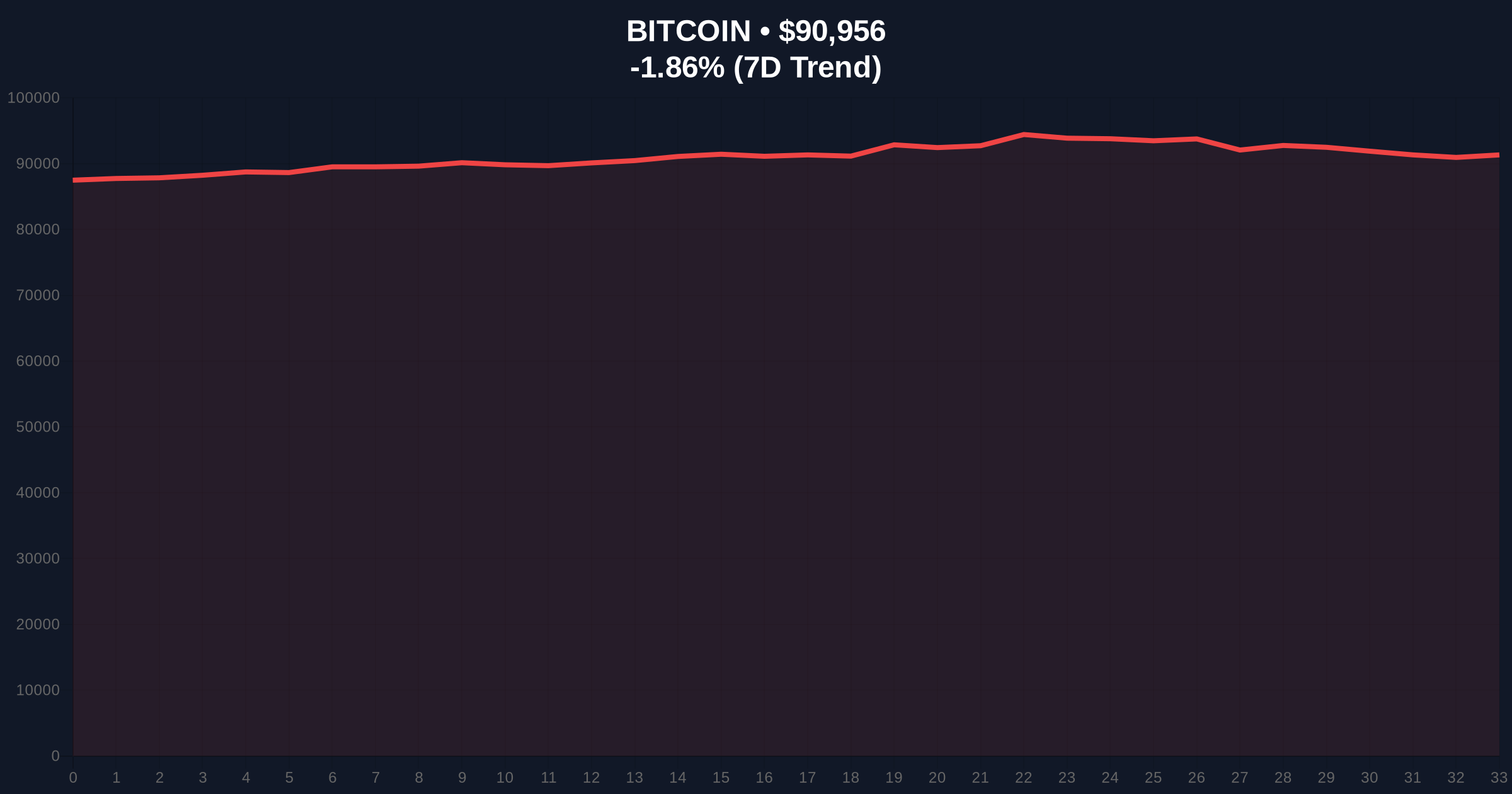

VADODARA, January 8, 2026 — Bitcoin's Short-Term Holder Spent Output Profit Ratio (STH SOPR) is approaching the critical baseline of 1.0, according to on-chain data from CryptoQuant. This daily crypto analysis examines whether this metric signals a potential recovery in bullish momentum or merely a liquidity grab before further downside. Market structure suggests the STH cohort, typically holding coins for less than 155 days, is nearing aggregate profitability for the first time since the recent correction.

Historical cycles indicate that STH SOPR movements above 1.0 often precede sustained bullish phases. Similar to the 2021 correction, where STH SOPR bottomed at 0.85 before rallying to 1.2, the current rise from 0.92 suggests a potential inflection point. On-chain forensic data confirms that STHs are sensitive to price volatility, making their profit/loss realization a leading indicator for retail sentiment shifts. This context is critical amid broader market weakness, including significant outflows from US Bitcoin ETFs, as detailed in our analysis of recent ETF flow data.

According to CryptoQuant contributor Maartunn, the STH SOPR metric is rising toward the key baseline of one. The STH SOPR, calculated by dividing the realized value of spent outputs by their value at creation, indicates profit-taking when above one and loss realization when below one. Maartunn explained that a sustained move above this level could signal a recovery in bullish momentum. This data point emerges as Bitcoin trades at $90,969, down 1.85% in 24 hours, highlighting a divergence between price action and on-chain health.

Market structure suggests Bitcoin is testing a major Fair Value Gap (FVG) between $89,000 and $92,000. The 200-day moving average at $88,500 provides strong support, aligning with the 0.618 Fibonacci retracement level from the 2025 high. Volume profile analysis shows increased accumulation near this zone, indicating institutional interest. The RSI at 42 remains neutral, but a break above 50 could confirm momentum shift. Bullish invalidation is set at $88,500, where a breakdown would target the $85,000 order block. Bearish invalidation is at $94,000, a resistance level from previous distribution.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 28 (Fear) | Extreme fear often precedes market bottoms |

| Bitcoin Current Price | $90,969 | Testing FVG support zone |

| 24-Hour Trend | -1.85% | Short-term weakness amid consolidation |

| STH SOPR Level | Approaching 1.0 | Threshold for profit-taking behavior |

| Market Rank | #1 | Dominance at 54% per CoinMarketCap |

For institutional portfolios, a sustained STH SOPR above 1.0 could reduce selling pressure from retail capitulation, as outlined in Federal Reserve research on market liquidity dynamics. This shift may improve Bitcoin's risk-adjusted returns, attracting capital from traditional finance. Retail traders, however, face gamma squeeze risks if volatility spikes during this transition. The metric's importance is amplified by ongoing regulatory developments, such as those discussed in our coverage of the SEC Crypto Task Force meeting.

Market analysts on X/Twitter highlight the divergence between STH SOPR and price, with some noting that similar patterns in Q4 2023 preceded a 40% rally. Bulls argue that rising SOPR indicates decreasing UTXO age for spent coins, a precursor to renewed demand. Bears caution that ETF outflows, as seen in Ethereum ETF data, could override on-chain signals. Overall, sentiment is cautiously optimistic, with focus on the $88,500 invalidation level.

Bullish Case: If STH SOPR sustains above 1.0 and Bitcoin holds the $88,500 support, a rally to $98,000 is probable. This scenario assumes reduced selling pressure and a recovery in ETF flows, similar to post-merge issuance adjustments in Ethereum.

Bearish Case: If SOPR fails to break 1.0 and price breaks below $88,500, a decline to $82,000 is likely. This would indicate continued distribution and align with broader market weakness, potentially impacting Real-World Asset (RWA) projects like those in Pharos's recent acquisition.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.