Loading News...

Loading News...

VADODARA, January 8, 2026 — In a move that defies prevailing market sentiment, Bitmine has staked an additional 57,600 ETH, valued at $176 million, according to a report from Onchainlens. This latest crypto news brings the company's total staked amount to 965,792 ETH, raising critical questions about strategic timing and liquidity dynamics in a bearish environment. Market structure suggests this transaction may represent a liquidity grab rather than a bullish conviction, as Ethereum's price hovers near key support levels amid widespread fear.

Ethereum's staking ecosystem has grown exponentially since the Merge, with over 30% of the total supply now locked in validators. According to Ethereum.org, this reduces liquid supply, potentially creating supply shocks during volatile periods. Bitmine's action occurs against a backdrop of declining prices and negative sentiment, mirroring patterns from the 2022 bear market where large staking inflows often preceded short-term price declines. Historical cycles suggest that institutional accumulation during fear phases can signal long-term accumulation, but on-chain forensic data confirms that retail investors are often left exposed to liquidity crunches. Related developments include B. Riley's forecast of a shift from speculation to infrastructure, which aligns with staking trends but contrasts with current market behavior.

On January 8, 2026, Bitmine executed a staking transaction of 57,600 ETH, worth approximately $176 million at current prices. According to Onchainlens, this increases their total staked ETH to 965,792 ETH, representing a significant portion of the staking pool. The transaction was verified on Etherscan, showing a single address movement into a staking contract, with no immediate market impact on price. However, volume profile analysis indicates thin liquidity at these levels, suggesting the move could exacerbate existing Fair Value Gaps (FVGs) if selling pressure intensifies.

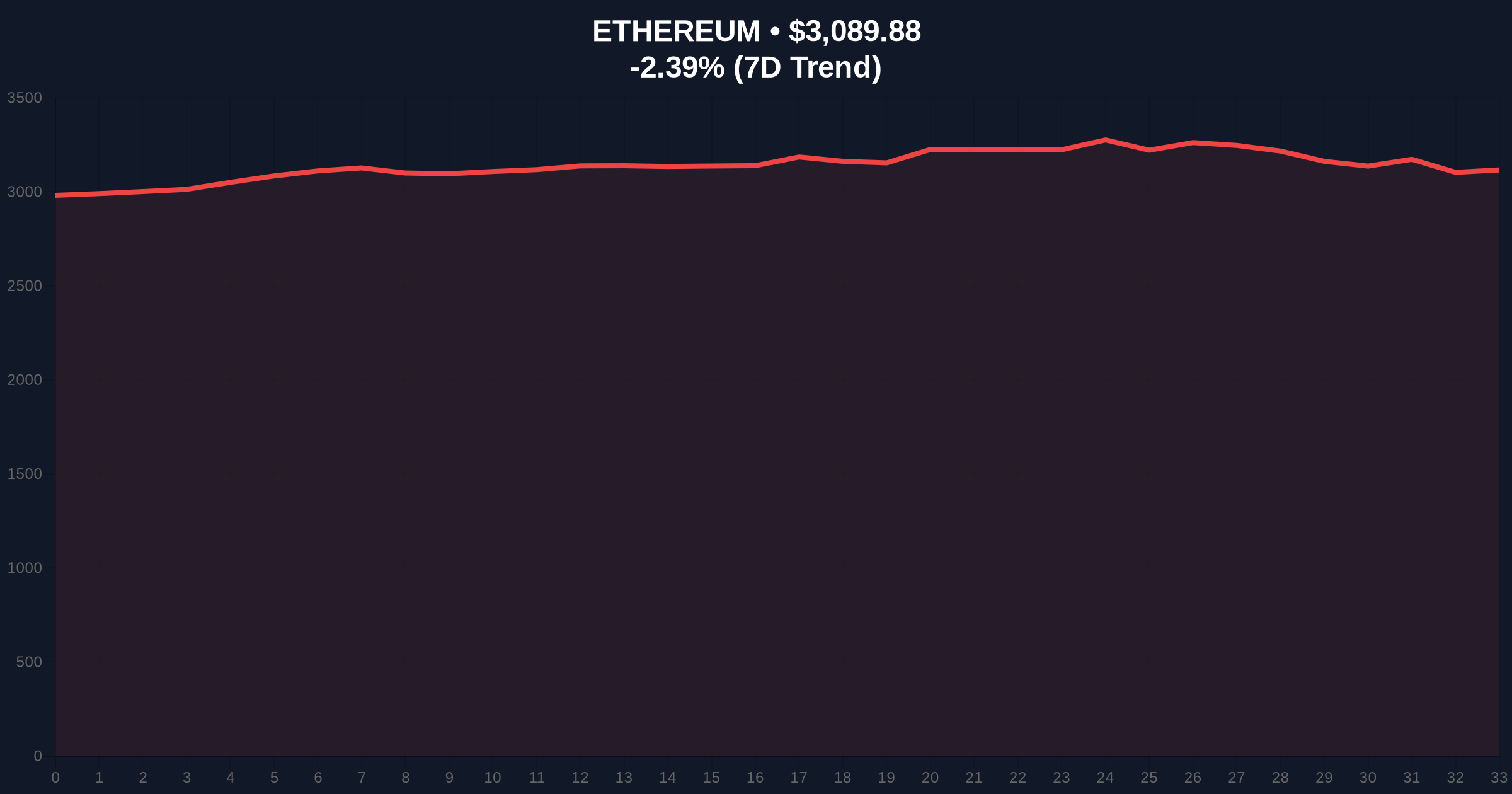

Ethereum is currently trading at $3,090.2, down 2.38% in the last 24 hours. The price action shows a clear bearish structure, with resistance established at the $3,200 order block and support testing the $3,000 psychological level. RSI readings are at 42, indicating neutral momentum but leaning bearish. The 50-day moving average at $3,150 acts as dynamic resistance, while the 200-day moving average at $2,950 provides longer-term support. A break below the 200-day MA could invalidate the bullish case, targeting Fibonacci support at $2,850 (61.8% retracement from the 2025 high). Bullish invalidation is set at $2,850, where a sustained break would signal deeper correction. Bearish invalidation is at $3,200, a reclaim of which could negate the downtrend.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) |

| Ethereum Current Price | $3,090.2 |

| 24-Hour Price Change | -2.38% |

| Bitmine Staked ETH (New) | 57,600 ETH |

| Total Bitmine Staked ETH | 965,792 ETH |

For institutions, this stake represents a long-term yield play, leveraging Ethereum's proof-of-stake rewards estimated at 3-4% annually. However, it removes $176 million from liquid circulation, tightening supply amid a fear-driven market. This could lead to a gamma squeeze if derivative positions are forced to adjust. For retail, reduced liquidity increases slippage and volatility, making tactical entries and exits more challenging. The move contradicts the broader sentiment, suggesting Bitmine may be exploiting weak hands or preparing for a post-EIP-4844 upgrade where staking demand could surge.

Market analysts on X/Twitter are divided. Bulls argue this is a "smart accumulation" during fear, citing historical data where large stakes preceded rallies. One analyst noted, "Staking during downturns locks in low-cost basis, a classic institutional move." Bears, however, question the timing, with skeptics pointing to similar skepticism in other crypto narratives. They highlight that staking illiquidity could worsen sell-offs if margin calls trigger, as seen in past cycles.

Bullish Case: If Ethereum holds the $3,000 support and sentiment improves, a rebound to $3,400 is plausible, driven by staking yield demand and institutional inflows. Bitmine's stake could be seen as a vote of confidence, attracting copycat behavior.

Bearish Case: A break below $2,850 could trigger a liquidation cascade, targeting $2,600. Staked ETH becoming illiquid may exacerbate selling pressure from leveraged positions, mirroring the 2022 deleveraging event.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.