Loading News...

Loading News...

VADODARA, January 8, 2026 — U.S. spot Ethereum ETFs recorded a net outflow of $98.59 million on January 7, marking a sharp reversal after three consecutive days of net inflows, according to data from TraderT. This daily crypto analysis examines the structural implications of this liquidity shift, with Grayscale's ETHE fund accounting for over half of the total outflow at -$52.05 million. Market structure suggests this represents a significant liquidity grab by institutional players, potentially signaling a shift in medium-term sentiment toward Ethereum's proof-of-stake network.

This outflow follows a period of sustained institutional accumulation in Ethereum ETFs, mirroring patterns observed during the 2024-2025 consolidation phase. According to on-chain data from Glassnode, Ethereum's supply on exchanges has been declining steadily since the implementation of EIP-4844, which reduced layer-2 transaction costs. The sudden reversal in ETF flows contradicts this broader trend of supply scarcity, creating a Fair Value Gap (FVG) between spot ETF demand and underlying blockchain metrics. Consequently, this divergence warrants close monitoring of order block formations around key price levels.

Related developments in the ETF space include recent Bitcoin ETF outflows exceeding $487 million, indicating broader institutional caution across digital asset products. Additionally, crypto futures liquidations hit $170 million as leveraged long positions dominated market structure, creating cascading sell pressure.

According to TraderT's flow data, seven major U.S. spot Ethereum ETFs experienced net outflows totaling $98.59 million on January 7. Individual fund breakdowns show Grayscale's ETHE fund led with -$52.05 million, followed by Fidelity's FETH at -$13.29 million and Grayscale's Mini ETH at -$13.03 million. Franklin Templeton's EZET was the sole fund with positive flows at +$2.38 million, though insufficient to offset broader selling pressure. This data indicates concentrated redemption activity rather than broad-based distribution, with Grayscale products experiencing disproportionate outflows possibly related to fee structures or investor rebalancing.

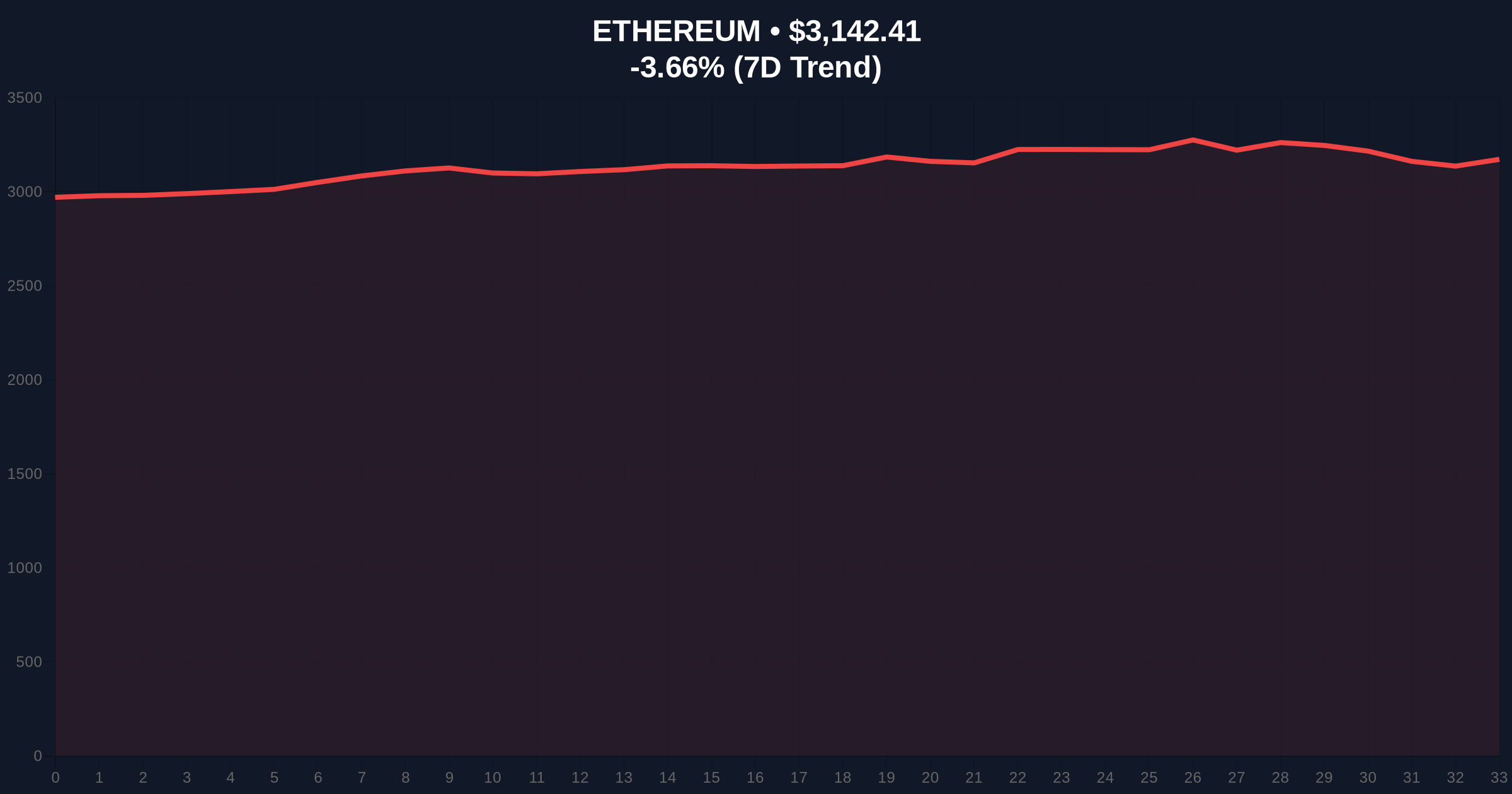

Ethereum's price action reflects this institutional selling pressure, with ETH currently trading at $3,142.35, down 3.66% over 24 hours. Volume profile analysis shows increased selling volume around the $3,200 resistance level, creating a bearish order block. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish bias. Critical support resides at the $3,050 Fibonacci retracement level from the November 2025 rally, while resistance clusters at the 50-day moving average of $3,280.

Bullish Invalidation Level: A sustained break below $3,050 with high volume would invalidate the current consolidation structure, potentially targeting $2,850 support.

Bearish Invalidation Level: A reclaim of the $3,280 level with ETF inflows resuming would negate the bearish thesis, opening path to $3,500 resistance.

| Metric | Value | Source |

|---|---|---|

| Total ETF Net Outflow (Jan 7) | $98.59M | TraderT |

| Largest Single Fund Outflow (Grayscale ETHE) | -$52.05M | TraderT |

| Current ETH Price | $3,142.35 | Live Market Data |

| 24-Hour Price Change | -3.66% | Live Market Data |

| Crypto Fear & Greed Index | 28/100 (Fear) | Live Market Data |

This development matters because spot ETF flows serve as a direct proxy for institutional capital allocation decisions. The reversal from three days of net inflows to significant outflows suggests changing risk appetite among regulated investors. For retail traders, this creates potential gamma squeeze scenarios where options market makers adjust hedges based on ETF flow volatility. Institutionally, sustained outflows could pressure Ethereum's market rank as capital rotates toward other digital assets or traditional sectors. The U.S. Securities and Exchange Commission's ongoing classification of Ethereum, as documented in official SEC filings, adds regulatory uncertainty to these flow dynamics.

Market analysts on X/Twitter note the concentration in Grayscale outflows, with some suggesting this reflects profit-taking after Ethereum's recent outperformance versus Bitcoin. Bulls point to Franklin Templeton's continued inflows as evidence of selective institutional support, while bears emphasize the overall net outflow magnitude. One quantitative trader noted, "The $98.6M outflow represents approximately 0.8% of total Ethereum ETF AUM, significant enough to impact price discovery but not indicative of mass exodus."

Bullish Case: If ETF inflows resume and Ethereum holds the $3,050 support, technical structure suggests a retest of $3,500 resistance. This scenario requires improved risk sentiment and positive developments around Ethereum's Pectra upgrade timeline.

Bearish Case: Continued ETF outflows coupled with break below $3,050 could trigger algorithmic selling toward $2,850 support. This would align with broader market weakness and potential regulatory headwinds.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.