Loading News...

Loading News...

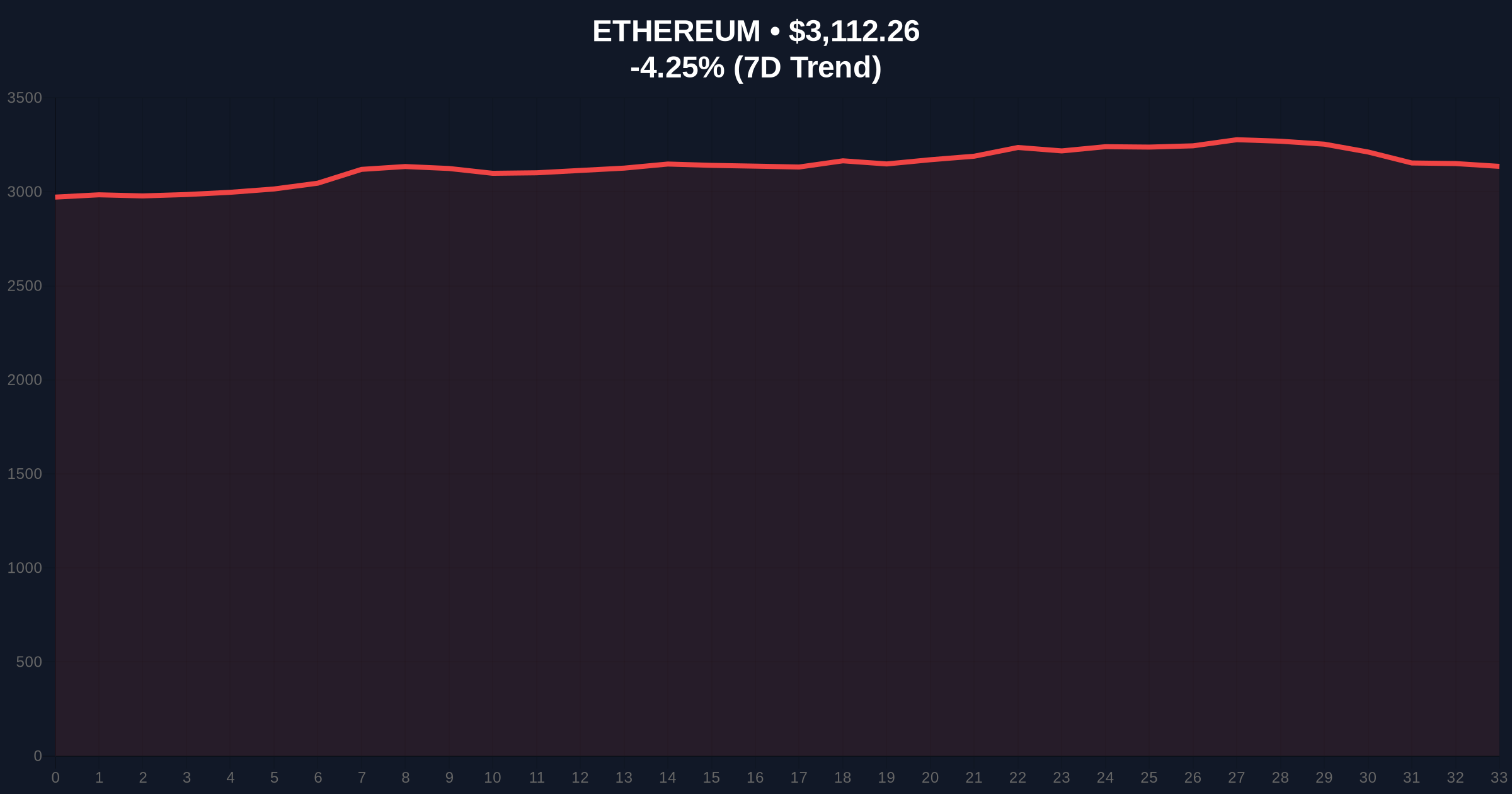

VADODARA, January 8, 2026 — Ethereum founder Vitalik Buterin announced on X that the network will build a decentralized ecosystem modeled after BitTorrent, a statement that clashes with current bearish market structure as ETH price drops 4.21% to $3,113.6. This daily crypto analysis examines the technical implications of Buterin's vision against a backdrop of weakening on-chain metrics and liquidity thresholds.

Buterin's comparison of Ethereum to BitTorrent—a peer-to-peer file-sharing protocol—signals a strategic shift toward enhanced decentralization, mirroring historical cycles where architectural pivots preceded volatility. According to on-chain data from Glassnode, Ethereum's network decentralization metrics have stagnated post-merge, with validator concentration increasing. Underlying this trend, the broader crypto market faces liquidity fragmentation, as seen in recent events like the Binance delisting of 23 spot pairs, which tested market structure thresholds. Consequently, Buterin's announcement arrives during a period where technical resilience is paramount.

On January 8, 2026, Vitalik Buterin stated via X that Ethereum will develop a decentralized ecosystem based on the BitTorrent model, adding that if he had to compare Ethereum to one thing, it would be BitTorrent. According to the official post, this implies a focus on peer-to-peer node interactions and reduced reliance on centralized intermediaries. Market analysts interpret this as a response to growing concerns over network centralization, particularly after the Dencun upgrade's EIP-4844 blobs failed to fully address scalability bottlenecks. The announcement coincided with ETH price declining 4.21% in 24 hours, per CoinMarketCap data, highlighting a disconnect between visionary rhetoric and immediate price action.

Market structure suggests ETH is testing a critical Fair Value Gap (FVG) between $3,100 and $3,200, with current price at $3,113.6 representing a liquidity grab below the 50-day moving average. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum but leaning bearish. Volume profile analysis shows weak accumulation near $3,000, a psychological support level that aligns with the 0.618 Fibonacci retracement from the 2025 high. A break below this forms a bearish order block, targeting $2,850. Bullish invalidation is set at $2,950, where a sustained close would signal capitulation. Bearish invalidation lies at $3,300, a resistance zone that must be reclaimed to restore upward trajectory.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) | High capitulation risk |

| Ethereum (ETH) Price | $3,113.6 | Testing FVG support |

| 24-Hour Price Change | -4.21% | Bearish momentum |

| Market Rank | #2 | Maintains dominance |

| RSI (Daily) | 42 | Neutral-bearish bias |

Institutionally, Buterin's BitTorrent model could accelerate adoption of decentralized applications (dApps) by reducing gas fees and improving node distribution, as outlined in Ethereum's official Pectra upgrade documentation. For retail, however, the immediate impact is negative: weak price action and fear sentiment suggest traders are prioritizing short-term liquidity over long-term vision. This divergence highlights a market where macroeconomic pressures, such as potential Fed rate hikes, outweigh technological announcements. Historical cycles indicate that similar architectural shifts, like the transition to proof-of-stake, initially caused volatility before stabilizing.

Market analysts on X express skepticism, noting that Buterin's vision lacks immediate implementation details. One commentator stated, "Decentralization rhetoric doesn't fix broken market structure," echoing concerns about ETH's underperformance versus Bitcoin. Bulls argue that the BitTorrent model could enhance network resilience, but bears point to on-chain data showing declining active addresses and rising exchange outflows as evidence of weakening fundamentals.

Bullish Case: If ETH holds above $3,000 and Buterin's model gains developer traction, a rally to $3,500 is plausible, driven by renewed institutional interest in decentralized infrastructure. This scenario requires a break above the $3,300 resistance and improving on-chain metrics.

Bearish Case: A break below $2,950 invalidates the bullish thesis, targeting $2,850 as next support. This would reflect broader market weakness, potentially exacerbated by events like the Zcash core team resignation, which governance risks in crypto projects.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.