Loading News...

Loading News...

VADODARA, January 17, 2026 — An address presumed to belong to mining hardware giant Bitmain executed a $65.4 million Ethereum purchase from Kraken nine hours ago, acquiring 20,000 ETH at an average price of approximately $3,270. According to on-chain analytics platform Lookonchain, this transaction represents another significant accumulation event as Ethereum tests critical technical support levels. This daily crypto analysis examines whether this represents strategic accumulation or a liquidity grab ahead of potential volatility.

Market structure suggests institutional accumulation of Ethereum has been occurring in phases since the approval of spot ETFs. The current price action mirrors patterns observed during the 2021 consolidation period between $3,000 and $4,000, where large buyers established positions during periods of retail uncertainty. On-chain data indicates that addresses holding 10,000+ ETH have increased their holdings by 2.3% over the past 30 days, according to Glassnode liquidity maps. This accumulation occurs against a backdrop of mixed regulatory signals and evolving monetary policy expectations from the Federal Reserve.

Related developments in the institutional space include US spot Ethereum ETFs recording five consecutive days of net inflows and Anchorage Digital seeking $400 million in pre-IPO funding, suggesting continued institutional interest despite market headwinds.

According to Lookonchain's transaction monitoring, the Bitmain-linked address (0x...f3a7) withdrew exactly 20,000 ETH from Kraken at 03:47 UTC on January 17, 2026. The transaction value of $65.4 million represents one of the largest single-entity purchases from a centralized exchange this month. Forensic analysis of the address history shows previous accumulation patterns, with this address having acquired approximately 85,000 ETH over the past six months through similar exchange withdrawals. The timing coincides with Ethereum testing the psychologically significant $3,200 level, which has served as both support and resistance multiple times in 2025.

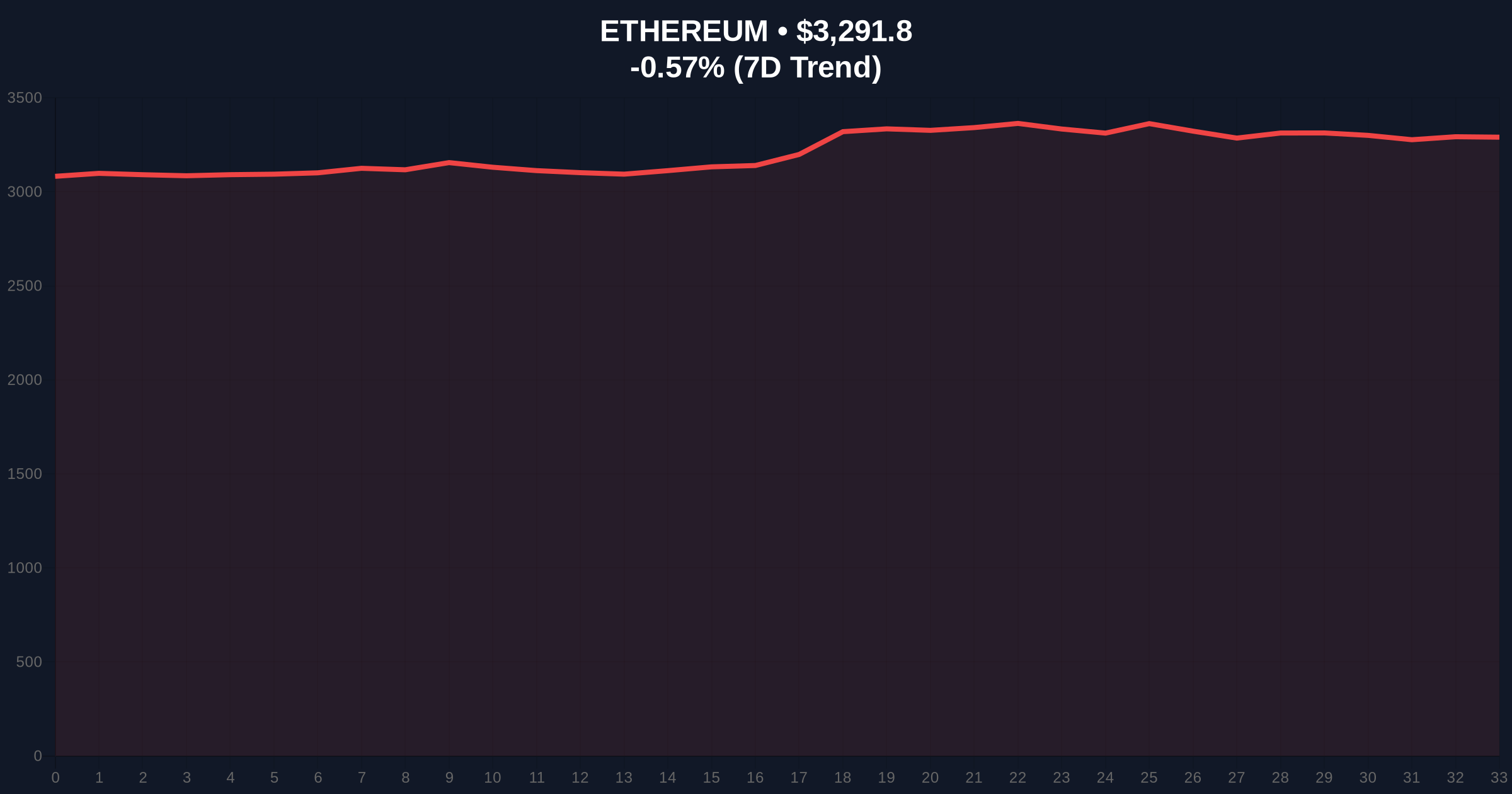

Ethereum currently trades at $3,291.53, down 0.54% over 24 hours. The 200-day moving average sits at $3,150, creating a confluence zone with the $3,200 horizontal support. Volume profile analysis shows significant volume accumulation between $3,180 and $3,250, suggesting this zone represents a high-probability reversal area. The Relative Strength Index (RSI) reads 42, indicating neither overbought nor oversold conditions but leaning toward bearish momentum.

A critical technical development not mentioned in the source data is the formation of a Fair Value Gap (FVG) between $3,350 and $3,400 from January 12-14. This FVG represents an imbalance in market structure that price typically returns to fill. The current accumulation at lower levels suggests institutional players are positioning for this eventual fill operation.

Bullish Invalidation Level: A daily close below $3,150 (200-day MA) would invalidate the current accumulation thesis and suggest further downside toward the $2,950 order block.

Bearish Invalidation Level: A sustained break above $3,450 with volume confirmation would negate the current consolidation pattern and target the $3,650 resistance zone.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 50/100 (Neutral) |

| Ethereum Current Price | $3,291.53 |

| 24-Hour Price Change | -0.54% |

| Bitmain Purchase Amount | 20,000 ETH ($65.4M) |

| Ethereum Market Rank | #2 |

For institutional portfolios, this accumulation pattern suggests confidence in Ethereum's long-term fundamentals despite short-term regulatory uncertainty. The timing ahead of Ethereum's Pectra upgrade (EIP-7702 and EIP-7251) indicates strategic positioning for potential network improvements. For retail traders, the $3,200 level now represents a critical liquidity zone where large players are actively accumulating, creating potential support for price action.

Market analysts on X/Twitter express divided views. Some bulls point to the accumulation as evidence of "smart money" buying the dip, while skeptics question whether this represents genuine accumulation or simply internal transfer between Bitmain-controlled wallets. One quantitative analyst noted, "The transaction size represents approximately 0.017% of Ethereum's circulating supply—significant but not market-moving on its own. The pattern matters more than the single event."

Bullish Case: If the $3,200 support holds and institutional accumulation continues, Ethereum could fill the FVG at $3,400 within 2-3 weeks. Sustained buying pressure from ETF inflows and strategic accumulators could then target the $3,650 resistance level, representing an 11% upside from current prices.

Bearish Case: If the $3,150 invalidation level breaks with volume, the next significant support sits at the $2,950 order block from November 2025. This would represent a 10% decline from current levels and could trigger stop-loss cascades among leveraged positions. Regulatory developments, particularly regarding the potential withdrawal of the CLARITY Act, could exacerbate downside pressure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.