Loading News...

Loading News...

VADODARA, January 7, 2026 — U.S. spot Ethereum ETFs recorded a net inflow of $113.64 million on January 6, marking the third consecutive day of positive flows. According to data from TraderT, BlackRock's ETHA fund dominated with $197.7 million in inflows, while Grayscale's ETHE and Mini ETH funds saw outflows totaling $85.45 million. This daily crypto analysis examines the structural implications for Ethereum's market dynamics.

Ethereum ETF flows have become a critical liquidity indicator since their approval. Historical patterns show that sustained inflows often precede price consolidation phases. The current three-day streak mirrors accumulation patterns observed in Bitcoin ETFs during early 2025. Market structure suggests institutional players are building positions despite retail fear sentiment. This divergence creates a potential Fair Value Gap (FVG) between spot prices and institutional demand. Related developments include the Altcoin Season Index plunging to 23, indicating capital rotation toward larger assets like Ethereum.

On January 6, 2026, TraderT data revealed specific fund movements. BlackRock's ETHA led with +$197.7 million. Fidelity's FETH saw a minor outflow of -$1.62 million. Bitwise's ETHW and 21Shares' CETH recorded modest inflows of +$1.39 million and +$1.62 million, respectively. Grayscale's ETHE and Mini ETH funds experienced significant outflows of -$53 million and -$32.45 million. The net result: $113.64 million in positive flows. This follows similar patterns on January 4 and 5, establishing a clear trend.

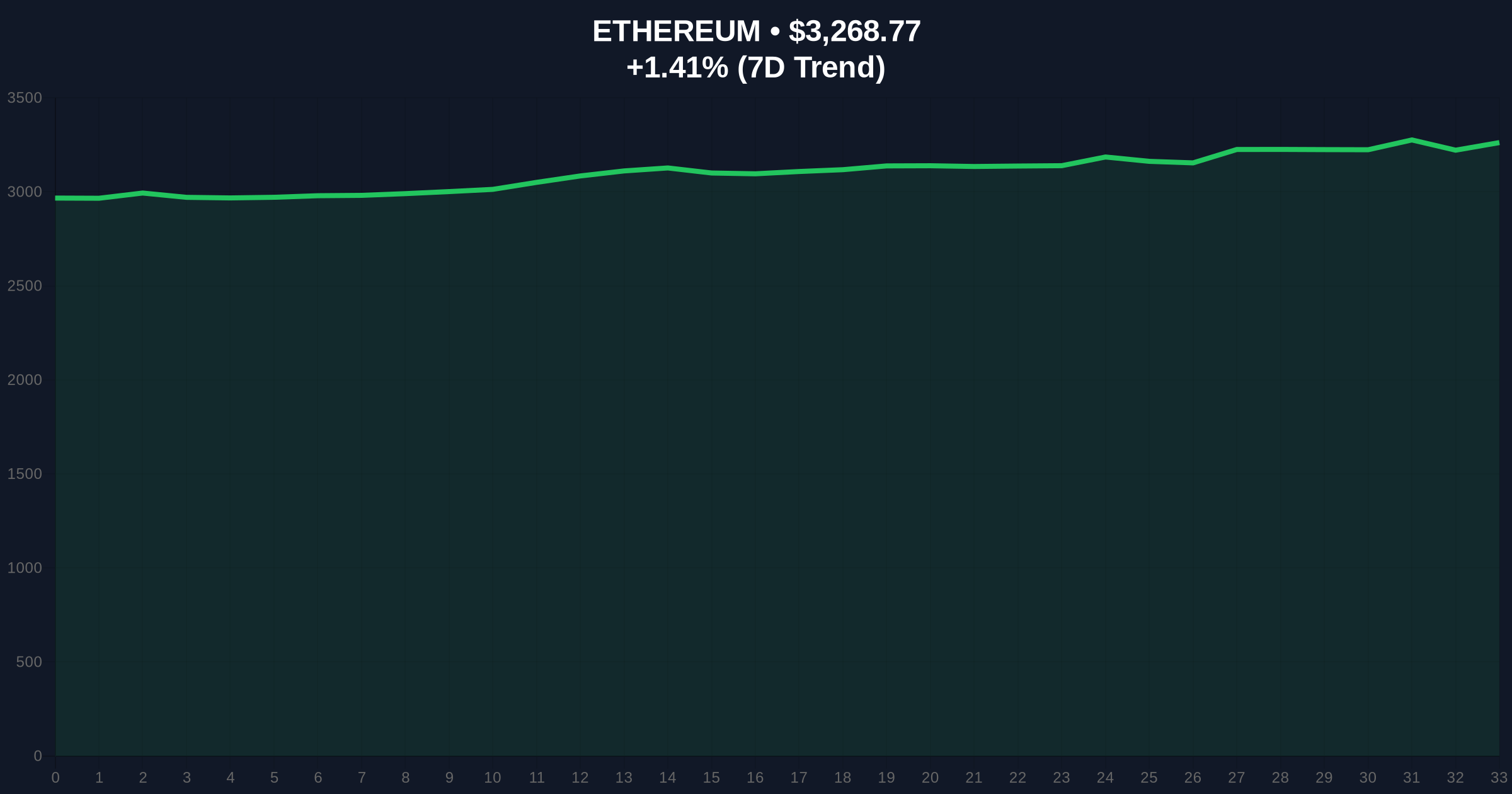

Ethereum currently trades at $3,269.83, up 1.44% in 24 hours. The Volume Profile indicates accumulation near the $3,200-$3,300 range. Key support sits at the 50-day moving average of $3,150, which aligns with the 0.618 Fibonacci retracement level from the recent swing high. Resistance is established at $3,400, a previous Order Block. RSI reads 52, suggesting neutral momentum. Bullish Invalidation Level: $3,150. A break below this level would signal failed accumulation and potential downside to $3,000. Bearish Invalidation Level: $3,400. A sustained break above this resistance would confirm institutional buying pressure and target $3,600.

| Metric | Value |

|---|---|

| Net ETF Inflow (Jan 6) | $113.64M |

| BlackRock ETHA Inflow | +$197.7M |

| Grayscale Total Outflow | -$85.45M |

| Ethereum Current Price | $3,269.83 |

| Crypto Fear & Greed Index | Fear (42/100) |

Institutional impact is profound. According to the SEC.gov framework, ETF flows directly affect market liquidity and price discovery. Sustained inflows indicate institutional conviction despite macro fear. This creates a liquidity grab scenario where large buyers absorb sell-side pressure. Retail impact is muted; the Fear & Greed Index at 42 suggests caution. However, institutional accumulation can lead to a Gamma Squeeze if options markets align. The divergence between institutional flows and retail sentiment presents a tactical opportunity for informed traders.

Market analysts on X/Twitter highlight the BlackRock dominance. One quant noted, "BlackRock's $197M inflow versus Grayscale's $85M outflow shows capital rotation, not net selling." Bulls argue this signals long-term accumulation for Ethereum's upcoming Pectra upgrade, which includes EIP-7702 for account abstraction. Bears point to Grayscale's outflows as profit-taking. Overall sentiment is cautiously optimistic, with focus on the $3,150 support holding.

Bullish Case: If inflows continue, Ethereum could break $3,400 resistance. This would target $3,600 as the next Order Block. Institutional accumulation would validate the current FVG. Upside scenario: $3,800 by Q1 2026, driven by ETF demand and positive developments in blockchain security initiatives enhancing network confidence.

Bearish Case: If the $3,150 support fails, a retest of $3,000 is likely. Grayscale outflows could accelerate, triggering a liquidity crisis. Downside scenario: $2,800 if macro fear intensifies, similar to patterns seen in recent Bitcoin deposit movements indicating institutional caution.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.