Loading News...

Loading News...

VADODARA, February 2, 2026 — Bitmain Technologies Ltd., the world's largest cryptocurrency mining hardware manufacturer, faces an unrealized loss exceeding $6.9 billion on its Ethereum holdings. According to a report from CryptoPotato, the company's ETH portfolio valuation has collapsed to $9.2 billion from an initial investment of approximately $15.7 billion. This represents a 41% decline in portfolio value. Market structure suggests this positions Bitmain as a potential forced seller, creating a significant liquidity overhang for Ethereum's price action.

Bitmain's unrealized loss stems from a massive Ethereum accumulation strategy. The company currently holds $9.2 billion worth of ETH. This marks a 41% decline from its total investment of roughly $15.7 billion. On-chain data indicates Bitmain likely accumulated these positions during Ethereum's 2024-2025 bull cycle. The timing suggests poor entry execution near cycle tops. Market analysts question whether Bitmain used leverage or debt financing for these purchases. The sheer scale of the loss raises concerns about corporate treasury management at institutional mining firms.

, the report's reliance on CryptoPotato data requires verification. Independent blockchain forensic analysis could confirm wallet clustering and transaction patterns. The unrealized nature of the loss provides temporary breathing room. However, margin calls or operational cash flow needs could trigger actual selling. This creates a persistent bearish order block above current prices.

Historically, miner capitulation events precede major market bottoms. The 2018 Bitcoin cycle saw similar large-scale miner sell-offs. In contrast, Ethereum's transition to Proof-of-Stake altered miner economics. Bitmain's situation reflects a hybrid model: a hardware manufacturer holding substantial staking assets. This blurs traditional miner liquidity cycles. Underlying this trend is the broader Extreme Fear sentiment gripping crypto markets.

The current Crypto Fear & Greed Index sits at 14/100. This aligns with past capitulation phases. Consequently, Bitmain's paper losses may represent a sentiment extreme. Other market participants face similar pressures. For instance, Justin Sun's proposed $100 million Bitcoin accumulation tests this fearful structure. Meanwhile, prediction markets hit record $12 billion volume as hedges against volatility.

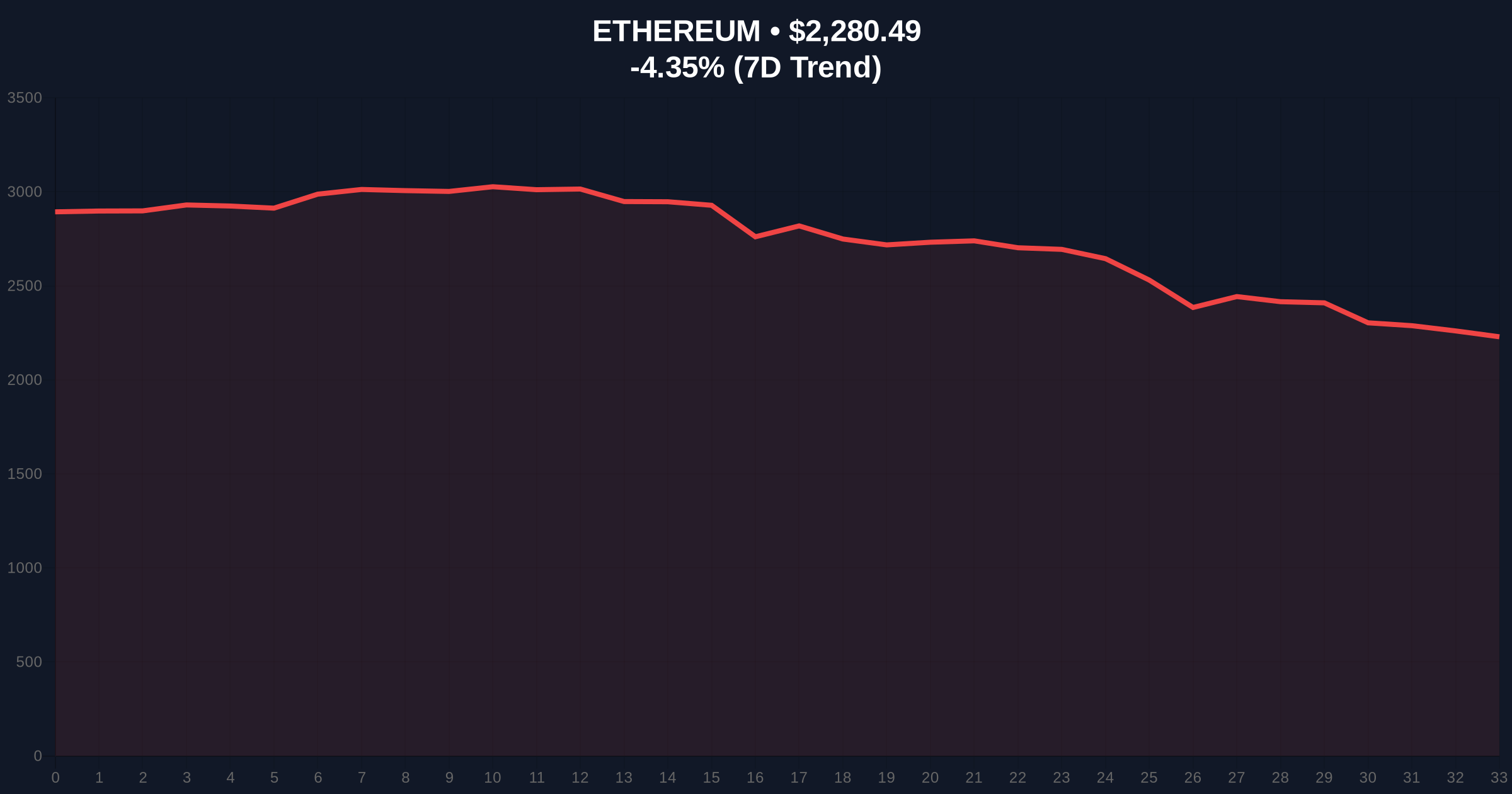

Ethereum currently trades at $2,277.53, down 4.48% in 24 hours. The price sits near critical Fibonacci support levels. Specifically, the 0.618 retracement from the 2025 high aligns with the $2,150 zone. This level represents Bitmain's potential breakeven or stop-loss cluster. A break below $2,150 would invalidate the current consolidation structure. Volume profile analysis shows weak buying interest at current levels.

Relative Strength Index (RSI) readings hover near oversold territory. However, oversold conditions can persist during capitulation. The 200-day moving average acts as dynamic resistance near $2,800. Ethereum's network fundamentals, including EIP-4844 blob fee reductions, provide underlying support. Yet miner selling pressure could override these technical improvements. Market structure suggests watching for a liquidity grab below $2,100 to flush weak hands.

| Metric | Value |

|---|---|

| Bitmain Unrealized Loss | $6.9 Billion |

| Current ETH Holdings Value | $9.2 Billion |

| Portfolio Decline | 41% |

| Ethereum Current Price | $2,277.53 |

| 24-Hour Change | -4.48% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

Bitmain's situation matters for three reasons. First, it exposes concentration risk among crypto-native corporations. Second, it creates a potential supply overhang. If Bitmain liquidates even 10% of its position, that's $920 million in selling pressure. Third, it tests Ethereum's post-merge economic resilience. Miners turned validators face new financial constraints. Institutional liquidity cycles now include staking rewards versus hardware depreciation.

Real-world evidence appears in Bitcoin mining stocks. These equities often lead crypto price movements. Recent underperformance suggests broader miner distress. Retail market structure remains fragile. The Extreme Fear sentiment confirms widespread risk aversion. Consequently, Bitmain's paper losses could trigger a reflexive selling feedback loop.

"The Bitmain situation highlights the maturity mismatch in crypto corporate treasuries. Companies accumulated assets during bull markets without adequate hedging. Now, operational expenses meet depreciating portfolios. This creates forced selling catalysts that exacerbate downturns. Market participants should monitor miner wallet flows for early warning signals." — CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current data. Scenario A: Ethereum holds the $2,150 support. This allows Bitmain to avoid realized losses. Sentiment gradually improves from Extreme Fear. Scenario B: Selling pressure breaks $2,150. This triggers stop-loss orders and miner capitulation. A liquidity cascade could target the $1,850 fair value gap from 2024.

The 12-month institutional outlook depends on macroeconomic conditions. Federal Reserve policy remains the dominant driver. According to the Federal Reserve's latest statements, interest rate cuts could provide relief. However, crypto-specific pressures like miner distress may delay recovery. The 5-year horizon still favors Ethereum's scaling roadmap. But short-term liquidity crises can derail long-term narratives.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.