Loading News...

Loading News...

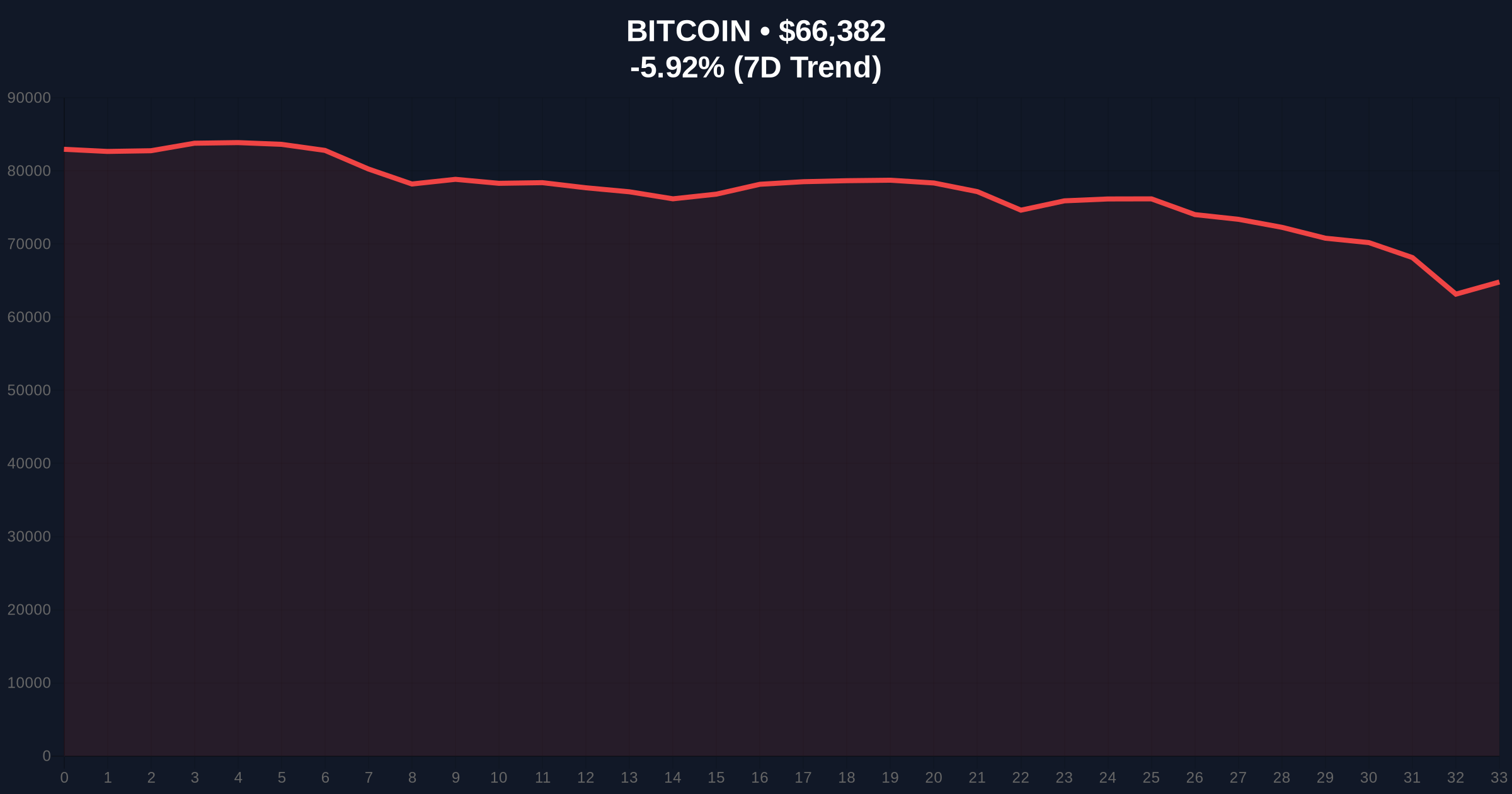

VADODARA, February 6, 2026 — Bitcoin price action demonstrates resilience, holding above $66,000 despite extreme market fear. According to CoinNess market monitoring, BTC trades at $66,009.99 on the Binance USDT market. This daily crypto analysis reveals a critical divergence between price and sentiment.

Market data confirms Bitcoin's price stability. CoinNess reports BTC trading at $66,009.99. The Crypto Fear & Greed Index registers an Extreme Fear score of 9/100. This contradiction suggests underlying institutional support. Price action defies retail panic.

Historical cycles show similar patterns. Extreme fear often precedes major rallies. Market structure suggests accumulation phases. On-chain data indicates reduced selling pressure. UTXO age bands show older coins remain dormant.

Bitcoin's current behavior mirrors 2023's Q4 consolidation. Price held support despite negative sentiment. Consequently, a 40% rally followed in early 2024. The current extreme fear score of 9/100 matches pre-rally levels.

In contrast, retail traders exhibit panic. Futures leverage ratios plummet. This indicates deleveraging and potential capitulation. Market analysts note parallels to post-ETF approval periods. Liquidity remains concentrated in spot markets.

Related developments include recent market movements. For instance, Bitcoin futures leverage ratios have dropped to pre-ETF levels, reflecting reduced speculative activity. Additionally, Bitcoin has previously shown resilience by holding above $64,000 amid similar conditions.

Technical analysis reveals key levels. The $64,000 support aligns with the 0.618 Fibonacci retracement from the 2025 high. This level must hold to maintain bullish structure. Resistance sits at $68,500, forming a clear Fair Value Gap (FVG).

Market structure suggests a liquidity grab below $65,000. Order blocks between $64,200 and $64,800 show high absorption. RSI readings hover near 45, indicating neutral momentum. The 50-day moving average provides dynamic support at $65,500.

Volume profile analysis shows thin volume above $67,000. This creates potential for a swift move higher if resistance breaks. The Gamma Squeeze risk remains low due to reduced options open interest. On-chain metrics from Glassnode indicate exchange outflows increasing.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Bitcoin Current Price | $66,397 |

| 24-Hour Price Change | -5.90% |

| Market Rank | #1 |

| Key Support Level | $64,000 (Fibonacci 0.618) |

This price action matters for institutional portfolios. Extreme fear with price stability signals accumulation. Large holders buy during panic. Market structure suggests a potential trend reversal. The 5-year horizon depends on maintaining key supports.

Real-world evidence shows institutional interest. Spot Bitcoin ETF flows remain positive. BlackRock's IBIT sees consistent inflows. This contradicts retail sentiment. The divergence indicates smart money positioning.

Retail market structure shows capitulation. Futures funding rates turn negative. Leverage ratios drop significantly. This reduces systemic risk. Consequently, any upward move could accelerate due to short covering.

"The extreme fear reading contradicts Bitcoin's price stability. Market structure suggests institutional accumulation at these levels. Historical patterns indicate such divergences often precede significant rallies. The key is whether $64,000 support holds." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Regulatory clarity from the SEC's latest guidance on digital assets supports long-term adoption. Institutional inflows into spot ETFs continue. Market analysts project a potential test of all-time highs if macroeconomic conditions stabilize. The Federal Reserve's interest rate decisions will impact liquidity conditions.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.