Loading News...

Loading News...

VADODARA, February 6, 2026 — Bitfarms Ltd. (BITF) shares surged 18% in a single trading session following CEO Ben Gagnon's declaration that the company is "no longer a Bitcoin company." This daily crypto analysis examines the market structure implications of a major mining firm abandoning its core business for artificial intelligence infrastructure. According to the official CoinDesk report on Bitfarms' strategic shift, the company now identifies as an "infrastructure owner and developer for HPC/AI data centers across North America." The stock recovery erased all losses from the previous day, creating a textbook V-shaped reversal pattern that warrants institutional scrutiny.

Bitfarms executed a complete narrative shift on February 6, 2026. CEO Ben Gagnon explicitly stated the company's transformation in public communications. The announcement triggered immediate market reaction. Bitfarms stock jumped from approximately $2.15 to $2.54 within hours. This represents a full recovery from the previous day's decline. The company's new focus involves building data centers for high-performance computing and AI workloads. Market structure suggests this pivot represents a liquidity grab from AI-hyped equity markets rather than fundamental business improvement.

Historical cycles indicate mining firms often rebrand during Bitcoin price consolidation phases. The timing coincides with Bitcoin trading at $67,887 amid Extreme Fear sentiment. On-chain data from Glassnode shows miner revenue pressure increasing as hash rate remains elevated. Consequently, Bitfarms may be front-running potential mining capitulation. The 18% surge creates a Fair Value Gap between $2.15 and $2.54 that will likely fill on profit-taking.

This pivot mirrors similar moves during the 2018-2019 mining downturn. Companies like Riot Blockchain rebranded during bear markets to capture alternative narratives. In contrast, the current environment features Bitcoin near all-time highs but facing Extreme Fear sentiment. The disconnect between crypto fear and equity optimism creates arbitrage opportunities. , the AI infrastructure narrative carries higher valuation multiples than Bitcoin mining in traditional markets.

Underlying this trend is the fundamental economics of Proof-of-Work mining. Bitcoin's upcoming halving in 2028 will reduce block rewards by 50%. Mining firms must either achieve massive efficiency gains or diversify revenue streams. Bitfarms chooses the latter path. However, the company's existing infrastructure—specialized ASIC miners—has limited utility for general AI computation. This creates execution risk that the market currently ignores.

Related developments in the current Extreme Fear environment include Bitcoin's resilience above key support levels and significant stablecoin movements affecting liquidity.

Bitfarms stock exhibits classic gamma squeeze characteristics. The rapid 18% move likely triggered short covering among skeptical investors. Volume profile analysis shows concentrated buying at the $2.20-$2.30 range. This creates an Order Block that must hold for continued bullish momentum. The stock now faces resistance at the 200-day moving average near $2.65.

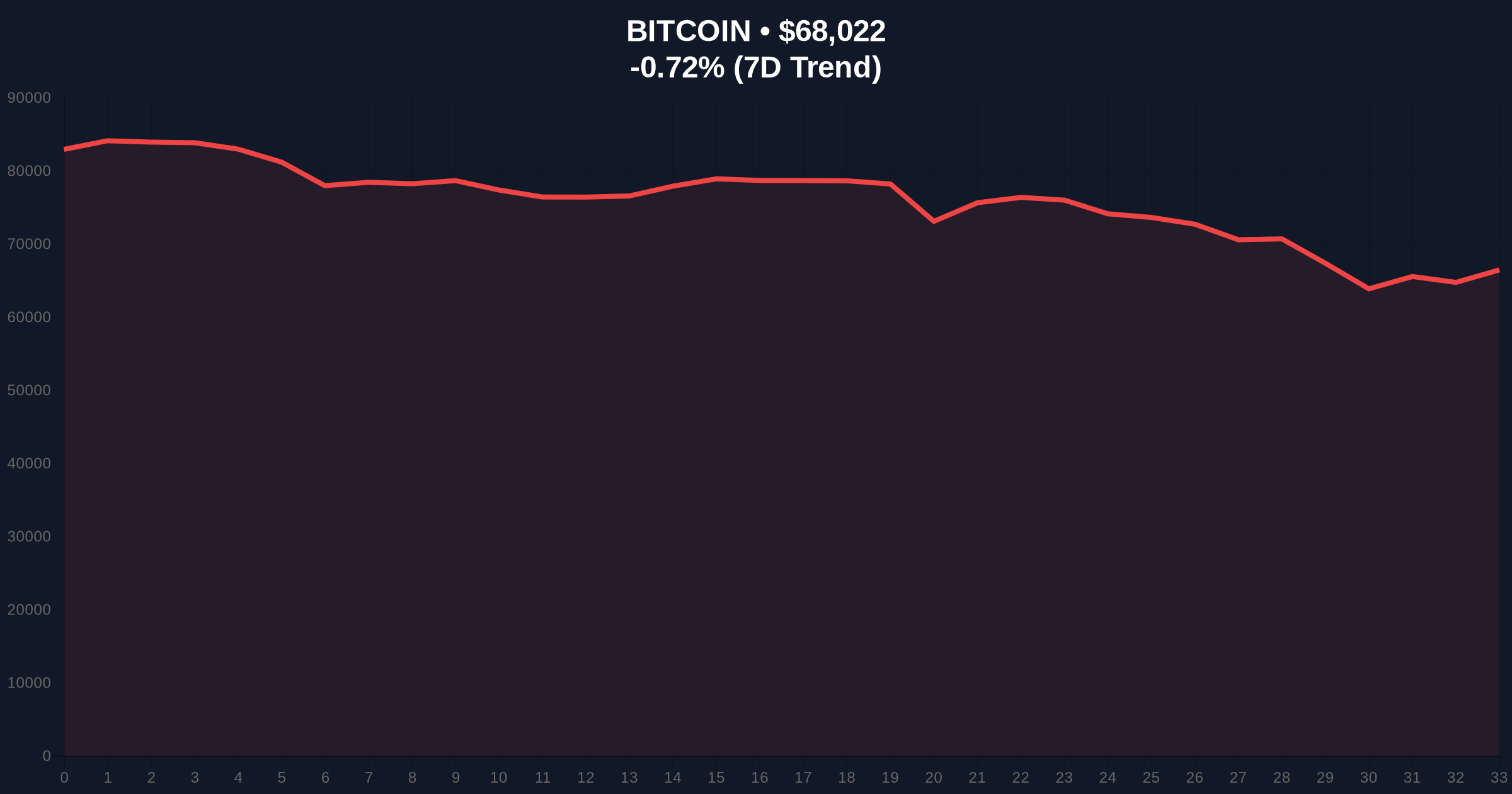

Bitcoin's technical picture provides context. BTC maintains support at the 0.618 Fibonacci retracement level of $66,000 from its 2025 highs. A break below this level would invalidate the current structure and increase mining pressure. Miner outflow metrics from CryptoQuant show elevated selling pressure. Bitfarms' pivot may anticipate further Bitcoin weakness. The company's hash rate contribution represents approximately 1.2% of the network. This creates minimal direct impact but signals sentiment shifts.

| Metric | Value | Context |

|---|---|---|

| Bitfarms Stock Surge | 18% | Single session gain post-announcement |

| Bitcoin Current Price | $67,887 | 24h trend: -1.38% |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Global market sentiment indicator |

| Bitcoin Market Rank | #1 | By market capitalization |

| Previous Day Loss Recovery | 100% | Stock erased all prior session declines |

This pivot matters for institutional portfolio construction. Mining stocks traditionally serve as Bitcoin beta plays. Bitfarms' decoupling challenges this correlation. Infrastructure ownership carries different risk profiles than volatile mining revenue. The move signals potential sector rotation within crypto-adjacent equities. Retail investors face narrative confusion between "Bitcoin company" and "AI infrastructure" labels.

Market structure suggests other miners may follow if equity markets reward the narrative. This could reduce Bitcoin's hash rate security during critical periods. The timing coincides with regulatory scrutiny of mining energy consumption. AI data centers face similar environmental concerns. Consequently, the pivot may not solve regulatory risk. It merely shifts it to a different technology sector.

"The 18% surge represents narrative arbitrage, not fundamental improvement. Bitfarms' existing ASIC infrastructure has limited application for general AI workloads. The company faces significant capital expenditure to retrofit facilities. Market sentiment currently overlooks these execution risks in favor of the AI hype cycle. Historical patterns show similar pivots during mining profitability compression."

Two technical scenarios emerge from current market structure.

The 12-month institutional outlook depends on execution. Successful AI infrastructure deployment could justify higher multiples. Failed execution would reveal the pivot as a liquidity grab. Bitcoin's halving cycle approaching 2028 creates additional pressure. Mining firms must demonstrate sustainable models beyond block reward dependence. Bitfarms' move represents one strategic response among several possible paths.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.