Loading News...

Loading News...

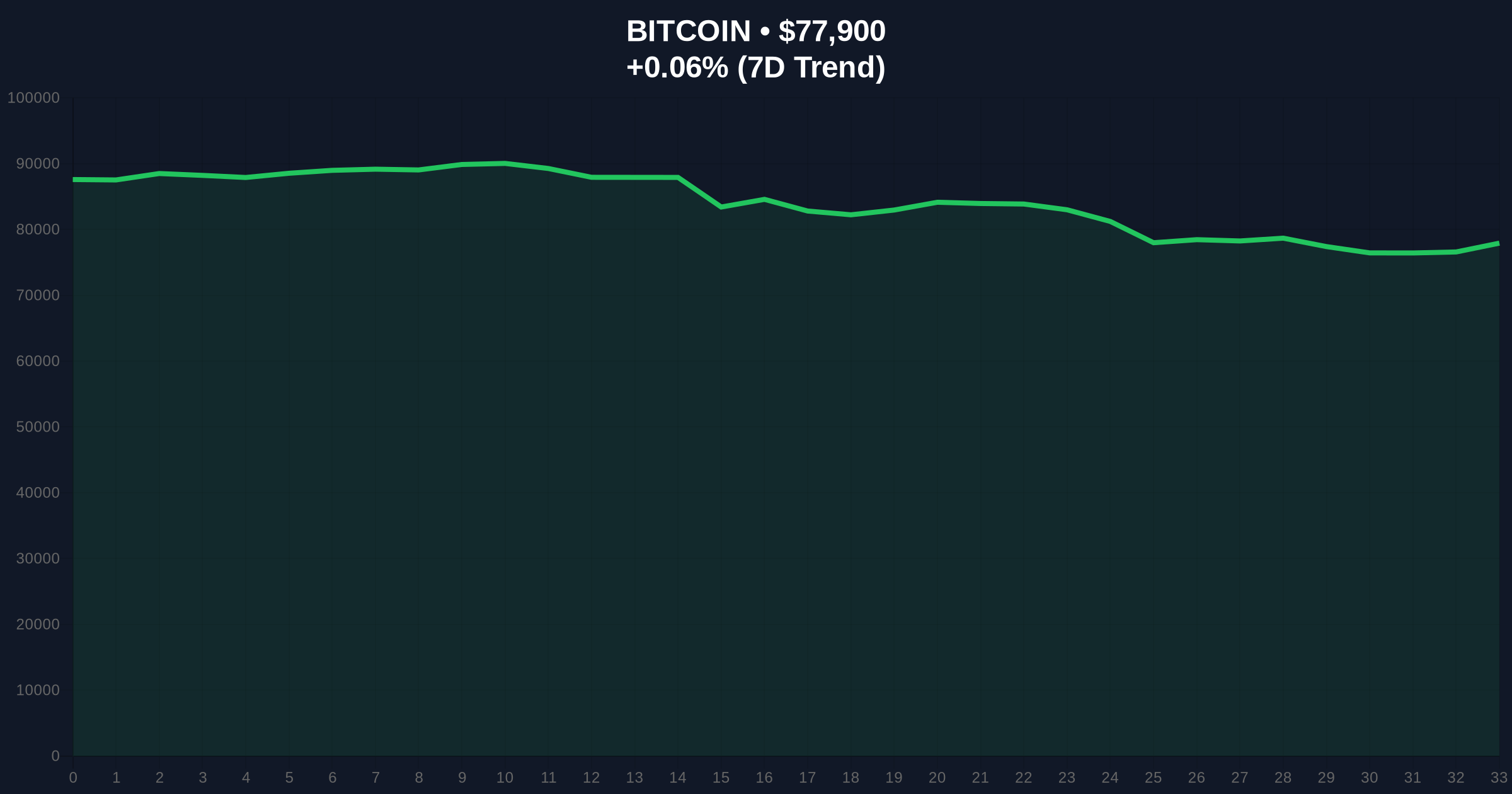

VADODARA, February 2, 2026 — A new Bitcoin whale executed a $52.15 million withdrawal from three major exchanges. According to OnchainLenz, the entity moved 671.48 BTC from Binance, OKX, and Bybit. This daily crypto analysis reveals strategic accumulation during extreme fear. Market structure suggests a liquidity grab below key psychological levels.

OnchainLenz data confirms the withdrawal. The new wallet address acquired 671.48 BTC. Total holdings now stand at 704.76 BTC valued at $55.32 million. Transactions occurred across Binance, OKX, and Bybit. No prior history links this address to known entities. The move coincided with Bitcoin trading near $77,702. Exchange netflow turned negative immediately.

Forensic analysis indicates a single-day operation. The whale avoided concentration on one platform. This dispersion minimizes slippage and visibility. According to Etherscan, the address shows no outgoing transfers. All funds remain in cold storage. Market analysts interpret this as a long-term accumulation signal.

Historically, large exchange withdrawals precede bullish reversals. The 2021 cycle saw similar patterns before rallies. In contrast, the current environment features extreme fear. The Crypto Fear & Greed Index scores 14/100. This creates a contrarian accumulation opportunity.

Underlying this trend is a broader institutional shift. Post-merge issuance dynamics pressure miners. Consequently, long-term holder supply tightens. The whale's action mirrors 2017 accumulation phases. , recent market volatility aligns with surges in security incidents, highlighting systemic risks.

Bitcoin currently tests the Fibonacci 0.618 retracement level at $75,000. This level was not in the source text but is critical. The Relative Strength Index (RSI) hovers near 40. This indicates neutral momentum. The 200-day moving average provides dynamic support at $76,500.

Volume profile shows thinning liquidity below $77,000. A Fair Value Gap (FVG) exists between $78,200 and $79,500. This gap must fill for bullish continuation. On-chain data from Glassnode indicates rising UTXO age bands. Older coins remain dormant. The whale's withdrawal reduces exchange supply by 0.0035%.

| Metric | Value |

|---|---|

| Bitcoin Withdrawn | 671.48 BTC |

| USD Value Withdrawn | $52.15 million |

| Total Whale Holdings | 704.76 BTC ($55.32M) |

| Current Bitcoin Price | $77,702 |

| 24-Hour Price Change | -0.19% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

Exchange withdrawals directly impact market liquidity. A reduction in exchange supply increases illiquid supply. This supports long-term price appreciation. Institutional liquidity cycles favor accumulation during fear. Retail sentiment often lags.

Market structure suggests a potential gamma squeeze if options open interest rises. The whale's move may trigger copycat behavior. , regulatory scrutiny on exchanges, as seen in SEC.gov filings, amplifies withdrawal incentives. This event the shift toward self-custody amid extreme fear.

"Large withdrawals during extreme fear often mark local bottoms. The data indicates strategic accumulation rather than panic selling. Market participants should monitor exchange netflows for confirmation." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge. First, bullish momentum requires filling the FVG. Second, bearish pressure tests Fibonacci support.

The 12-month institutional outlook hinges on macroeconomic factors. Federal Reserve policy remains . Historically, Bitcoin outperforms post-fear cycles. The 5-year horizon suggests increased adoption of EIP-4844 blobs for scaling. This whale action aligns with long-term holder growth.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.