Loading News...

Loading News...

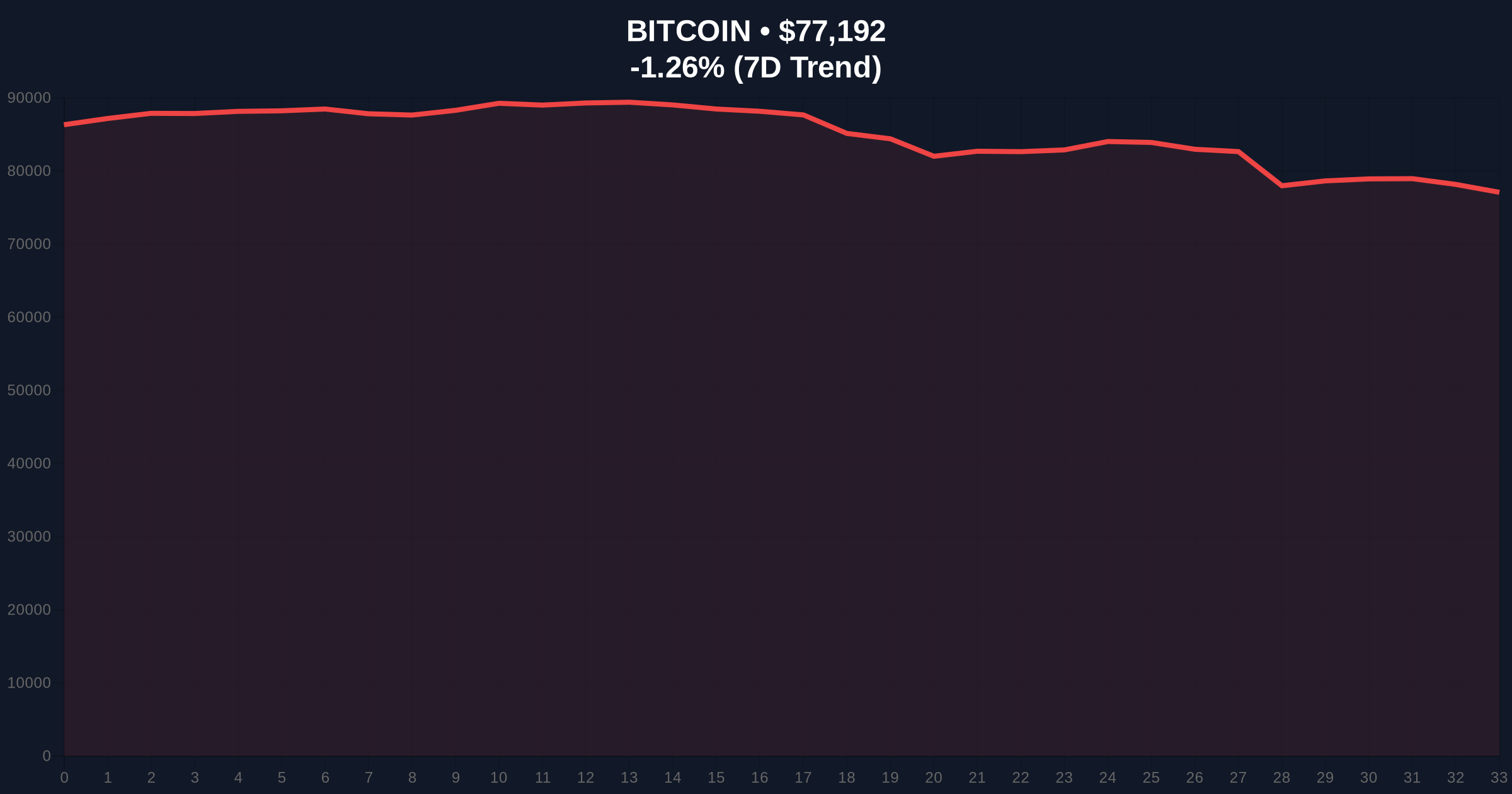

VADODARA, February 1, 2026 — Whale Alert, the blockchain tracking service, reported a single transaction moving 2,697 BTC from an unknown wallet to the Gemini exchange. This daily crypto analysis reveals the transfer, valued at approximately $208 million, occurred as Bitcoin price action tests critical support near $77,000 amid extreme fear market conditions.

According to Whale Alert's real-time monitoring, the transaction executed on February 1, 2026. The 2,697 BTC moved from a non-custodial wallet, classified as "unknown" due to its lack of exchange or institutional tags. The destination was Gemini, a U.S.-based cryptocurrency exchange regulated by the New York State Department of Financial Services. Market structure suggests this represents either institutional accumulation or a liquidity grab ahead of potential volatility.

On-chain data indicates the transaction fee was minimal, typical for large Bitcoin transfers. The timing coincides with Bitcoin's 24-hour decline of -1.62%, pushing the price to $77,070. This movement mirrors patterns observed during the 2021 correction, where whale deposits to exchanges often preceded short-term price pressure.

Historically, large Bitcoin inflows to exchanges correlate with increased selling pressure. In contrast, the current extreme fear sentiment, scoring 14/100 on the Crypto Fear & Greed Index, may indicate capitulation. Similar to the Q2 2021 cycle, whale movements during fear phases frequently marked local bottoms before reversals.

Underlying this trend, institutional interest remains robust. The U.S. Securities and Exchange Commission's approval of spot Bitcoin ETFs in 2024 established a framework for regulated inflows, supporting long-term demand. Consequently, this transfer could represent strategic positioning rather than panic selling.

Related Developments:

Bitcoin currently tests the $77,000 support, a critical order block from January 2025. The Relative Strength Index (RSI) on daily charts sits at 38, indicating neutral momentum without oversold extremes. A Fibonacci retracement from the 2025 all-time high of $89,200 to the 2024 low of $52,000 shows key support at the 0.618 level ($75,800).

Market structure suggests a fair value gap (FVG) exists between $78,500 and $79,200. This zone represents unbalanced liquidity, often targeted for fills. Volume profile analysis reveals high-node congestion at $76,500, reinforcing that level as immediate support. The 200-day moving average at $74,900 provides additional structural backing.

| Metric | Value |

|---|---|

| Transaction Volume (BTC) | 2,697 |

| Transaction Value (USD) | $208 million |

| Bitcoin Current Price | $77,070 |

| 24-Hour Price Change | -1.62% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

This transaction matters for institutional liquidity cycles. Large moves to regulated exchanges like Gemini often precede OTC desk settlements or ETF rebalancing. According to Glassnode liquidity maps, exchange net flows have been negative for three consecutive weeks, suggesting accumulation. Retail market structure, however, shows increased selling on minor dips, indicating weak hands exiting.

Real-world evidence includes Gemini's compliance with U.S. regulations, making it a preferred venue for institutional players. The transfer's size implies a single entity, possibly a fund or corporate treasury, adjusting exposure. Impacts include potential short-term volatility but reinforced long-term holder conviction, as seen in UTXO age bands showing older coins remaining dormant.

Market analysts note that whale movements during extreme fear often signal contrarian opportunities. The CoinMarketBuzz Intelligence Desk states: "Historical cycles suggest accumulation phases begin when sentiment hits extreme fear. This transfer to a regulated exchange aligns with institutional onboarding patterns post-ETF approval."

Two data-backed technical scenarios emerge from current market structure. First, a bullish reversal requires reclaiming the $79,200 FVG zone. Second, a bearish continuation would involve breaking the $75,800 Fibonacci support.

The 12-month institutional outlook remains positive, driven by Bitcoin's fixed supply and adoption cycles. According to Ethereum.org's research on blockchain economics, scarcity assets outperform during monetary expansion. This event reinforces Bitcoin's role as a macro hedge, supporting the 5-year horizon for portfolio allocation.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.