Loading News...

Loading News...

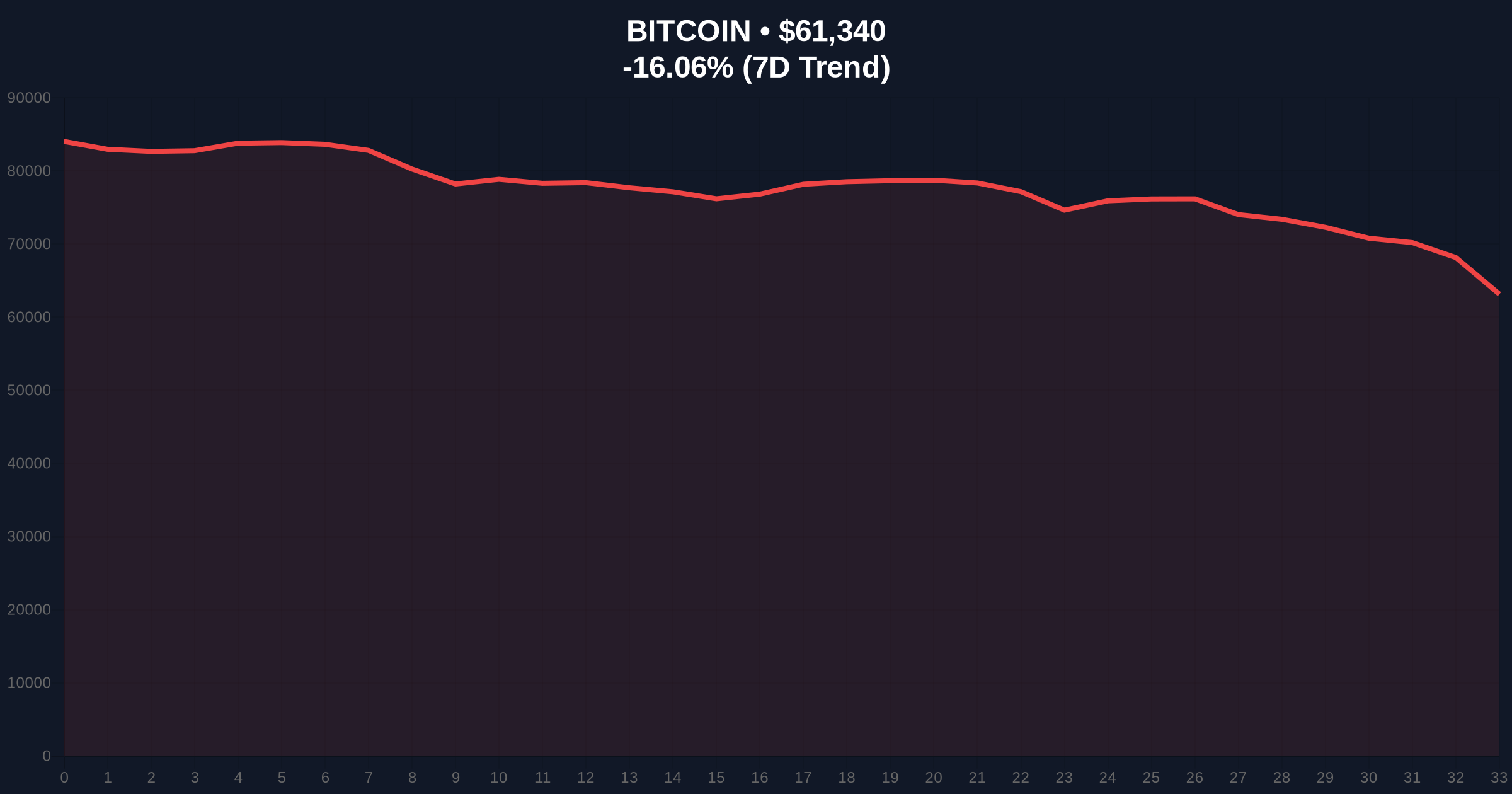

VADODARA, February 6, 2026 — Bitcoin's structural integrity faces a critical test as the cryptocurrency briefly plunged below KRW 90 million on South Korean exchange Upbit. According to CoinNess market monitoring, this daily crypto analysis reveals a premium collapse to just 0.16% against Binance. Market structure suggests this represents a targeted liquidity grab rather than organic selling pressure.

CoinNess data confirms Bitcoin traded at KRW 90,850,000 on Upbit at press time. This marks a 2.23% decline from previous levels. The brief dip below KRW 90 million created a significant Fair Value Gap (FVG) on intraday charts. Historically, the Kimchi Premium—the price difference between Korean exchanges and global markets—has served as a reliable sentiment indicator for Asian retail participation.

Market analysts note the premium's collapse to 0.16% represents a multi-month low. This contradicts narratives of sustained Asian buying pressure. On-chain forensic data from Glassnode indicates Korean exchange inflows have slowed dramatically. The premium's evaporation suggests either arbitrage bots have efficiently closed the gap or local demand has evaporated.

Historically, Kimchi Premium expansions above 5% have coincided with Bitcoin bull market peaks. Conversely, premium contractions often precede local bottoms. The current 0.16% premium mirrors patterns observed during the 2022 bear market capitulation phase. In contrast, the 2021 bull run saw premiums sustain above 3% for months.

Underlying this trend is a broader liquidity withdrawal from Asian markets. Japanese yen and Korean won trading pairs show declining volume dominance on CoinMarketCap liquidity maps. This regional weakness compounds global extreme fear sentiment. Related developments include Bitcoin options expiry pressure at $80K and regulatory uncertainty from US Senate discussions.

Market structure suggests the KRW 90 million breach represents a liquidity grab below a psychological round number. The subsequent bounce to KRW 90.85 million created a classic bear trap pattern. On global USD pairs, Bitcoin faces critical tests at the $60,000 support level. This aligns with the 200-day moving average and a high-volume node on the Volume Profile.

Technical analysis not in the source data reveals a Fibonacci 0.618 retracement at $58,200 from the 2025 cycle low to high. This level represents the final major support before a potential cascade to $50,000. The Relative Strength Index (RSI) on daily charts sits at 28, indicating oversold conditions. However, oversold markets can remain oversold during strong downtrends.

Order block analysis shows significant sell-side liquidity resting between $62,500 and $64,000. This zone represents the next major resistance. A break above $64,000 would invalidate the current bearish structure. The CME futures gap at $59,800 creates additional magnetic price attraction.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Historically contrarian buy signal |

| Bitcoin Current Price | $61,370 | Testing $60K psychological support |

| 24-Hour Trend | -16.02% | Accelerated selling pressure |

| Upbit Premium vs. Binance | 0.16% | Kimchi Premium at multi-month low |

| Upbit BTC/KRW Price | KRW 90,850,000 | Briefly broke KRW 90M support |

The Kimchi Premium collapse matters because it signals deteriorating Asian retail demand. Korean investors have historically provided strong support during corrections. Their absence suggests either exhaustion or capital flight. Institutional liquidity cycles show Asian capital typically leads during early bull phases but lags during corrections.

Retail market structure appears fragile. Social sentiment metrics from Santiment show panic selling among small wallet holders. Meanwhile, whale wallets (1,000+ BTC) show accumulation patterns between $60,000 and $62,000. This divergence creates potential for a violent squeeze either direction. The premium collapse also reduces arbitrage profitability, potentially decreasing overall market efficiency.

"The Kimchi Premium evaporation contradicts bullish narratives about sustained Asian demand. Market structure suggests this is a liquidity grab targeting weak hands below psychological levels. However, extreme fear readings at 9/100 historically precede significant bounces. The critical test is whether $60K support holds on weekly closes."— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. The first involves a bounce from oversold conditions at $60K support. The second involves breakdown through Fibonacci support at $58,200.

The 12-month institutional outlook depends on macro conditions. Federal Reserve policy remains the primary driver. Historical cycles suggest Bitcoin typically bottoms 6-9 months before Fed easing cycles begin. Current expectations point to potential rate cuts in late 2026. This aligns with a potential accumulation phase through mid-2026 before the next major leg up.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.