Loading News...

Loading News...

VADODARA, January 8, 2026 — CoinMarketCap's Altcoin Season Index remains frozen at 23, unchanged from the previous day. This daily crypto analysis reveals a market structure favoring Bitcoin over altcoins. According to CoinMarketCap's methodology, the index compares the 90-day performance of the top 100 cryptocurrencies against Bitcoin. An altcoin season requires 75% of these assets to outperform Bitcoin. The current reading suggests a prolonged Bitcoin season.

Historical cycles indicate altcoin seasons typically follow Bitcoin rallies. The 2021 cycle saw the index peak above 75 during the DeFi summer. Current conditions mirror late 2020, where Bitcoin dominance preceded altcoin breakouts. Market structure suggests institutional capital flows into Bitcoin ETFs are suppressing altcoin performance. This aligns with broader macroeconomic pressures, including the Federal Reserve's stance on interest rates, as detailed in official Federal Reserve communications. Related developments include BlackRock's recent $460 million Bitcoin and Ethereum withdrawal, signaling institutional accumulation, and NYSE American's GDLC ETF options filing, which could further entrench Bitcoin dominance.

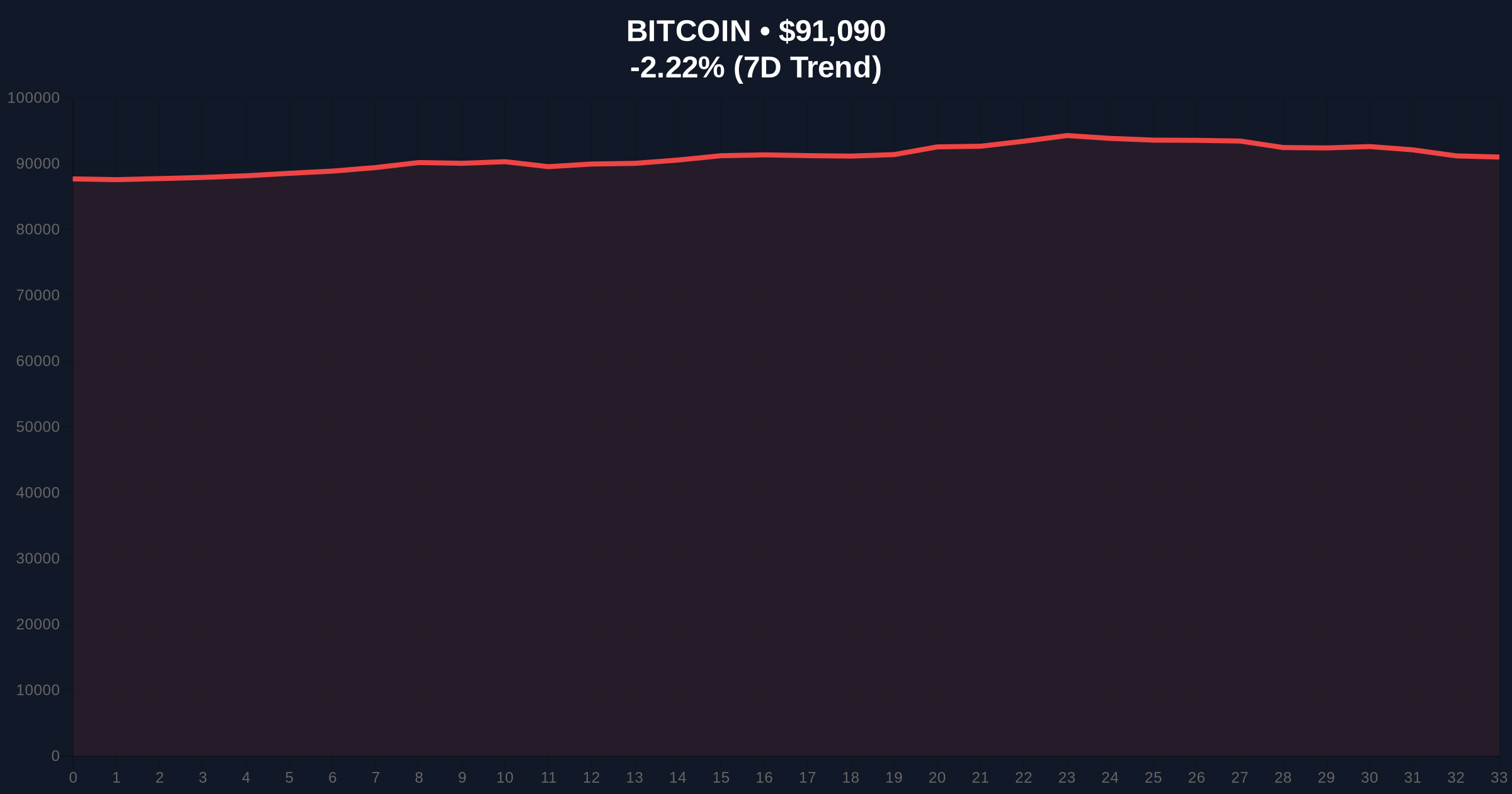

On January 8, 2026, CoinMarketCap's Altcoin Season Index held at 23. The index measures whether 75% of the top 100 cryptocurrencies outperform Bitcoin over 90 days. According to CoinMarketCap data, this score has remained below 30 for three consecutive weeks. Market analysts attribute this to Bitcoin's resilience amid volatility. Bitcoin's price action shows a 2.23% decline to $91,080, while altcoins like Ethereum face steeper corrections. The lack of movement indicates a liquidity grab favoring Bitcoin.

Bitcoin's daily chart reveals a Fair Value Gap (FVG) between $88,500 and $90,000. This zone acts as a potential order block for buyers. The Relative Strength Index (RSI) sits at 45, indicating neutral momentum. The 50-day moving average provides dynamic support at $89,200. Volume profile analysis shows low participation in altcoins, confirming the index stagnation. Bullish invalidation: A break below the Fibonacci 0.618 support at $88,000 would signal deeper correction. Bearish invalidation: A surge above $93,500 could trigger a short squeeze, but altcoin participation remains key.

| Metric | Value | Change |

|---|---|---|

| Altcoin Season Index | 23 | 0 |

| Crypto Fear & Greed Index | 28 (Fear) | -5 points |

| Bitcoin Price | $91,080 | -2.23% (24h) |

| Bitcoin Dominance | 54.8% | +0.5% |

| Top 100 Altcoin Avg. Performance | -3.1% vs Bitcoin (90-day) | Stable |

For institutions, this signals continued Bitcoin preference, reducing altcoin allocation risks. Retail traders face compressed yields in altcoin markets. The stagnation delays potential gamma squeeze events in altcoin options. Market structure suggests capital rotation into altcoins requires Bitcoin stability above $90,000. According to on-chain data, Ethereum's post-merge issuance rate remains low, but network activity hasn't translated to price outperformance. This divergence highlights broader market inefficiencies.

Market analysts on X/Twitter note the index reflects "risk-off" behavior. One trader stated, "Altcoin liquidity is drying up as Bitcoin ETFs absorb flows." Sentiment aligns with the Fear reading on the Crypto Fear & Greed Index. Bulls argue altcoin seasons historically follow Bitcoin consolidation phases. Bears point to regulatory uncertainties, such as the Trump family's banking license bid, which could impact market structure.

Bullish Case: Bitcoin holds $90,000, triggering a liquidity grab into altcoins. The Altcoin Season Index breaks above 50 within two weeks. Ethereum's upcoming Pectra upgrade, including EIP-4844 for blob transactions, could catalyze outperformance. Target: Index reaches 60 by month-end. Bearish Case: Bitcoin breaks $88,000 support. Altcoins face capitulation, pushing the index below 20. Prolonged Bitcoin dominance extends into Q1 2026. Target: Index stagnates below 30 for another month.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.