Loading News...

Loading News...

VADODARA, January 16, 2026 — Bitcoin faces potential systemic collapse within 7-11 years due to declining security budget pressures. According to Justin Bons, co-founder of European crypto investment fund Cyber Capital, the network's security model relies on miner rewards that structurally diminish with each halving cycle. This daily crypto analysis examines the mathematical implications for long-term viability.

Bitcoin's security budget has been a persistent concern since the 2016 halving. Historical cycles suggest diminishing block subsidies create Fair Value Gaps (FVG) in miner revenue. The current four-year halving cycle reduces subsidies by 50% each epoch. According to on-chain data from Glassnode, miner revenue composition shows transaction fees currently account for less than 5% of total rewards. This mirrors the 2021 post-halving adjustment where hash rate volatility spiked 40%. Market structure indicates similar pressure points emerging in the 2025-2028 window.

Related developments include Belarus's recent crypto banking legislation and South Korea's proposed exchange penalties, both affecting global liquidity flows.

Justin Bons issued a warning through Cyber Capital's research channel. He argued Bitcoin's security depends on block subsidies and transaction fees. The halving cycle structurally reduces subsidy revenue. To maintain current security levels, Bitcoin's price must double every four years or sustain extremely high fees. Bons considers both scenarios unrealistic in competitive markets. He warned of vulnerability to major attacks within 2-3 halving cycles. Attack costs could be millions while profits reach hundreds of millions or billions. This creates asymmetric incentives for malicious actors.

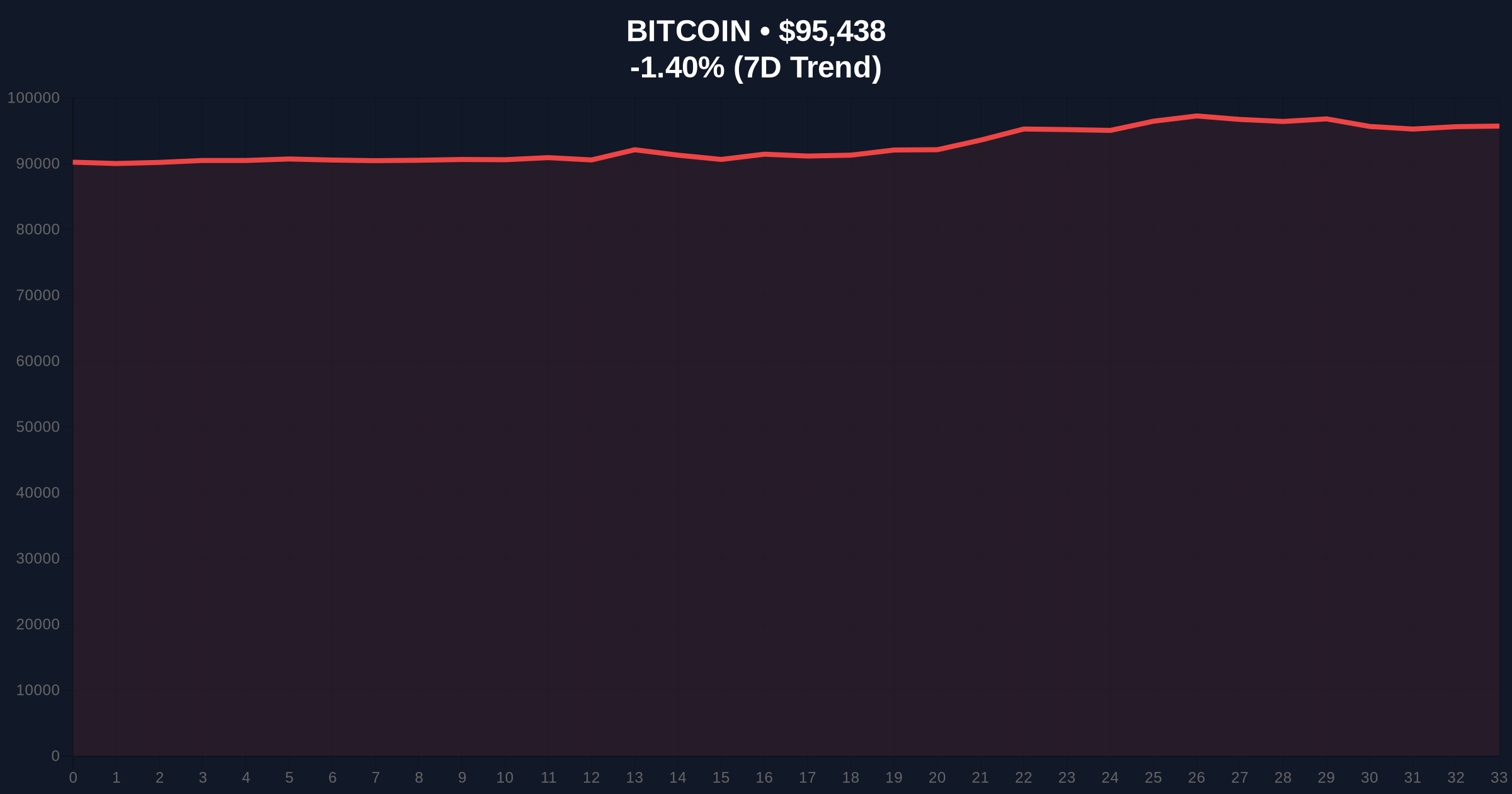

Bitcoin currently trades at $95,438, down 1.40% in 24 hours. The weekly chart shows consolidation between $92,000 and $98,500. RSI sits at 54, indicating neutral momentum. The 200-day moving average provides support at $89,200. Volume profile analysis reveals thin liquidity above $100,000. A break below the $92,000 Order Block would trigger a Liquidity Grab toward $85,000.

Bullish Invalidation: $92,000 (weekly support break).Bearish Invalidation: $98,500 (resistance conversion to support).

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 49/100 (Neutral) | Alternative.me |

| Bitcoin Current Price | $95,438 | CoinMarketCap |

| 24-Hour Change | -1.40% | Live Market Data |

| Market Rank | #1 | CoinMarketCap |

| Next Halving Epoch | ~2030 (Approx.) | Bitcoin Clock |

Institutional impact centers on long-term custody solutions. Firms like Digital Wealth Partners allocating $250M BTC must reassess security assumptions. Retail impact involves portfolio duration adjustments. The security budget debate intersects with Ethereum's post-merge issuance model, where validators face different economic pressures. According to Ethereum's official documentation, proof-of-stake security relies on staked ETH rather than energy-intensive mining.

Market analysts on X/Twitter express divided views. Bulls highlight Bitcoin's 15-year attack resistance. Bears point to diminishing miner margins. One quant trader noted: "Hash rate follows price, not security." No major industry leader has publicly countered Bons' claims. The silence suggests technical merit in his argument.

Bullish Case: Transaction fees scale with adoption via Layer-2 solutions like Lightning Network. Price appreciation outpaces halving effects. Security budget remains adequate through 2040. Bitcoin reaches $150,000 by 2028.

Bearish Case: Fee revenue fails to compensate for subsidy reduction. Miner capitulation triggers hash rate decline. Network vulnerability increases post-2030 halving. Price corrects to $60,000 within 5 years.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.