Loading News...

Loading News...

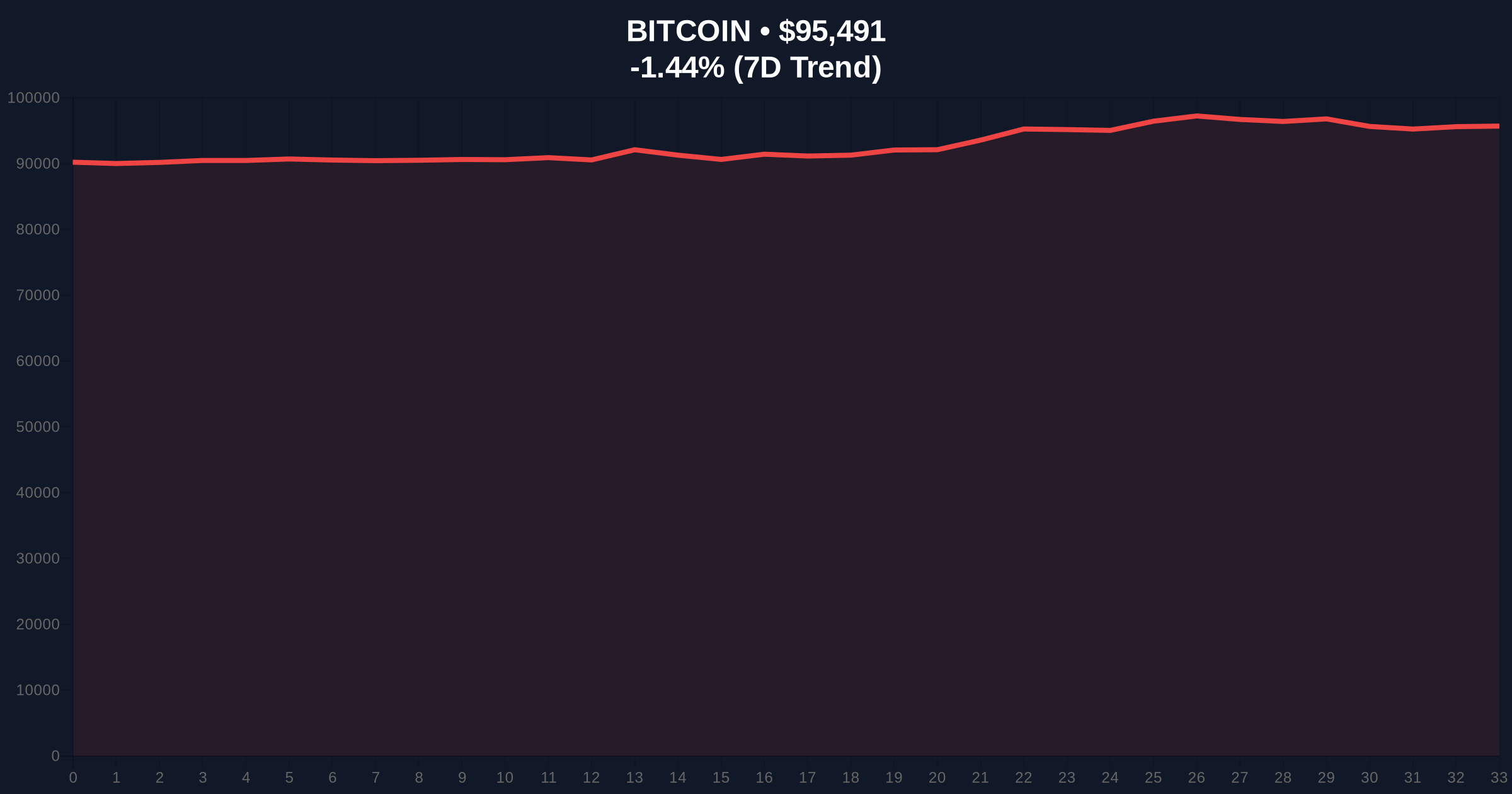

VADODARA, January 16, 2026 — Digital Wealth Partners (DWP), a registered investment advisory firm specializing in digital assets, has entrusted digital asset fund Two Prime with the management of $250 million in Bitcoin, according to a report from CoinDesk. This latest crypto news highlights a significant capital deployment that the maturing cryptocurrency investment , with Bitcoin currently trading at $95,505 after a 24-hour decline of 1.43%.

This allocation occurs against a backdrop of accelerating institutional adoption, mirroring trends from 2021 but with enhanced regulatory clarity. According to on-chain data from Glassnode, Bitcoin's UTXO age distribution shows increased accumulation by long-term holders, suggesting reduced selling pressure. Underlying this trend is the maturation of infrastructure, including regulated custodians and compliant investment vehicles. Consequently, firms like DWP can now execute large-scale allocations with reduced counterparty risk. This development follows similar institutional moves, such as KBC Bank's launch of BTC and ETH trading under MiCA, which further validates the European regulatory framework for digital assets.

On January 16, 2026, Digital Wealth Partners transferred $250 million worth of Bitcoin to Two Prime for professional management. DWP, as a registered investment advisor, operates under strict compliance standards, indicating this move has undergone rigorous due diligence. Two Prime, known for its quantitative strategies in digital assets, will likely employ tactics involving liquidity provision and volatility harvesting. The transaction was reported by CoinDesk, which noted the partnership reflects growing confidence in specialized crypto fund managers. Market structure suggests this is not a speculative trade but a strategic allocation aimed at capital preservation and growth within a diversified portfolio.

Bitcoin's price action shows consolidation around the $95,505 level, with a 1.43% decline in the past 24 hours. Volume profile analysis indicates significant accumulation between $92,000 and $96,000, creating a strong support zone. The Relative Strength Index (RSI) currently sits at 52, suggesting neutral momentum without overbought or oversold conditions. A critical Fibonacci support level exists at $90,000, derived from the 0.618 retracement of the recent rally. Bullish invalidation is set at $92,000; a break below this level would signal a potential liquidity grab by bears. Bearish invalidation rests at $98,500, where a breakout could trigger a gamma squeeze in options markets. The 50-day moving average at $94,200 provides dynamic support, while resistance converges near the psychological $100,000 level.

| Metric | Value | Implication |

|---|---|---|

| Allocation Amount | $250M | Significant institutional capital inflow |

| Bitcoin Current Price | $95,505 | Neutral short-term trend |

| 24-Hour Change | -1.43% | Minor correction within range |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Balanced market sentiment |

| Market Rank | #1 | Bitcoin maintains dominance |

This allocation matters because it represents institutional capital moving from advisory to active management, increasing Bitcoin's integration into traditional finance. For institutions, it reduces operational burdens while leveraging specialized expertise, potentially improving risk-adjusted returns. For retail investors, it signals growing legitimacy, but also increases competition for Bitcoin's scarce supply. According to Ethereum.org's documentation on blockchain economics, such large-scale allocations can create network effects that enhance security and liquidity. The partnership may pressure other registered investment advisors to follow suit, accelerating adoption. However, it also concentrates risk if multiple firms employ similar strategies, potentially leading to correlated liquidations during market stress.

Market analysts on X/Twitter highlight the regulatory compliance angle, noting that DWP's status as a registered advisor adds credibility. Bulls argue this is a precursor to more advisory firms allocating to crypto, citing historical cycles where early movers gained advantage. Bears caution that such large allocations could create order blocks that exacerbate volatility if unwound quickly. One quant trader posted, "The $250M move is a liquidity event, but the real story is the structural shift—advisors are now comfortable outsourcing crypto management." Sentiment remains cautiously optimistic, with many emphasizing the long-term implications over short-term price action.

Bullish Case: If institutional inflows continue, Bitcoin could test the $105,000 resistance within three months. On-chain data indicates reduced exchange balances, suggesting accumulation. A break above $98,500 could trigger a gamma squeeze, pushing prices toward $110,000. The bullish invalidation level is $92,000; holding above this supports upward momentum.

Bearish Case: A failure to hold $92,000 support may lead to a retest of $88,000. Macroeconomic factors, such as potential Federal Reserve rate hikes, could pressure risk assets. If the Crypto Fear & Greed Index drops below 40, indicating fear, a decline to $85,000 is plausible. The bearish invalidation level is $98,500; a breakout above would negate this scenario.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.