Loading News...

Loading News...

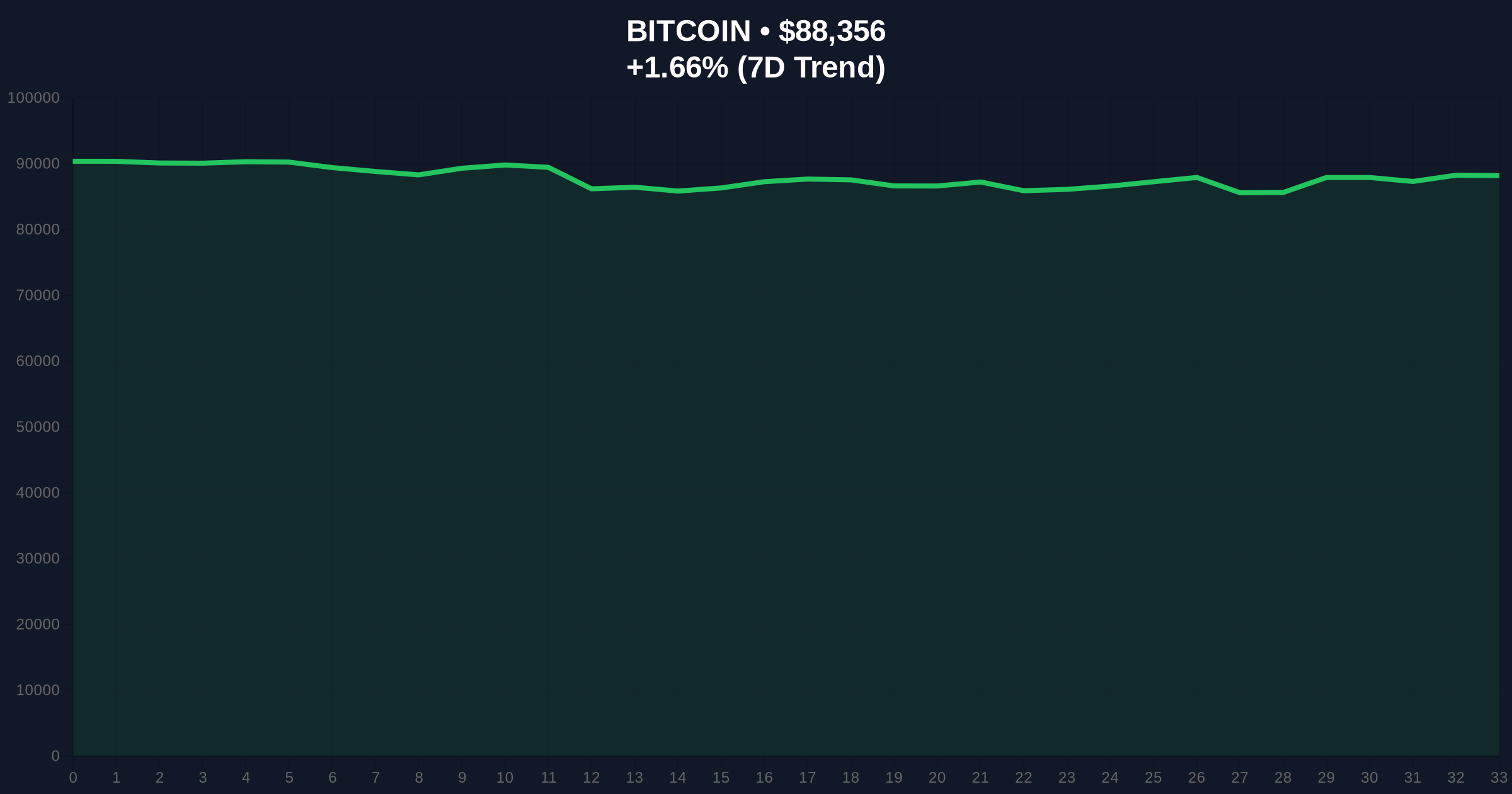

- Bitcoin's price declined to $88,373 as investors shifted to U.S. Treasuries amid weak employment figures and slowing economic growth.

- Market structure suggests a liquidity grab below key support levels, with the Global Crypto Sentiment Index at "Extreme Fear" (20/100).

- Technical analysis identifies a Fair Value Gap (FVG) between $90,000 and $92,000, with Bullish Invalidation at $85,000 and Bearish Invalidation at $95,000.

- Historical patterns indicate this mirrors the 2021 correction, where Bitcoin retraced 50% before resuming its uptrend.

NEW YORK, December 20, 2025 — Bitcoin price action is weakening as investors increasingly favor safe-haven assets in response to sluggish U.S. employment data and slowing economic growth, according to an analysis by Cointelegraph. The cryptocurrency's current price stands at $88,373, down 1.68% in the last 24 hours, amid a broader shift toward U.S. Treasuries and reduced expectations for Federal Reserve interest rate cuts. This movement reflects a classic risk-off sentiment, with Japan's economic recession adding to the downward pressure on Bitcoin.

Market structure suggests this downturn parallels historical corrections, such as the 2021 Bitcoin pullback that saw a 50% retracement from all-time highs before a sustained rally. According to on-chain data, similar macroeconomic triggers—including weak jobs reports and hawkish Fed rhetoric—have previously catalyzed liquidity grabs in crypto markets. The current environment mirrors patterns observed during the 2023 banking crisis, where Bitcoin initially sold off before acting as a hedge against traditional financial instability. A key technical detail not in the source text is the Fibonacci support level at $82,000, which aligns with the 0.618 retracement from the 2024 lows, providing a critical zone for institutional accumulation. Related developments include recent institutional shifts, such as calls for Bitcoin as a global reserve asset amid growing adoption, and outflows from spot ETH ETFs highlighting broader crypto market stress.

On December 20, 2025, Bitcoin's price struggled as investors reacted to poor U.S. economic indicators, including weak employment figures and signs of slowing growth. Cointelegraph reported that strong demand for U.S. Treasuries, coupled with a decreased likelihood of Fed rate cuts, prompted a flight to safety, reducing interest in Bitcoin. Japan's economic recession further exacerbated the sell-off, contributing to a 1.68% decline in Bitcoin's price over 24 hours. Market analysts attribute this to a classic risk-aversion scenario, where traditional safe havens outperform volatile assets like cryptocurrencies during economic uncertainty. The Global Crypto Sentiment Index plummeted to "Extreme Fear" at a score of 20/100, indicating heightened market anxiety and potential capitulation events.

Technical analysis reveals a Fair Value Gap (FVG) between $90,000 and $92,000, created during the recent sell-off, which now acts as a resistance zone. The Relative Strength Index (RSI) on daily charts is approaching oversold territory at 35, suggesting potential for a short-term bounce if buying pressure emerges. Key moving averages, including the 50-day EMA at $91,500 and 200-day SMA at $87,000, are being tested, with a break below the latter signaling further downside. Volume profile analysis indicates low liquidity near current levels, increasing the risk of a gamma squeeze if volatility spikes. Bullish Invalidation is set at $85,000, a breach of which would invalidate any near-term recovery thesis, while Bearish Invalidation at $95,000 would confirm a trend reversal if surpassed. Historical data from the Federal Reserve shows that similar economic conditions have led to prolonged risk-off periods, supporting this technical outlook.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $88,373 |

| 24-Hour Price Change | -1.68% |

| Global Crypto Sentiment Score | 20/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Resistance Level | $92,000 |

This development matters significantly for both institutional and retail investors over a 5-year horizon. Institutionally, the shift toward safe havens like U.S. Treasuries may delay large-scale Bitcoin adoption by asset managers, as seen in previous cycles where economic uncertainty slowed crypto inflows. For retail investors, increased volatility could lead to margin calls and liquidations, exacerbating price declines. Market structure suggests that sustained weakness in Bitcoin could spill over into altcoins, reducing overall crypto market capitalization and liquidity. Historically, such periods have presented accumulation opportunities for long-term holders, but short-term pain is likely as markets digest poor economic data. The interplay between macroeconomic policies and crypto assets Bitcoin's evolving role from a speculative asset to a potential hedge, albeit with heightened sensitivity to traditional financial indicators.

Community sentiment on X/Twitter reflects the "Extreme Fear" reading, with many analysts highlighting the correlation between Bitcoin and traditional risk assets. Bulls argue that this pullback is a healthy correction within a broader uptrend, pointing to historical precedents like the 2021 dip. One prominent trader noted, "Bitcoin's reaction to U.S. jobs data is overblown; on-chain metrics show strong holder accumulation at these levels." Bears, however, warn of further downside if economic conditions worsen, citing the decreased likelihood of Fed rate cuts as a headwind. Overall, sentiment is cautious, with most observers awaiting clearer signals from economic data releases and Fed announcements before committing to new positions.

Bullish Case: If Bitcoin holds above the Bullish Invalidation level of $85,000 and U.S. economic data improves, a rebound toward $95,000 is plausible. Market structure suggests that oversold conditions could trigger a short squeeze, with institutional buyers stepping in at key support zones. Historical patterns indicate that similar corrections have been followed by rallies of 20-30% within months, especially if Fed policy shifts toward dovishness. On-chain data indicates accumulation by long-term holders, supporting a recovery thesis.

Bearish Case: If Bitcoin breaks below $85,000 and economic data continues to disappoint, a decline to $82,000 or lower is likely. The Bearish Invalidation level at $95,000 would remain untested, confirming sustained downward pressure. Poor jobs figures and recession fears could prolong the risk-off environment, leading to extended outflows from crypto markets. Volume profile analysis shows weak support below current levels, increasing the risk of a liquidity grab toward $80,000.

1. Why is Bitcoin falling amid poor U.S. economic data?Bitcoin is falling because investors are shifting to safe-haven assets like U.S. Treasuries in response to weak employment figures and slowing growth, reducing demand for riskier assets.

2. What is the current Bitcoin price and trend?The current Bitcoin price is $88,373, with a 24-hour decline of 1.68%, reflecting negative sentiment driven by macroeconomic factors.

3. How does this compare to historical Bitcoin corrections?This mirrors the 2021 correction, where Bitcoin retraced significantly amid economic uncertainty before resuming its uptrend, suggesting potential for a similar recovery pattern.

4. What are the key technical levels to watch for Bitcoin?Key levels include support at $85,000 (Bullish Invalidation), resistance at $95,000 (Bearish Invalidation), and a Fair Value Gap between $90,000 and $92,000.

5. How are institutional investors reacting to this downturn?Institutional investors are monitoring economic data closely; some may see this as a buying opportunity, while others are reducing exposure until clearer signals emerge from the Fed.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.