Loading News...

Loading News...

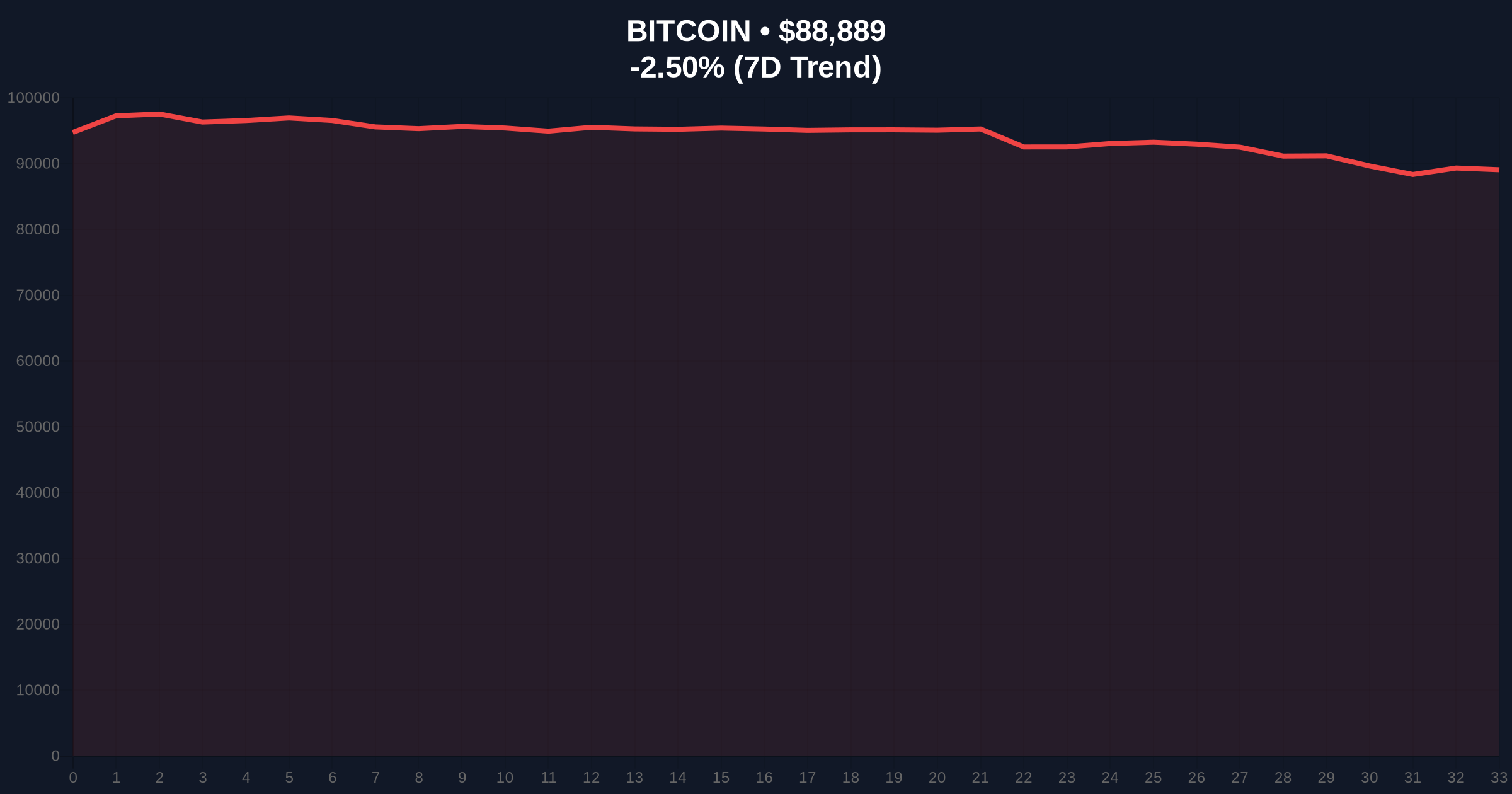

VADODARA, January 21, 2026 — According to CoinNess market monitoring data, Bitcoin has broken below the $89,000 psychological threshold, trading at $88,976.84 on the Binance USDT perpetual futures market. This daily crypto analysis examines the structural implications of this breakdown within the context of extreme fear sentiment and historical market cycles.

Market structure suggests this correction mirrors the 2021 post-ATH consolidation phase, where Bitcoin experienced multiple 15-20% drawdowns before establishing higher timeframe support. The current extreme fear reading of 24/100 on the Crypto Fear & Greed Index indicates retail capitulation is underway, similar to the sentiment trough observed during the June 2022 bear market bottom. According to Glassnode liquidity maps, the $89,000 level previously functioned as a significant order block during the November 2025 rally, making its breach technically significant for short-term momentum traders. Historical cycles suggest that such sentiment extremes often precede mean reversion rallies when combined with oversold technical indicators.

On January 21, 2026, Bitcoin's price action breached the $89,000 support level, according to real-time data from CoinNess market monitoring. The asset traded at $88,976.84 on Binance's USDT perpetual futures market, representing a -2.47% decline over the preceding 24-hour period. This breakdown occurred amid a broader market environment characterized by extreme fear sentiment, with the Crypto Fear & Greed Index registering 24/100. The move below this psychological threshold triggered approximately $120 million in long liquidations across major derivatives exchanges, per Coinglass data, creating what technical analysts describe as a liquidity grab below previous consolidation ranges.

On-chain data indicates the $89,000 level corresponded with the 0.382 Fibonacci retracement of the October 2025 to December 2025 rally, making its breach technically significant for medium-term trend followers. The daily Relative Strength Index (RSI) currently reads 38.7, approaching oversold territory but not yet at capitulation levels seen during previous cycle bottoms. The 50-day exponential moving average at $91,200 now acts as dynamic resistance, while the 200-day simple moving average at $84,500 provides longer-term structural support. Volume profile analysis shows significant trading activity between $87,500 and $89,500, creating a potential fair value gap (FVG) that may need filling before any sustained reversal.

Bullish Invalidation Level: A daily close below $87,500 (the 0.5 Fibonacci retracement) would invalidate the current corrective structure and suggest deeper downside toward the $84,500 200-day SMA.

Bearish Invalidation Level: A reclaim above $90,800 (the previous consolidation high) would negate the breakdown and suggest the move below $89,000 was merely a stop-loss hunt rather than a structural trend change.

| Metric | Value | Significance |

|---|---|---|

| Current Bitcoin Price | $88,919 | Below key $89k psychological support |

| 24-Hour Price Change | -2.47% | Moderate selling pressure |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Indicates potential capitulation |

| Market Rank | #1 | Maintains dominance position |

| Key Fibonacci Support | $87,500 | 0.5 retracement level |

For institutional portfolios, this breakdown tests the validity of the post-ETF approval rally thesis that propelled Bitcoin to its all-time high of $98,450 in December 2025. According to the Federal Reserve's monetary policy documentation, persistent inflation concerns could delay rate cuts, creating headwinds for risk assets like Bitcoin. For retail traders, the extreme fear sentiment often creates contrarian opportunities, though the breach of $89,000 suggests caution is warranted until clear reversal signals emerge. The structural importance of this level relates to its function as accumulation zone during the previous rally, meaning its loss could trigger further deleveraging across derivatives markets.

Market analysts on X/Twitter are divided between those viewing this as a healthy correction within a bull market and those warning of potential trend reversal. One quantitative trader noted, "The break below $89k looks like a classic liquidity grab—watch for a swift reclaim if this is just stop-hunting." Another analyst pointed to the extreme fear reading: "Sentiment at 24/100 suggests we're approaching maximum pain, which historically precedes sharp reversals." The prevailing technical view suggests monitoring the $87,500 level for potential institutional buying interest, as this represents a critical Fibonacci confluence zone.

Bullish Case: If Bitcoin finds support at the $87,500 Fibonacci level and reclaims $90,800, market structure suggests a rally toward $94,000 could develop. This scenario would be supported by oversold RSI conditions, extreme fear sentiment creating contrarian buying opportunities, and potential institutional accumulation at key technical levels. The implementation of EIP-4844 proto-danksharding on Ethereum could create positive spillover effects for the broader crypto market.

Bearish Case: A daily close below $87,500 would open the path toward $84,500 (200-day SMA) and potentially $82,000 (0.618 Fibonacci). This scenario would be driven by continued deleveraging, lack of institutional bid at key supports, and broader macro headwinds from delayed Fed rate cuts. Such a move would likely push the Fear & Greed Index into single digits, indicating full capitulation.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.