Loading News...

Loading News...

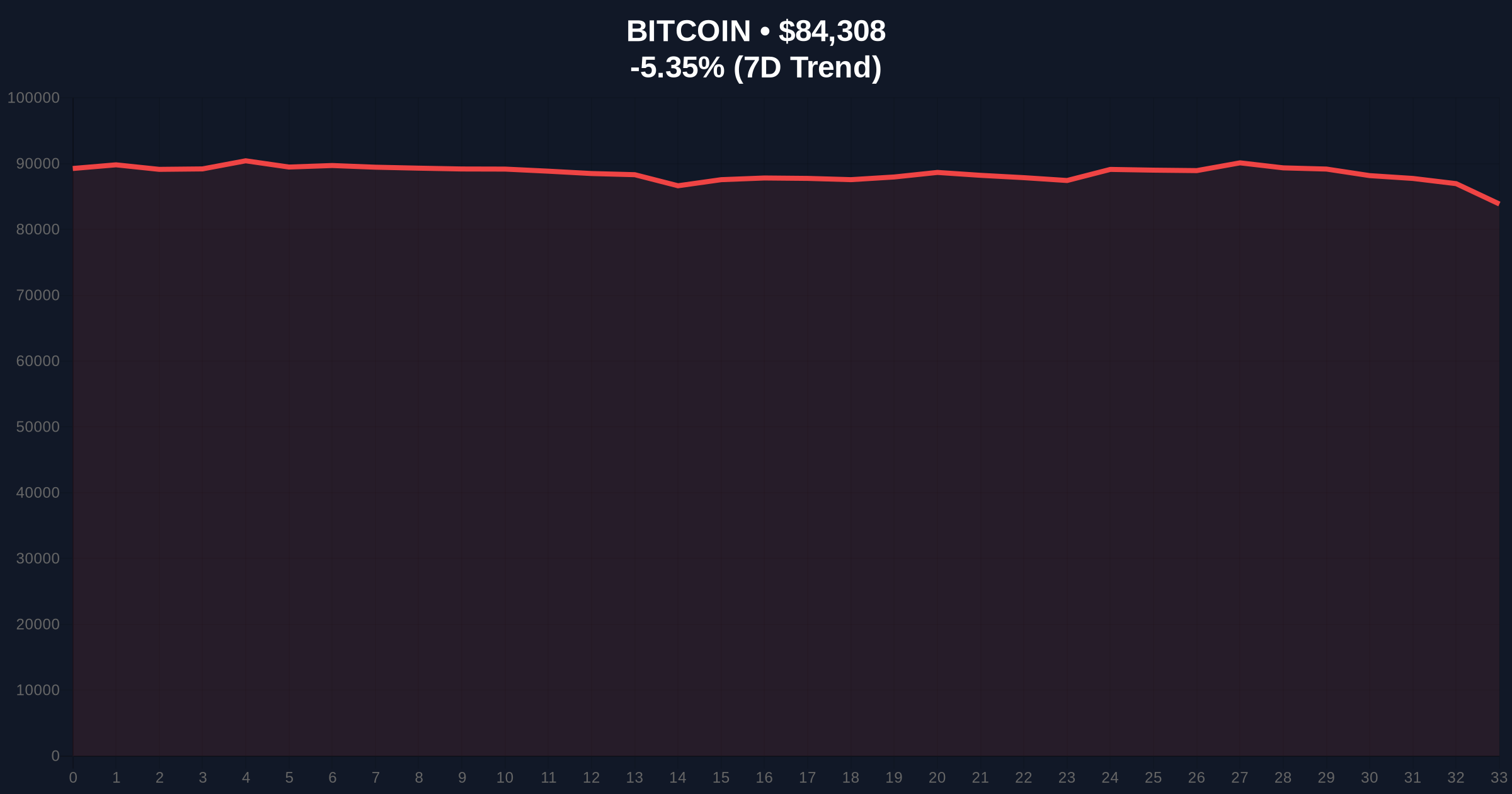

VADODARA, January 29, 2026 — Bitcoin price action is testing a critical support level at $84,000. Market structure suggests a potential sharp decline if this level fails. Analysts warn of a retreat to $71,000 in a worst-case scenario. This Bitcoin price action defines the current market battle.

According to CoinDesk, 21Shares analyst Matt Mena identified $84,000 as a key support level for BTC. He stated a break below this point could lead to a retreat to $75,000. Mena also noted potential for a recovery to $100,000 within Q1 2026.

John Glover, Chief Investment Officer at Ledn, analyzed the current correction. He described it as an extension of the downtrend from last year's high. Glover suggested BTC could fall as low as $71,000 in a worst-case scenario. Market data confirms the struggle at this level.

Historically, Bitcoin corrections often retrace to key Fibonacci levels. The current pullback from the 2025 high mirrors the 2021 cycle's consolidation phase. In contrast, institutional inflows have provided underlying support this cycle.

, regulatory uncertainty continues to pressure sentiment. The SEC's recent delays on crypto innovation exemptions add to market headwinds. This creates a complex macro backdrop for price discovery.

Market structure suggests $84,000 is a major Order Block. A break below creates a Fair Value Gap (FVG) targeting $75,000. The 200-day moving average provides dynamic support near $82,000.

Consequently, the Fibonacci 0.618 retracement level from the 2024 low sits at approximately $78,500. This aligns with historical support zones. Volume Profile indicates weak accumulation below $84,000. This signals potential for a liquidity grab.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $84,306 |

| 24-Hour Trend | -5.35% |

| Critical Support Level | $84,000 |

| Worst-Case Target | $71,000 |

| Crypto Fear & Greed Index | Fear (Score: 26/100) |

This price action tests institutional conviction. A break below $84,000 could trigger stop-loss cascades. It would invalidate the current bullish market structure. Retail sentiment, already in Fear, could deteriorate further.

, on-chain data indicates large holders are not accumulating aggressively. This suggests caution at current levels. The market needs a catalyst to regain momentum. Regulatory clarity or a macro shift could provide that spark.

"The $84,000 level is a liquidity pool. A breakdown targets the $75,000–$71,000 zone. However, the 200-day MA and Fibonacci support create a complex battle. Market participants should watch for a decisive close below $84,000." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios. The bullish case requires holding $84,000 and reclaiming $90,000. The bearish case involves a breakdown and test of lower supports.

Historical cycles suggest Bitcoin often consolidates after major rallies. The 12-month outlook depends on macro conditions and adoption trends. Institutional interest remains a key driver for the 5-year horizon.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.