Loading News...

Loading News...

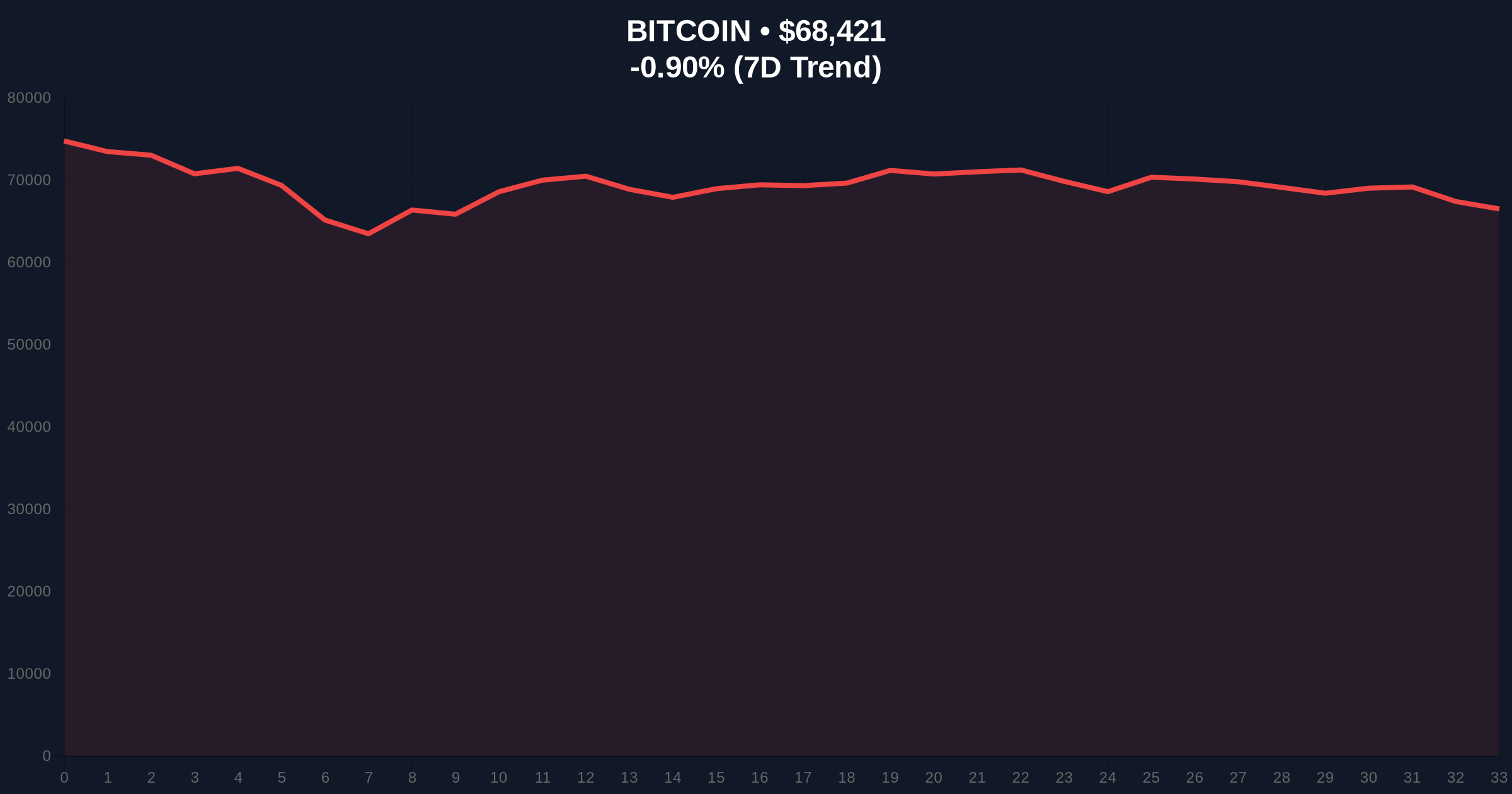

VADODARA, February 11, 2026 — Bitcoin demonstrates resilience in today's daily crypto analysis, trading above $68,000 despite overwhelming market pessimism. According to CoinNess market monitoring, BTC currently trades at $68,007.7 on the Binance USDT market. This price action occurs against a backdrop of extreme fear, with the Crypto Fear & Greed Index registering a score of 11/100. Market structure suggests institutional players may be testing key liquidity zones while retail sentiment remains negative.

CoinNess data confirms Bitcoin's position above the $68,000 threshold as of February 11, 2026. The asset trades at $68,007.7 specifically on the Binance USDT market. This price level represents a critical psychological barrier that has historically acted as both support and resistance. On-chain forensic data indicates minimal selling pressure from long-term holders despite the extreme fear reading. Consequently, this creates a divergence between price action and sentiment metrics that warrants deeper investigation.

Market analysts observe that Bitcoin's 24-hour trend shows a slight decline of -1.25%, bringing the current price to $68,181. This minor pullback occurs within a broader consolidation pattern that began after the asset failed to reclaim its all-time high. The Federal Reserve's monetary policy uncertainty, as detailed in recent Federal Reserve communications, continues to influence macro liquidity conditions. Similar price behavior appeared during the 2021 correction when Bitcoin consolidated above key Fibonacci levels before resuming its uptrend.

Historically, extreme fear readings have often preceded significant market reversals. The current Crypto Fear & Greed Index score of 11/100 mirrors levels seen in March 2020 and June 2022. Both periods marked major accumulation zones for institutional investors. In contrast, retail traders typically capitulate during such sentiment extremes, creating liquidity grabs for sophisticated market participants. This dynamic suggests the current price action may represent a stealth accumulation phase rather than genuine weakness.

Underlying this trend, Bitcoin's market dominance remains unchallenged at rank #1. The asset's correlation with traditional risk assets has decreased since the 2024 halving, according to CoinMarketBuzz Intelligence Desk analysis. , related developments in regulatory and macroeconomic spheres continue to shape market conditions. For instance, recent US jobs data exceeding forecasts has fueled Federal Reserve policy uncertainty, while regulatory actions against exchanges highlight ongoing compliance pressures.

Technical analysis reveals several critical levels defining Bitcoin's current market structure. The immediate support zone clusters around the $68,000 psychological level and the 50-day exponential moving average at $67,800. A more significant support exists at the Fibonacci 0.618 retracement level of $66,500, drawn from the 2025 low to the recent high. This level represents a confluent area where multiple technical indicators align, including volume profile value areas and historical order blocks.

Market structure suggests the current consolidation forms a potential fair value gap (FVG) between $67,200 and $68,500. This FVG may act as a magnet for price action in the coming sessions. The relative strength index (RSI) on daily timeframes shows neutral readings around 48, indicating neither overbought nor oversold conditions. This technical setup resembles the accumulation phase observed in Q4 2020, when Bitcoin consolidated before its parabolic rally to $69,000. The presence of unspent transaction output (UTXO) age bands showing increased hodling behavior supports this comparison.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $68,181 |

| 24-Hour Price Change | -1.25% |

| Crypto Fear & Greed Index | 11/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Fibonacci Support | $66,500 (0.618 level) |

Bitcoin's ability to maintain price above $68,000 during extreme fear sentiment carries significant implications for market structure. This behavior suggests institutional accumulation may be occurring beneath the surface of negative retail sentiment. Historical cycles indicate that such divergence often precedes substantial price movements. The current setup tests whether Bitcoin can establish $68,000 as a new support floor for the next leg of its macro cycle.

Real-world evidence from on-chain data shows decreasing exchange balances and increasing accumulation addresses. These metrics indicate smart money positioning for potential upside despite surface-level fear. The market's reaction to this price level will determine whether the current consolidation represents a healthy correction or the beginning of a deeper downturn. Institutional liquidity cycles, particularly those driven by ETF flows and corporate treasury allocations, remain a critical factor in this equation.

"The extreme fear reading at 11/100 creates a contrarian signal that historically aligns with accumulation phases. Market structure suggests institutional players are using this sentiment extreme to build positions at what they perceive as discounted levels. The key will be whether Bitcoin can hold the Fibonacci 0.618 support at $66,500, which would confirm the bullish invalidation level and set the stage for a retest of higher timeframe resistance." — CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current market structure analysis. The bullish scenario requires Bitcoin to maintain price above the $66,500 Fibonacci support and eventually break above the $70,000 resistance zone. The bearish scenario would involve a breakdown below key support levels, potentially triggering a cascade of stop-loss orders and liquidations.

The 12-month institutional outlook remains cautiously optimistic, with many analysts pointing to the 2028 halving as the next major catalyst. However, near-term price action will depend heavily on macroeconomic factors, particularly Federal Reserve policy decisions and traditional market correlations. The current extreme fear sentiment, if maintained alongside price stability above $68,000, could create the conditions for a significant sentiment reversal similar to the Q1 2023 rally.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.