Loading News...

Loading News...

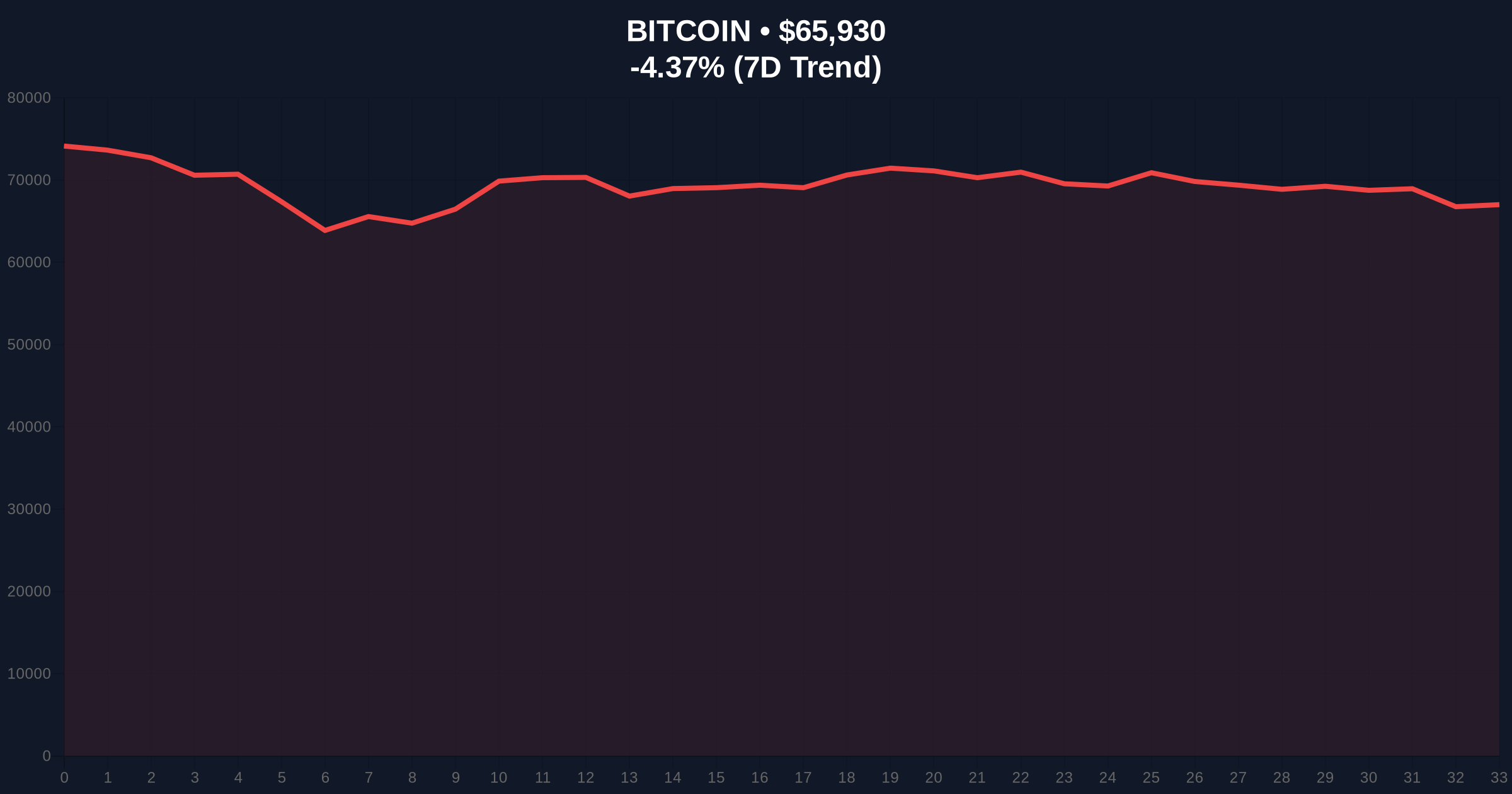

VADODARA, February 11, 2026 — Bitcoin has broken below the $66,000 psychological threshold, trading at $65,964.2 on Binance's USDT market according to CoinNess market monitoring. This daily crypto analysis reveals a market structure shift driven by extreme fear sentiment and technical breakdowns.

According to CoinNess market monitoring, BTC fell below $66,000 on February 11, 2026. The asset currently trades at $65,964.2 on Binance's USDT market. This represents a -3.57% decline over 24 hours. Market structure suggests this move constitutes a liquidity grab below a key round-number support level.

Consequently, the breakdown has triggered stop-loss orders and increased selling pressure. Underlying this trend, the Global Crypto Fear & Greed Index registers an "Extreme Fear" score of 11/100. This sentiment metric indicates panic selling and capitulation among retail traders.

Historically, Bitcoin has experienced similar breakdowns during mid-cycle corrections. In contrast to the 2021 bull run, current volatility aligns with post-halving consolidation phases. Market analysts note that extreme fear readings often precede significant reversals when combined with oversold technical indicators.

, this event mirrors previous liquidity grabs around psychological levels like $60,000 in 2025. The breakdown below $66,000 follows recent volatility where Bitcoin price action broke below $67k amid similar extreme fear conditions. Related developments include BlackRock's BUIDL fund listing on Uniswap and Ethena-backed SuiUSDe launching on Sui mainnet, both occurring amid extreme market fear.

Technical analysis reveals critical support at the Fibonacci 0.618 retracement level of $64,200, drawn from the 2025 low to the 2026 high. This level represents a major order block where institutional buyers historically accumulate. The Relative Strength Index (RSI) currently sits at 32, indicating oversold conditions but not yet extreme capitulation.

, the 50-day moving average at $68,500 now acts as resistance. A Fair Value Gap (FVG) exists between $66,500 and $67,200 that price may revisit. Volume profile analysis shows increased selling volume at the breakdown, confirming bearish momentum. According to Ethereum's official documentation on network upgrades, similar technical patterns often influence broader crypto market sentiment through correlation effects.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $66,080 |

| 24-Hour Change | -3.57% |

| Market Rank | #1 |

| Fear & Greed Index | Extreme Fear (11/100) |

| Key Fibonacci Support | $64,200 (0.618 level) |

This breakdown matters because it tests institutional conviction at critical technical levels. A hold above $64,200 would validate the bull market structure. Conversely, a break below could trigger further deleveraging across crypto derivatives markets. On-chain data indicates reduced exchange reserves, suggesting some accumulation despite price weakness.

, the extreme fear sentiment creates contrarian opportunities for long-term investors. Market structure suggests that panic selling often exhausts near major Fibonacci supports. Institutional liquidity cycles typically pivot at these levels, as seen in previous cycles.

"The breakdown below $66,000 represents a technical failure of immediate support. However, the Fibonacci 0.618 level at $64,200 remains the critical line in the sand for the broader uptrend. Extreme fear readings combined with oversold RSI conditions historically precede strong bounces when support holds." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the $64,200 Fibonacci support. Historical cycles indicate that mid-cycle corrections often resolve within 15-20% drawdowns before resuming uptrends.

The 12-month institutional outlook remains cautiously optimistic if $64,200 holds. Over a 5-year horizon, Bitcoin's network fundamentals and adoption trajectory suggest higher highs, but short-term volatility requires precise risk management.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.