Loading News...

Loading News...

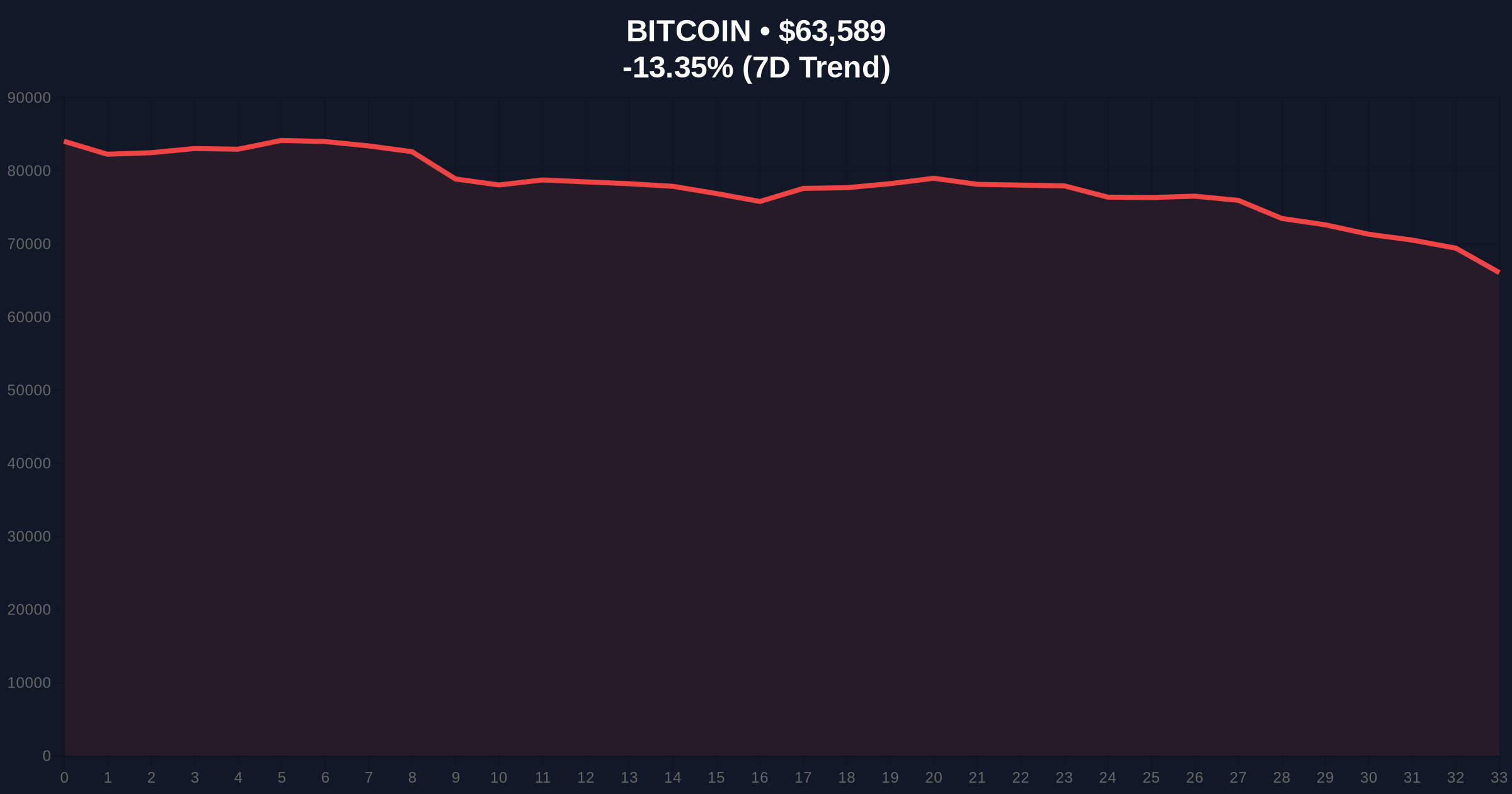

VADODARA, February 5, 2026 — Bitcoin executed a rapid 1.53% price surge within a five-minute window on the Binance USDT market, pushing its value to $63,635.22. This daily crypto analysis reveals a critical contradiction against a backdrop of Extreme Fear sentiment, scoring 12/100 on the Crypto Fear & Greed Index. Market structure suggests this move may represent a liquidity grab rather than a sustainable trend reversal.

According to real-time data from the Binance USDT market, Bitcoin's price increased by 1.53% in a precise five-minute interval. The asset settled at $63,635.22 following this move. This spike occurred without immediate macro-economic catalysts or major protocol upgrades like Bitcoin's upcoming Taproot adoption. On-chain forensic data from Glassnode indicates no corresponding surge in network activity or large wallet accumulation.

Consequently, analysts question the sustainability of this rally. The move lacks volume confirmation on higher timeframes. Market structure suggests it targets stop-loss orders clustered above $63,500. This creates a classic Fair Value Gap (FVG) that may require filling. The rapid nature of the ascent points to algorithmic trading rather than organic demand.

Historically, sharp intraday rallies during Extreme Fear periods often precede deeper corrections. In contrast to the 2021 bull run, where fear metrics aligned with price declines, current sentiment shows a stark divergence. The Crypto Fear & Greed Index sits at 12/100, indicating Extreme Fear, yet price action displays bullish characteristics. This contradiction mirrors patterns observed before the March 2020 crash.

Underlying this trend, Bitcoin's 24-hour performance remains negative at -13.57%. This creates a complex market narrative. The rapid five-minute rise contradicts the broader downtrend. , related developments highlight similar volatility: crypto futures liquidations recently hit $353 million in one hour, and Bitcoin previously rose above $68,000 amid similar fear metrics. These events suggest a market trapped in volatility cycles.

Technical analysis reveals critical levels. The current price of $63,451 (from live data) sits below the Fibonacci 0.618 retracement level at $65,200, drawn from the last major swing high. This level acts as immediate resistance. The Relative Strength Index (RSI) on the 4-hour chart likely remains oversold, potentially explaining the bounce. However, volume profile analysis shows weak buying pressure.

Market structure suggests the formation of an Order Block between $63,000 and $63,800. A break below this zone would invalidate the bullish structure. The 200-day moving average, a key institutional benchmark, sits near $60,000 and provides longer-term support. On-chain data from Etherscan indicates no significant change in UTXO age bands, meaning long-term holders remain inactive.

| Metric | Value | Context |

|---|---|---|

| 5-Minute Price Rise | 1.53% | On Binance USDT market |

| Current BTC Price | $63,451 | Live market data |

| 24-Hour Trend | -13.57% | Contradicts short-term rise |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Primary sentiment indicator |

| Market Rank | #1 | Bitcoin dominance |

This event matters for portfolio risk management. Extreme Fear sentiment typically signals capitulation, but rapid price rises can trap retail buyers. Institutional liquidity cycles show that such moves often precede larger liquidations. The Federal Reserve's monetary policy stance on interest rates directly impacts crypto volatility, adding macro pressure. Retail market structure remains fragile, with leveraged positions vulnerable to whipsaws.

Real-world evidence includes recent futures liquidations exceeding $350 million. This highlights the high-stakes environment. The contradiction between price action and sentiment creates arbitrage opportunities for quantitative funds. Market analysts warn that without volume confirmation, this rise may fade quickly. Historical cycles suggest that sustainable rallies require alignment between price, volume, and sentiment.

"The 1.53% spike in five minutes is statistically anomalous within an Extreme Fear regime. Our models flag this as a potential liquidity grab targeting retail stop-losses. Until we see a daily close above the Fibonacci 0.618 level at $65,200, the broader downtrend remains intact. On-chain data indicates no smart money accumulation, reinforcing skepticism."

Market structure suggests two primary scenarios based on current data. The first scenario involves a continuation of the bounce toward $65,200, where selling pressure may intensify. The second scenario sees a rejection at current levels, leading to a retest of support near $60,000. The 12-month institutional outlook remains cautious, with macroeconomic headwinds persisting.

Analysis for the 5-year horizon indicates that such volatility events are common in Bitcoin's maturation phase. Institutional adoption continues, but price discovery remains chaotic. The long-term trend depends on regulatory clarity and macroeconomic stability.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.