Loading News...

Loading News...

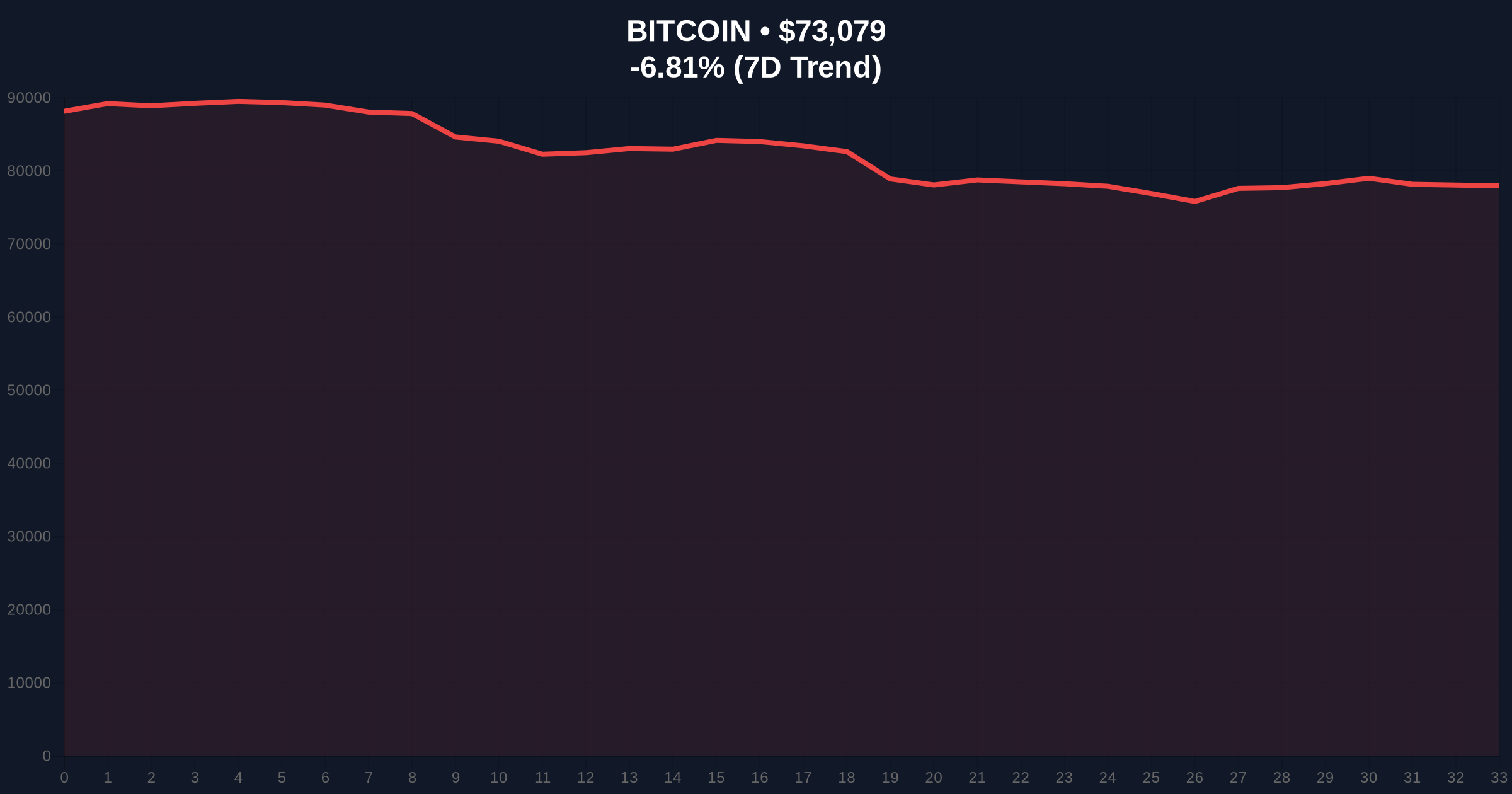

VADODARA, February 3, 2026 — Bitcoin breached the $73,000 psychological support level in early trading, according to CoinNess market monitoring. This daily crypto analysis reveals BTC trading at $72,984.05 on the Binance USDT market, marking a -6.95% decline over 24 hours. Market structure suggests a deliberate liquidity grab, with on-chain data indicating heightened selling pressure from short-term holders.

CoinNess data confirms Bitcoin fell below $73,000 on February 3, 2026. The asset currently trades at $72,971, with a 24-hour trend of -6.95%. This move occurred amid a global crypto sentiment reading of "Extreme Fear," scoring 17/100 on the Fear & Greed Index. Volume profile analysis shows increased activity around the $73,000 level, typical of a stop-loss hunting event. According to on-chain metrics from Glassnode, the Net Unrealized Profit/Loss (NUPL) metric has turned negative, signaling capitulation.

Historically, Bitcoin corrections of this magnitude often precede consolidation phases. In contrast to the 2021 bull run, where drops below key levels led to rapid recoveries, current market conditions mirror the 2018 bear market structure. Underlying this trend, the Federal Reserve's monetary policy, as detailed on FederalReserve.gov, continues to influence macro liquidity. Similar to the 2021 correction, this drop tests the 200-day moving average, a critical institutional benchmark.

Related developments include significant futures liquidations exceeding $200 million and long-term bullish predictions from institutional figures.

Market structure suggests a Fair Value Gap (FVG) between $73,500 and $74,200. The Relative Strength Index (RSI) on the daily chart reads 32, indicating oversold conditions but not extreme capitulation. A key Order Block sits at $71,500, aligning with the Fibonacci 0.618 retracement level from the 2025 all-time high. This level must hold to prevent a deeper correction toward $68,000. The 50-day moving average has crossed below the 200-day, forming a death cross on higher timeframes.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $72,971 |

| 24-Hour Change | -6.95% |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Support (Fibonacci 0.618) | $71,500 |

This price action matters for institutional liquidity cycles. A break below $73,000 invalidates the bullish structure established in Q4 2025. Retail market structure shows increased leverage liquidations, as seen in recent futures market data. On-chain data indicates long-term holders are distributing, while short-term speculators face margin calls. This creates a potential gamma squeeze scenario if price rebounds sharply.

"The drop below $73,000 is a technical breakdown, but historical cycles suggest such moves often trap late sellers. Market analysts note the Extreme Fear reading typically precedes a relief rally, though the invalidation level at $71,500 remains critical." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on macro liquidity. If the Federal Reserve pivots to rate cuts, Bitcoin could retest all-time highs by late 2026. Conversely, sustained high rates may prolong consolidation. This aligns with a 5-year horizon where Bitcoin's network effects strengthen despite short-term volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.