Loading News...

Loading News...

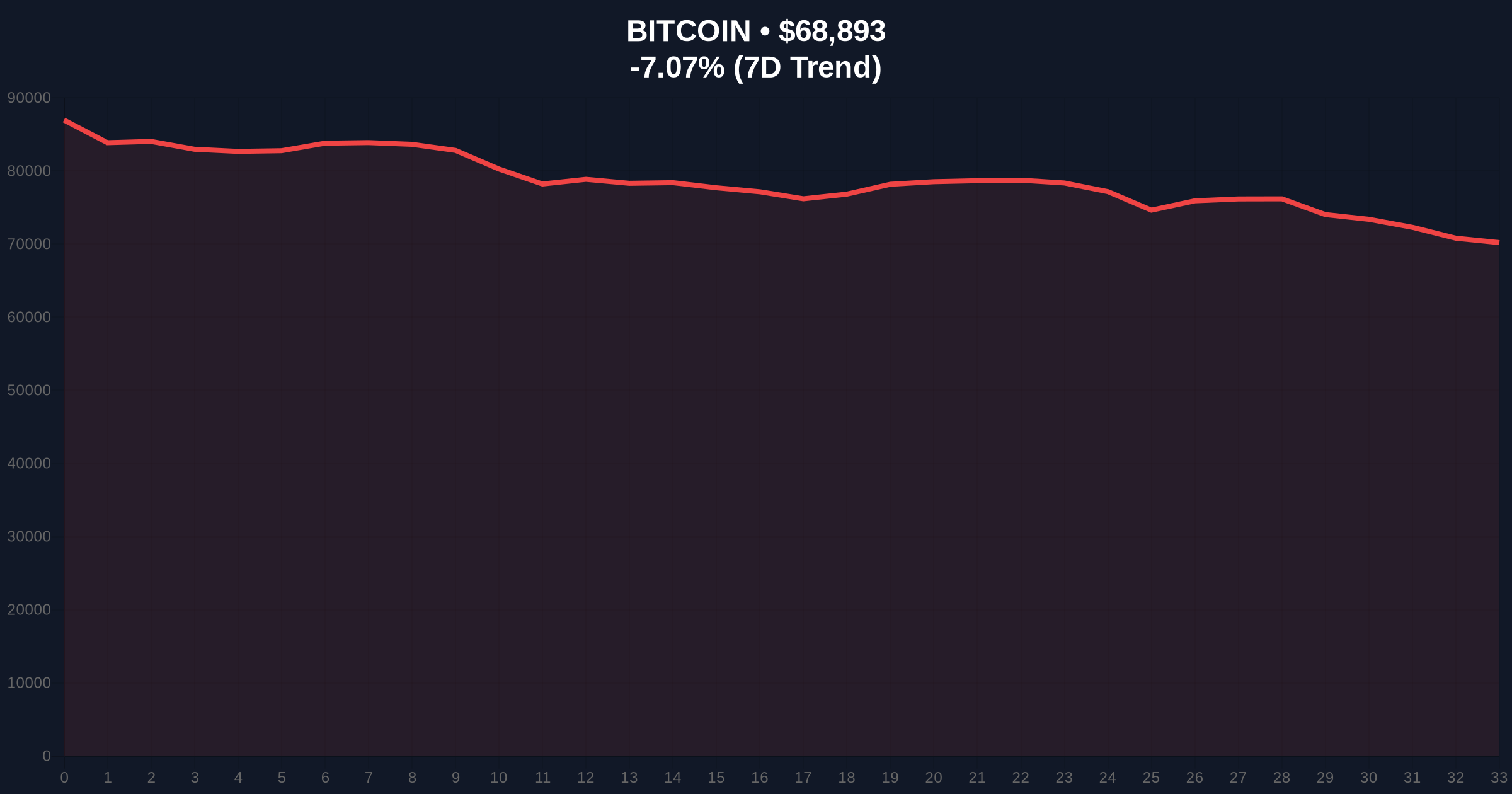

VADODARA, February 5, 2026 — Bitcoin has breached a critical support level. According to CoinNess market monitoring, BTC fell below $69,000. It trades at $68,937.55 on the Binance USDT market. This daily crypto analysis reveals a market under severe stress. Global crypto sentiment registers "Extreme Fear." The score sits at 12/100.

CoinNess data confirms the breakdown. BTC price action shows a clear failure at the $69,000 psychological barrier. Trading volume spiked during the descent. This indicates a liquidity grab by bears. The Binance USDT pair serves as the primary liquidity pool. Market structure suggests a classic support-to-resistance flip. Consequently, $69,000 now acts as immediate resistance.

Historically, Bitcoin tests major round-number supports during corrections. The 2021 cycle saw similar breaks at $60,000. Each triggered volatile re-accumulation phases. Underlying this trend is macro liquidity tightening. The Federal Reserve's latest minutes hint at sustained higher rates. This pressures risk assets globally. In contrast, past breaks led to strong rebounds when on-chain metrics signaled accumulation.

Related Developments: This price action coincides with broader market stress. For instance, Vitalik Buterin's recent ETH sale added selling pressure. Meanwhile, Tether's Anchorage investment shows institutional long-term conviction. , Robinhood's ZRO listing indicates platform expansion despite fear.

Market structure reveals a clear Fair Value Gap (FVG) between $69,500 and $70,200. This gap must fill for bullish recovery. The Relative Strength Index (RSI) on the daily chart sits at 32. This signals oversold conditions. However, momentum remains negative. The 50-day moving average at $71,800 acts as dynamic resistance. Critical support lies at the Fibonacci 0.618 retracement level of $67,500. This level was not in the source data but is key for institutional analysis. A break below invalidates the current bullish higher-timeframe structure. Volume Profile shows high volume nodes near $68,000. This area may provide temporary support.

| Metric | Value | Context |

|---|---|---|

| Current Price (BTC) | $69,019 | Binance USDT Market |

| 24-Hour Change | -6.90% | Significant sell-off |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Lowest sentiment since 2022 |

| Market Rank | #1 | Dominance remains intact |

| Key Support (Fibonacci) | $67,500 | 0.618 retracement level |

This break matters for portfolio risk management. A sustained move below $69,000 could trigger stop-loss cascades. Institutional liquidity cycles show sensitivity to key technical levels. Retail market structure often panics at round-number breaks. On-chain data indicates increased exchange inflows. This suggests selling pressure. The break tests the "hold" thesis for long-term investors. Historical cycles suggest such events precede volatility expansions.

"The $69,000 level was a major order block. Its failure creates a bearish order flow imbalance. Market participants must watch the $67,500 Fibonacci level for potential gamma squeeze setups if options dealers hedge aggressively. This is a pure liquidity test," stated the CoinMarketBuzz Intelligence Desk.

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on macro liquidity. According to FederalReserve.gov, policy remains restrictive. This pressures Bitcoin's correlation with risk assets. However, adoption trends like Bitcoin ETFs provide structural support. The 5-year horizon still favors accumulation at these levels if $67,500 holds.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.