Loading News...

Loading News...

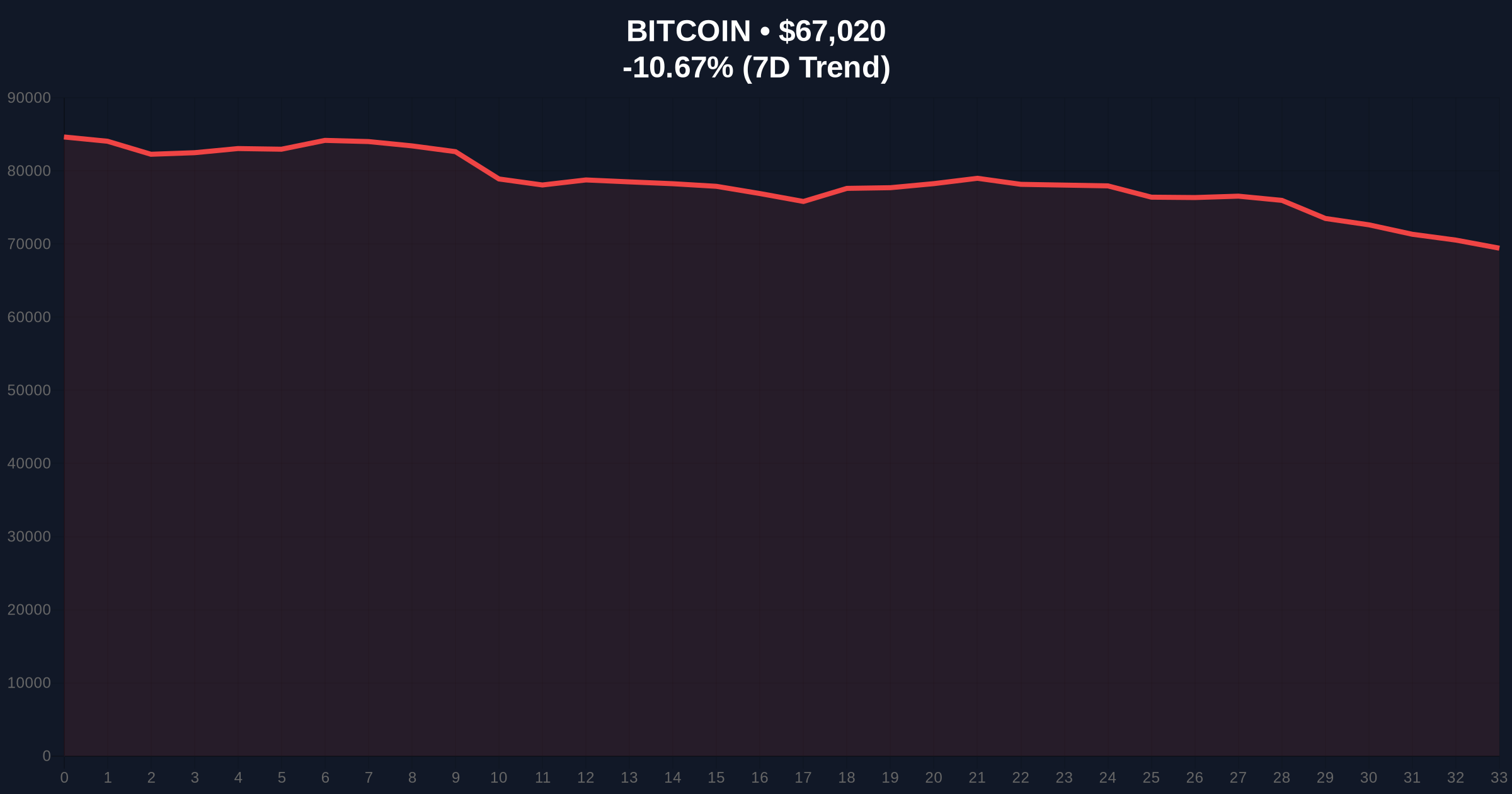

VADODARA, February 5, 2026 — Bitcoin has broken below the psychologically significant $67,000 level, trading at $66,883.99 on Binance's USDT market according to CoinNess market monitoring. This Bitcoin price action occurs as global crypto sentiment plunges to "Extreme Fear" with a score of 12/100, marking the most severe risk-off environment since the 2022 bear market capitulation phase. Market structure suggests this move represents more than typical volatility—it tests critical liquidity pools and institutional accumulation zones established during the 2024-2025 cycle.

According to CoinNess market monitoring, BTC fell below $67,000 during Asian trading hours on February 5, 2026. The asset traded at $66,883.99 on Binance's USDT market at the time of reporting. This represents a -10.32% decline over 24 hours, accelerating from earlier weakness. On-chain data indicates increased exchange inflows from long-term holders, suggesting profit-taking or defensive repositioning. Consequently, the breakdown creates a Fair Value Gap (FVG) between $67,500 and $68,200 that must be filled for any sustainable recovery.

Historically, Bitcoin has demonstrated fractal behavior around key psychological levels. The $67,000 level previously served as resistance during the 2021 cycle peak retest in 2025. In contrast, the current breakdown mirrors the July 2022 capitulation where BTC lost the $20,000 support amid similar extreme fear readings. Underlying this trend is a broader liquidity contraction, as evidenced by recent global exchange withdrawals and institutional deleveraging. Related developments include Gemini's operational retreat across multiple jurisdictions, which further constrains retail access points.

Market structure suggests Bitcoin is testing the Fibonacci 0.618 retracement level at approximately $65,200, drawn from the 2024 low to the 2025 all-time high. This level coincides with a high-volume node on the Volume Profile, indicating historical accumulation. The Relative Strength Index (RSI) on daily charts sits at 28, approaching oversold territory but not yet at capitulation extremes seen in previous cycles. , the 200-day moving average at $71,500 now acts as dynamic resistance. A sustained break below the Fibonacci 0.786 level at $63,000 would invalidate the broader bull market structure established post-2024 halving.

| Metric | Value |

|---|---|

| Current Price (BTC) | $67,279 |

| 24-Hour Change | -10.32% |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Fibonacci Support | $65,200 (0.618 level) |

This price action matters because it tests institutional conviction at critical technical levels. According to Glassnode liquidity maps, the $65,000-$67,000 zone contains approximately $4.2 billion in unrealized open interest from options and futures contracts. A breakdown triggers margin calls and forced liquidations, creating reflexive selling pressure. Consequently, retail market structure weakens as smaller addresses increase selling, per UTXO age band analysis. The Federal Reserve's monetary policy stance, detailed in recent Federal Reserve documentation, influences dollar liquidity and risk asset correlations, exacerbating the move.

"The break below $67,000 represents a liquidity grab by market makers targeting clustered stop-loss orders. Historical cycles suggest such moves often precede violent reversals if the Fibonacci 0.618 support holds. However, sustained trading below $65,200 would indicate deeper structural issues in institutional demand," stated the CoinMarketBuzz Intelligence Desk.

Two data-backed technical scenarios emerge from current market structure. First, a bullish reversal requires reclaiming the $67,500 FVG and holding above the $65,200 Fibonacci support. Second, a bearish continuation targets the $63,000 level if institutional buying fails to materialize.

The 12-month institutional outlook depends on macroeconomic liquidity conditions and Bitcoin's post-halving supply dynamics. If the Federal Reserve maintains restrictive policy, correlation with traditional risk assets may pressure BTC further. Conversely, easing could trigger a gamma squeeze as short positions cover.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.