Loading News...

Loading News...

VADODARA, February 3, 2026 — Bitcoin's Market Value to Realized Value (MVRV) Z-score has plummeted to its lowest level since October 2022, according to Glassnode analyst Chris Beamish. This daily crypto analysis reveals that the metric now mirrors levels seen when Bitcoin traded around $29,000, suggesting the market's recent overheating is resolving as price converges toward fair value. On-chain data indicates this shift represents a structural cooldown rather than a bearish breakdown.

Glassnode analyst Chris Beamish stated on X that Bitcoin's MVRV-Z score dropped significantly. He noted this decline places the metric at similar levels to October 2022. According to Beamish, this suggests the market overheating observed in previous bull runs is resolving. Consequently, Bitcoin's price is converging back toward its fair value. The MVRV-Z score measures how far Bitcoin's market value deviates from its realized value, with extreme readings indicating overvaluation or undervaluation. This current reading suggests speculative excess is draining from the system.

Historically, MVRV-Z score lows have often preceded periods of price consolidation or accumulation. The October 2022 reference point is particularly instructive. Bitcoin traded around $29,000 at that time before entering a prolonged sideways phase. Underlying this trend is the metric's function as a mean-reversion indicator. In contrast to the euphoric highs of late 2025, current readings suggest a return to equilibrium. This cooldown mirrors patterns seen after the 2017 and 2021 bull market peaks, where similar MVRV-Z corrections established healthier baselines for subsequent advances.

Related developments in the broader market context include exchange listings occurring amid extreme fear gauges and derivatives campaigns launching during similar sentiment conditions.

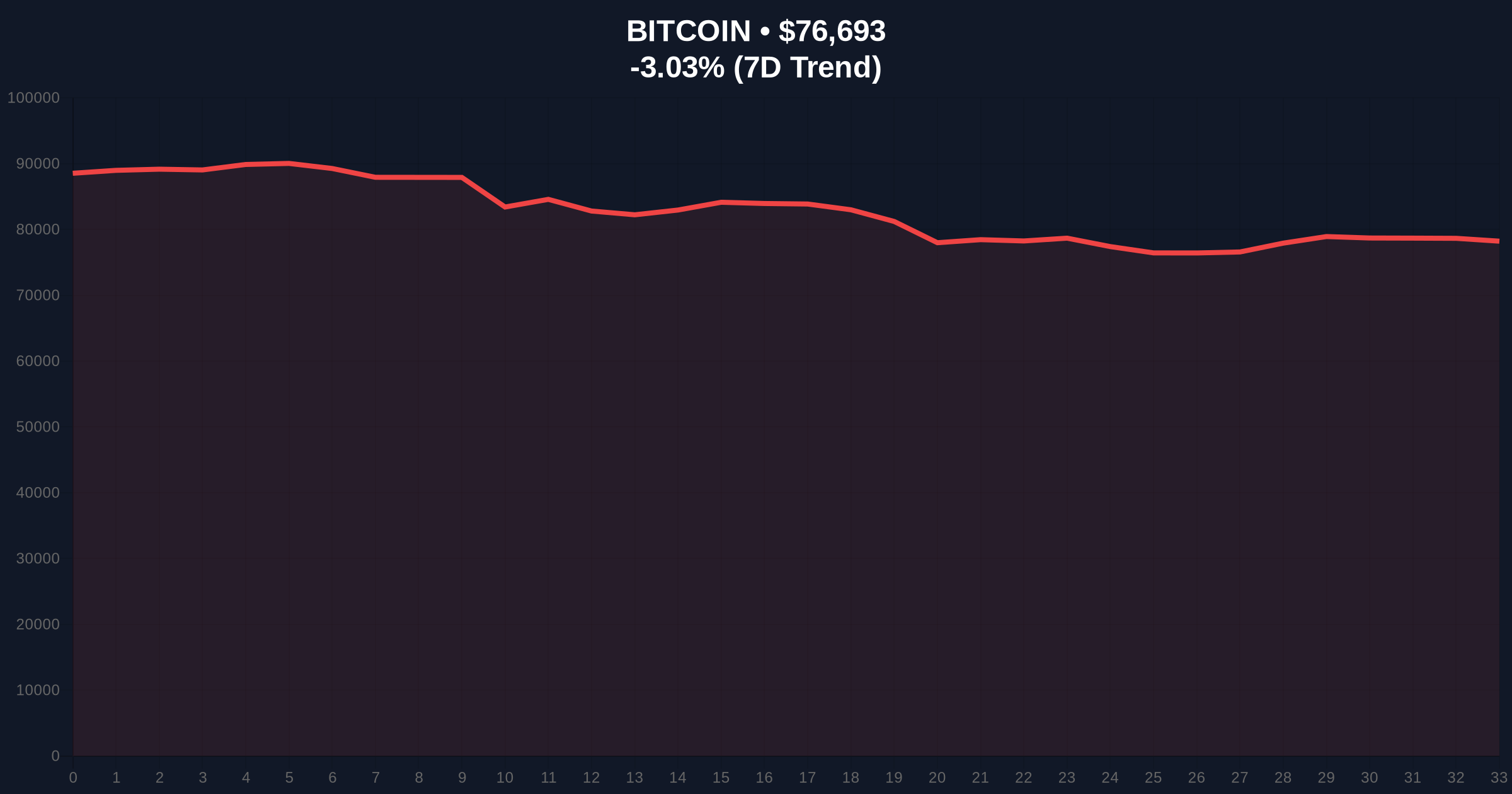

Market structure suggests Bitcoin is testing critical support levels. The current price of $76,686 represents a -3.04% 24-hour decline. Technical analysis reveals a key Fibonacci support zone between $75,000 and $77,000, corresponding to the 0.618 retracement level from the 2025 high. This area also aligns with the 200-day simple moving average, a widely watched institutional trend indicator. Volume profile data shows increased accumulation near these levels, suggesting strong buyer interest. The Relative Strength Index (RSI) on daily charts currently reads 42, indicating neutral momentum without oversold conditions.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Current Price | $76,686 | Testing key Fibonacci support |

| 24-Hour Price Change | -3.04% | Moderate correction within range |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Contrarian buy signal historically |

| MVRV-Z Score Level | October 2022 Low | Market overheating resolving |

| RSI (Daily) | 42 | Neutral momentum, not oversold |

This development matters because it signals a shift from speculative froth to value-based pricing. The MVRV-Z score's decline indicates Bitcoin's market value is approaching its realized value—the average price at which all coins last moved. Consequently, this reduces the risk of a sharp correction driven by overvaluation. Institutional liquidity cycles typically favor such environments where price aligns with fundamental on-chain metrics. Retail market structure often misinterpretes these cooldowns as bearish signals, creating buying opportunities for disciplined investors. The convergence toward fair value establishes a more sustainable foundation for long-term growth.

"The MVRV-Z score drop to October 2022 levels suggests the market is working through excess speculation. This is a healthy development that often precedes more sustainable advances. We're seeing price converge with realized value, which historically creates stronger support levels," according to the CoinMarketBuzz Intelligence Desk.

Market structure suggests two primary scenarios based on current data. The bullish scenario involves holding the $75,000 support and establishing a base for a rally toward previous highs. The bearish scenario involves breaking below this level and testing deeper support near $70,000. Historical cycles indicate that MVRV-Z score lows often mark accumulation zones rather than breakdown points.

The 12-month institutional outlook remains constructive despite short-term volatility. According to historical analysis from Ethereum.org's research on market cycles, similar MVRV-Z score corrections have typically preceded 6-12 month periods of gradual appreciation as markets rebuild from healthier valuations. This aligns with the 5-year horizon where fundamental adoption metrics outweigh short-term price fluctuations.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.