Loading News...

Loading News...

VADODARA, February 5, 2026 — Japanese corporations are accelerating cryptocurrency treasury adoption. This trend emerges amid extreme global market fear. According to former Solana Foundation executive Yu Oki, corporate buying will intensify this year. Oki now leads crypto strategy at IT firm Allied Architects. His analysis points to diverging performance between Japanese and U.S. institutional players. This latest crypto news highlights a critical regional divergence in institutional behavior.

Yu Oki provided exclusive commentary to CoinPost. He served as head of Solana Foundation's Superteam Japan. Oki now operates as crypto lead at Allied Architects. The Japanese IT services firm announced a crypto fund last month. Portfolio targets include Bitcoin, Ethereum, and Solana. Fund size remains undisclosed. Oki noted Japanese companies historically adapt U.S. models. They then optimize them for local regulatory frameworks. Market structure suggests this creates asymmetric opportunity.

U.S. crypto investment firms struggled in late 2025. Japanese entrants performed well during the same period. On-chain data indicates this performance gap stems from different accumulation strategies. Japanese firms typically avoid leverage-heavy approaches. They focus on direct asset custody and long-term treasury management. This contrasts with U.S. firms' reliance on derivatives and structured products. The divergence creates a fascinating liquidity experiment.

Historically, Japanese institutional adoption follows a specific pattern. Corporations wait for U.S. regulatory clarity. They then implement refined versions of American strategies. The 2017-2018 cycle saw this with Bitcoin mining investments. The 2021-2022 cycle witnessed it with NFT enterprise adoption. Current signals suggest 2026-2027 will focus on corporate treasuries.

Underlying this trend is Japan's Payment Services Act. The act provides clear digital asset custody guidelines. Consequently, corporate balance sheet allocation faces fewer legal uncertainties. This regulatory advantage explains the performance divergence Oki observed. In contrast, U.S. firms navigate evolving SEC guidance and state-level regulations.

Related Developments: This corporate accumulation occurs alongside significant futures liquidations and massive unrealized losses across global markets.

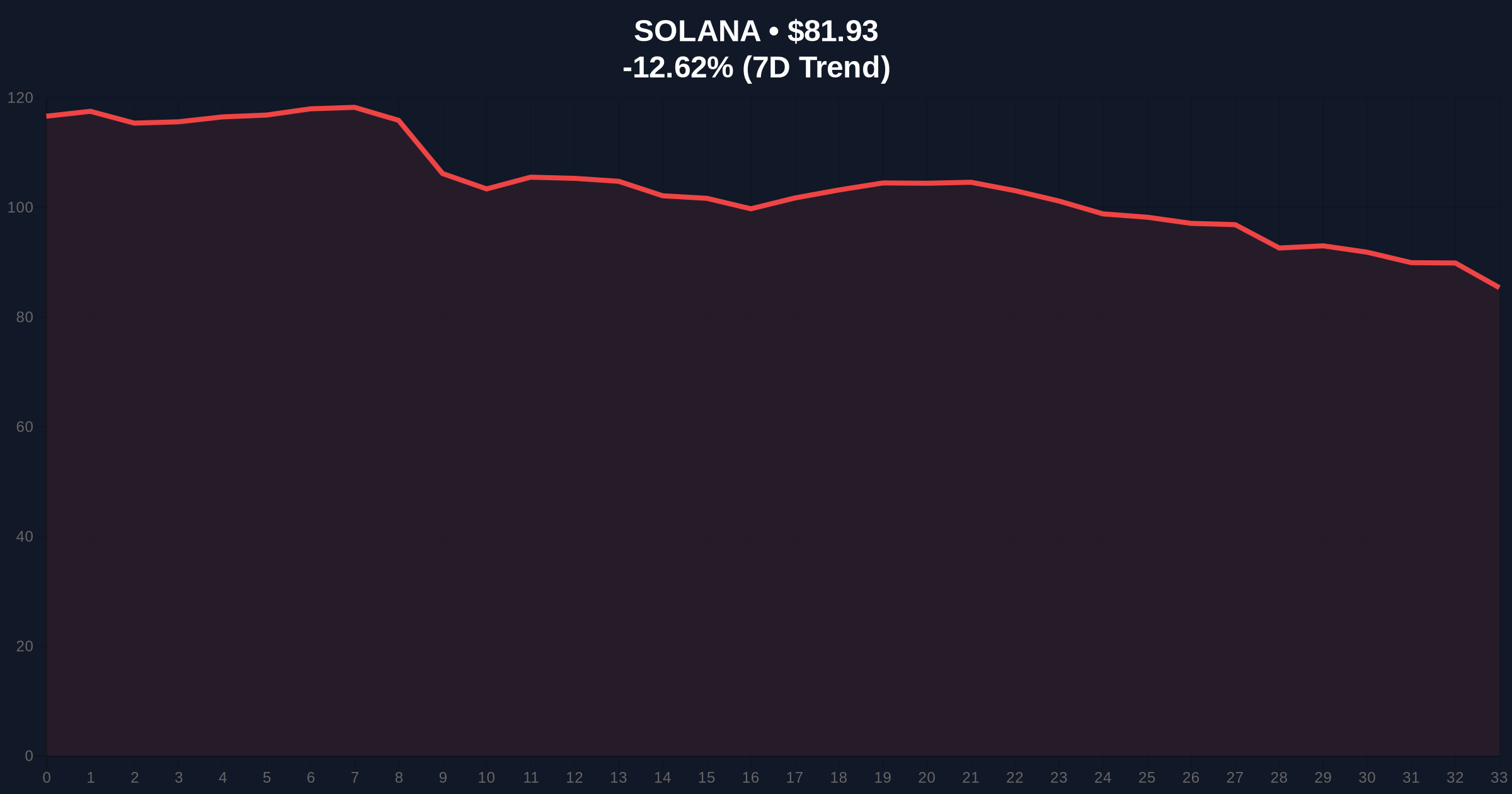

Solana's price action reveals the current market tension. SOL trades at $81.93. The asset shows a 24-hour decline of -12.61%. This drop creates a clear Fair Value Gap (FVG) on lower timeframes. The FVG spans from $85.50 to $88.20. This zone will likely act as immediate resistance.

Critical support sits at the Fibonacci 0.618 retracement level of $75.00. This level aligns with the 200-day moving average. A break below $75.00 would invalidate the current bullish structure. Volume profile analysis shows accumulation between $78.00 and $82.00. This suggests institutional buying despite retail panic.

Market structure suggests Japanese corporate buying provides a liquidity anchor. This anchor could prevent a full retest of 2025 lows. The Bank of Japan's yield curve control policies further support this thesis. Low domestic bond yields push corporations toward alternative assets. Cryptocurrencies offer non-correlated returns in this environment.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Maximum contrarian signal |

| Solana (SOL) Price | $81.93 | -12.61% 24h change |

| SOL Market Rank | #7 | Top 10 dominance holds |

| Key Fibonacci Support | $75.00 (0.618) | Critical accumulation zone |

| Fair Value Gap Resistance | $85.50 - $88.20 | Immediate technical hurdle |

Japanese corporate adoption matters for three reasons. First, it provides non-U.S. dollar liquidity. This diversifies the global buyer base. Second, corporate treasuries typically have longer holding periods. They reduce circulating supply and volatility. Third, successful Japanese models could export to other Asian markets.

Market analysts watch this development closely. Institutional liquidity cycles typically begin with regional pioneers. Japanese firms now play that role for corporate crypto adoption. Their success or failure will influence European and Southeast Asian corporations. The 5-year horizon suggests this could shift global capital flows.

Japanese companies have a proven track record of adopting and improving U.S. financial models. The current crypto treasury movement follows this pattern. While U.S. firms faced headwinds, Japanese entrants identified structural opportunities. This divergence creates a fascinating liquidity experiment for 2026.

— CoinMarketBuzz Intelligence Desk synthesis of market sentiment

Two primary scenarios emerge from current data. Scenario A: Japanese corporate buying establishes a liquidity floor. This floor supports prices above $75.00. Scenario B: Global fear overwhelms regional accumulation. Prices break key supports and retest lower levels.

The 12-month outlook hinges on these levels. Japanese corporate adoption provides a bullish catalyst. However, global macro conditions remain challenging. Federal Reserve policy and U.S. regulatory actions will influence outcomes. A successful Japanese model could attract $5-10 billion in corporate capital by 2027.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.