Loading News...

Loading News...

VADODARA, February 9, 2026 — Binance controls approximately 87% of the circulating supply of World Liberty Financial's USD1 stablecoin, a $4.7 billion concentration that market analysts flag as a critical liquidity vulnerability. According to data from Arkham Intelligence, this stake represents a disproportionate holding compared to Binance's positions in other major stablecoins like USDT or USDC. This latest crypto news highlights a deepening nexus between the exchange and the issuer, raising questions about market structure integrity during a period of extreme fear.

Forbes first reported the concentration, citing Arkham's on-chain forensic data. The USD1 stablecoin has a total circulating supply of $5.4 billion. Binance's wallet addresses hold roughly $4.7 billion of that total. Crypto researcher Molly White emphasized the risks of such a concentration. She stated that when a token is concentrated on a single exchange, it allows the exchange to exert undue influence over the project. White further noted that a significant portion of the 87% is likely held directly by Binance, not merely on behalf of customers. This creates a direct liability on the exchange's balance sheet.

Historical context adds a regulatory dimension. Binance founder Changpeng Zhao pleaded guilty in 2023 to failures in operating an anti-money laundering program. He received a four-month prison sentence. President Donald Trump pardoned him last year. This historical overhang compounds current market scrutiny of Binance's operational practices.

This concentration event occurs against a backdrop of Extreme Fear, with the Crypto Fear & Greed Index at 14/100. Historically, high stablecoin concentration on a single entity precedes liquidity crises. The 2022 collapse of Terra's UST demonstrated how concentrated stablecoin redemptions can trigger a death spiral. In contrast, major stablecoins like Tether's USDT maintain broader, multi-exchange distribution to mitigate single-point-of-failure risk.

Underlying this trend is a shift in how exchanges manage treasury assets. Binance's massive USD1 holding suggests it may be using the stablecoin as a primary liquidity reserve. This strategy diverges from holding US Treasury bills directly, as seen with Circle's USDC. Consequently, any stress on WLFI's collateral backing could transmit directly to Binance's solvency perception.

Related Developments: This concentration risk emerges as other systemic pressures mount. Regulatory stalemates in the U.S. and institutional reclassifications of crypto assets contribute to the fragile market structure.

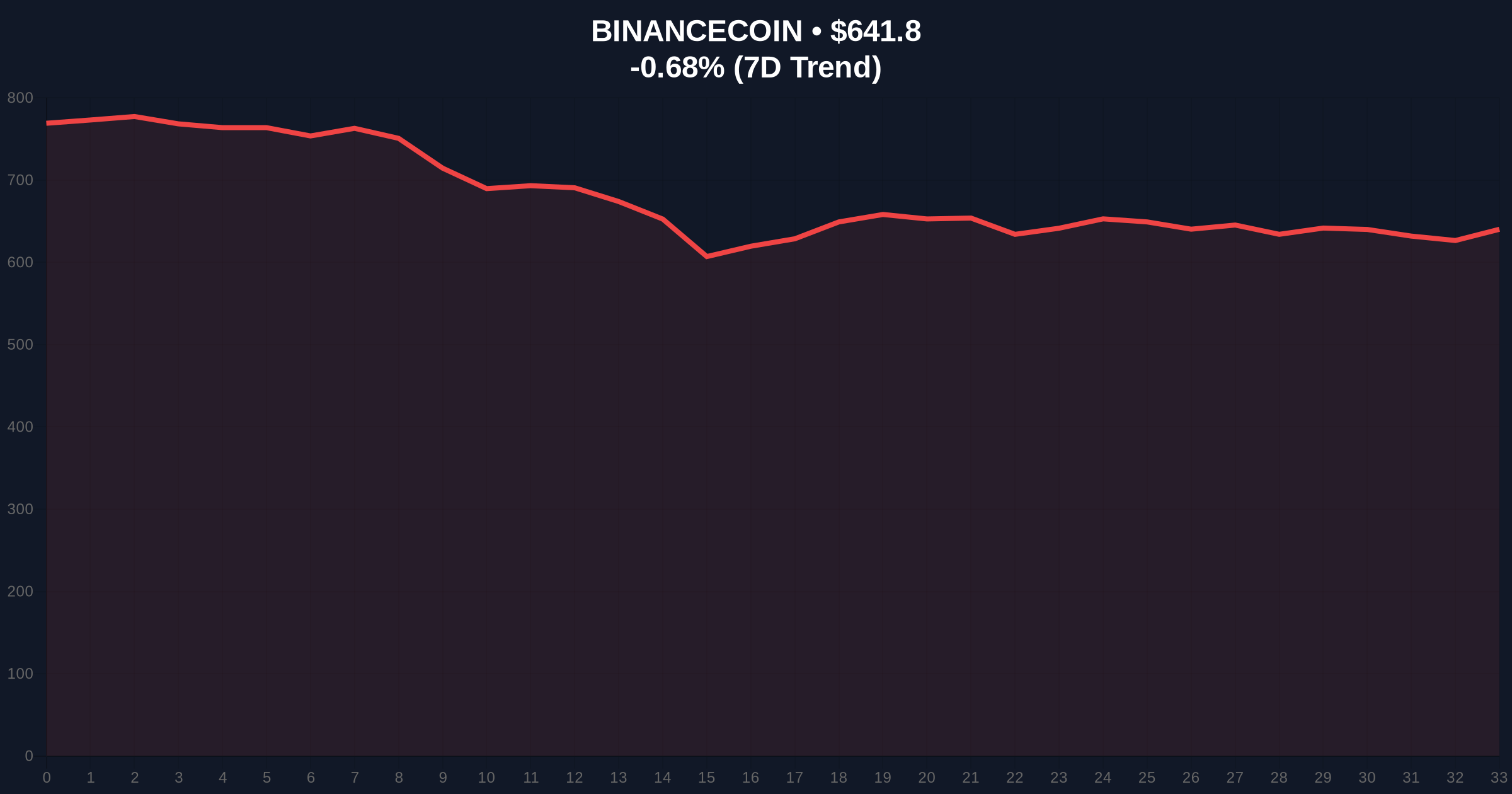

Market structure suggests the concentration creates a latent Fair Value Gap (FVG) in correlated assets. BNB, Binance's native token, currently trades at $641.59, down 0.72% in 24 hours. Its price action is now a key sentiment proxy for exchange stability. Technical analysis indicates a critical Fibonacci 0.618 retracement support level at $620, derived from its 2025 high-low range. A break below this level would invalidate the current consolidation structure and signal deepening fear.

On-chain data indicates that high concentrations often lead to volatile order block movements when the controlling entity rebalances. The USD1's peg stability now heavily depends on Binance's treasury management. If Binance were to rapidly liquidate a portion of its holdings to meet obligations, it could create a supply overhang, destabilizing the peg. This mechanic mirrors the gamma squeeze dynamics seen in equity options, where large concentrated positions force disproportionate price moves.

| Metric | Value |

|---|---|

| Binance's USD1 Holding | $4.7B (87% of supply) |

| Total USD1 Circulation | $5.4B |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| BNB Current Price | $641.59 |

| BNB 24h Change | -0.72% |

This concentration matters because it introduces systemic risk into the crypto liquidity matrix. A $5.4 billion stablecoin with 87% held on one exchange becomes a potential liquidity bomb. If Binance faces operational stress—whether from regulatory action, customer outflows, or collateral issues—it could be forced to liquidate USD1 holdings rapidly. Such a move would pressure the peg and drain liquidity from markets where USD1 is a primary trading pair.

Institutional liquidity cycles depend on stable, decentralized stablecoin distribution. The current structure contradicts that principle. Retail market structure is also at risk, as seen during previous stablecoin de-pegs where retail traders faced massive slippage and failed transactions. The U.S. Securities and Exchange Commission has previously highlighted concentration risks in its guidance on digital asset custody, making this a potential regulatory flashpoint.

"When a single entity controls the majority of a stablecoin's liquidity, it effectively becomes the market maker of last resort. This centralizes risk in a way that is antithetical to crypto's decentralized ethos. Any treasury management misstep at Binance could trigger a contagion event similar to the 2022 credit crunch, but localized within the crypto-native banking system." – CoinMarketBuzz Intelligence Desk

Market analysts outline two primary technical scenarios based on the current concentration risk and broader fear sentiment.

The 12-month institutional outlook hinges on de-risking this concentration. Historical cycles suggest that such high stakes either lead to a gradual distribution of holdings to other institutions or become the epicenter of a liquidity event. For the 5-year horizon, this event the need for stablecoin issuers to enforce distribution limits or face regulatory mandates, similar to bank concentration limits outlined by the Federal Reserve.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.