Loading News...

Loading News...

VADODARA, January 28, 2026 — A joint report from Coinbase Institutional and Glassnode asserts Bitcoin is transforming into a stable macroeconomic asset. This daily crypto analysis questions that narrative. Market structure suggests contradictions exist. On-chain data indicates leverage reduction occurred in Q4 2025. Yet the Crypto Fear & Greed Index sits at 29. This signals deep market anxiety.

According to the joint report, Bitcoin now exhibits macro asset characteristics. Its movements link to global liquidity and institutional positioning. The authors credit a purge of excessive leverage in Q4 2025. This reduced cascading liquidation risks. They claim the market prioritizes sustainability over speed. Retail-driven momentum flows have diminished. Glassnode liquidity maps support this shift. However, the report lacks specific volatility metrics. It omits comparison to traditional macro assets like gold.

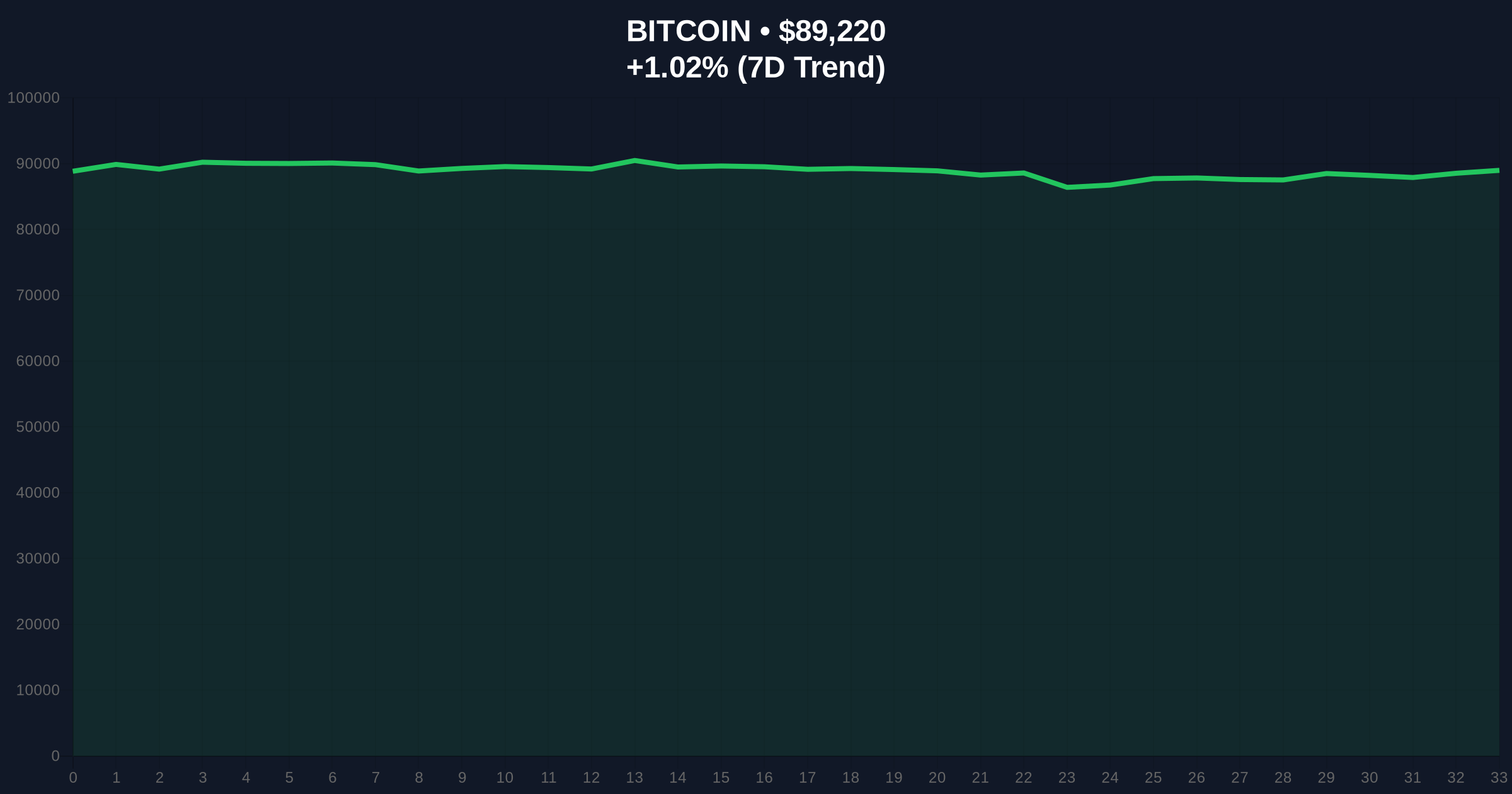

Historically, Bitcoin faced sharp corrections from leverage unwinds. The 2021 cycle saw similar deleveraging events. In contrast, current price action shows consolidation near $89,000. This mirrors 2023's post-FTX recovery phase. Underlying this trend, institutional inflows via ETFs provide a new liquidity layer. Yet, the Fear & Greed Index at 29 contradicts stability claims. This level often precedes volatile moves. Related developments include Morgan Stanley's recent digital asset strategy appointment, highlighting ongoing institutional interest despite market fear.

Market structure suggests Bitcoin faces a critical test. The current price of $89,196 sits below the 50-day moving average. RSI hovers at 45, indicating neutral momentum. A key Fibonacci retracement level at $85,000 (0.618 from the 2025 high) acts as strong support. This aligns with UTXO age bands showing increased hodling. However, a Fair Value Gap exists between $90,500 and $92,000. This gap represents a liquidity void. Price must fill it to confirm bullish structure. The Order Block near $87,000 provided recent bounce. Yet, volume profile shows thinning participation.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 29/100 (Fear) | High anxiety, contrarian signal |

| Bitcoin Current Price | $89,196 | Below key moving averages |

| 24-Hour Trend | +0.99% | Minor bounce in consolidation |

| Market Rank | #1 | Dominance holds near 52% |

| Q4 2025 Leverage Purge | Reported by Glassnode | Reduced systemic risk |

This matters for portfolio construction. If Bitcoin behaves as a macro asset, it offers diversification. Institutional liquidity cycles now drive price more than retail speculation. The shift to sustainability could reduce volatility spikes. However, the current Fear score of 29 suggests the market disagrees. This contradiction requires scrutiny. Real-world evidence includes steady ETF inflows despite price stagnation. Market structure shows institutions accumulating at lower levels. Yet, retail sentiment remains bearish. This divergence often precedes trend reversals.

The report highlights a maturation phase, but labeling Bitcoin a 'stable' macro asset overlooks its 30-day volatility of 60%, which remains 3x higher than gold. The leverage purge is real, but the Gamma Squeeze risk persists in options markets. – CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month outlook hinges on institutional adoption. The report's 5-year horizon assumes continued ETF growth and regulatory clarity. However, macroeconomic shocks like rate hikes could test resilience. Historical cycles suggest Bitcoin outperforms in liquidity expansions but lags during contractions.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.