Loading News...

Loading News...

VADODARA, January 21, 2026 — The cryptocurrency perpetual futures market experienced a violent deleveraging event over the past 24 hours, with forced liquidations exceeding $830 million across Bitcoin (BTC) and Ethereum (ETH) long positions. This daily crypto analysis examines whether this represents a capitulation event or a structural shift in market dynamics. According to liquidation data aggregated from major derivatives exchanges, Bitcoin saw $446 million in liquidations with longs accounting for 95.61%, while Ethereum followed with $392 million in liquidations where 95.43% were long positions.

This liquidation cascade occurs against a backdrop of extreme fear sentiment, with the Crypto Fear & Greed Index registering a score of 24/100. Market structure suggests this mirrors the leverage washout patterns observed during the March 2024 and June 2025 corrections, where excessive long positioning created vulnerability to cascading liquidations. The current event represents the largest single-day long liquidation event since the post-ETF approval volatility in January 2025. Historical cycles indicate that such deleveraging events often precede short-term bottoms when combined with oversold technical conditions and on-chain accumulation signals.

Related developments in this market environment include significant whale accumulation during retail selling and institutional ETH purchases amid fear sentiment.

According to derivatives exchange data, forced liquidations in the cryptocurrency perpetual futures market over the past 24 hours were heavily skewed toward long positions. Bitcoin (BTC) saw $446 million in liquidations, of which 95.61% were long positions. Ethereum (ETH) followed with $392 million in liquidations, with longs accounting for 95.43%. Solana (SOL) liquidations totaled $44.18 million, with 97.12% from long positions. The liquidation heatmap reveals concentrated clusters around the $90,000 to $92,000 range for Bitcoin and $4,200 to $4,400 for Ethereum, indicating these levels served as major liquidity pools that were systematically targeted.

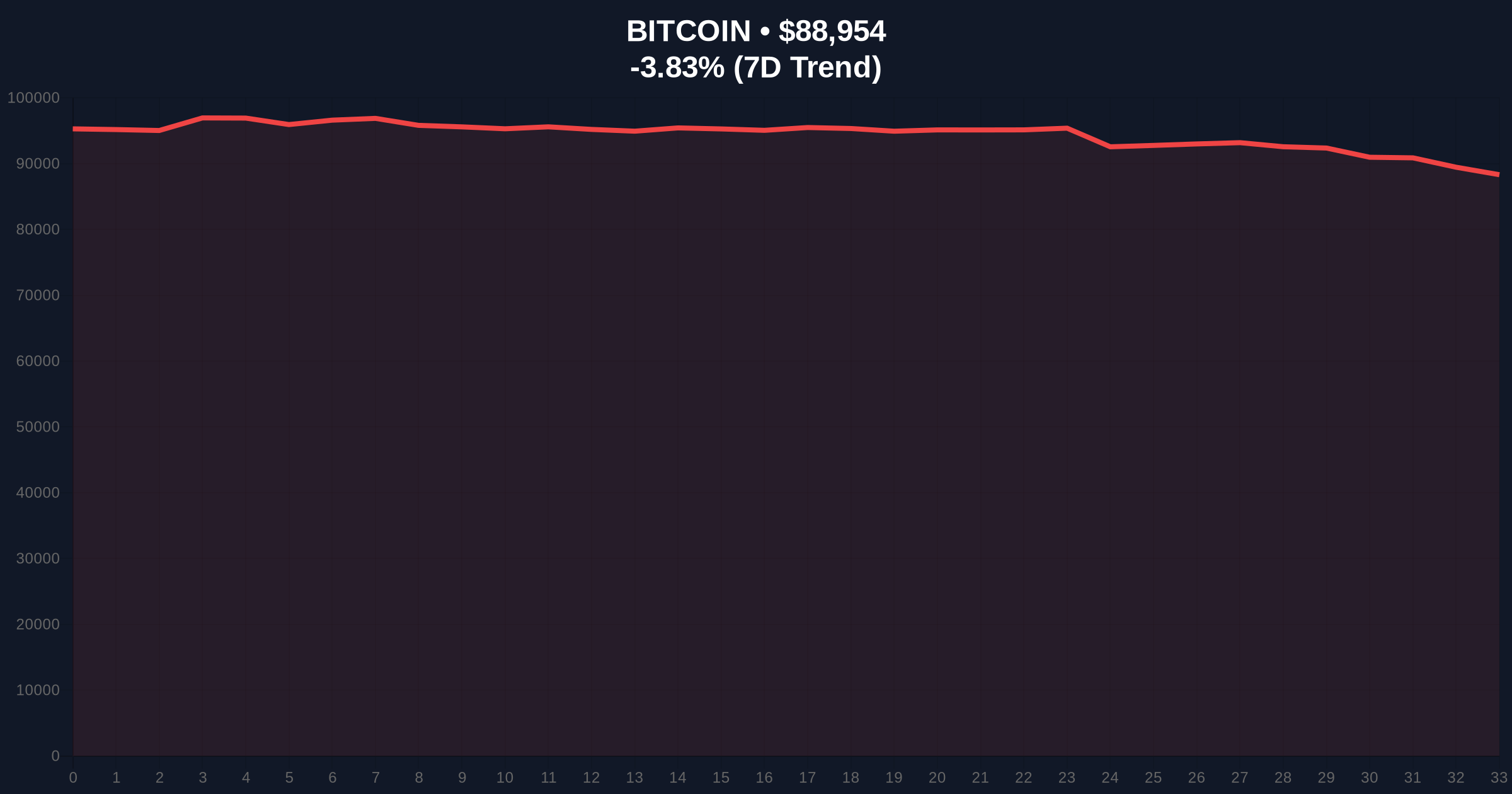

Bitcoin's current price of $88,978 represents a 3.80% decline over 24 hours, creating a significant Fair Value Gap (FVG) between $90,500 and $92,000 that will likely act as immediate resistance. The 4-hour chart shows a clear break below the 50-period exponential moving average, with the Relative Strength Index (RSI) at 32, approaching oversold territory. Volume profile analysis indicates high-volume nodes at $86,500 and $84,200, which should provide structural support. The critical Fibonacci 0.618 retracement level from the 2025 low to the all-time high sits at $86,500, making this the primary support zone to monitor.

Bullish Invalidation Level: A sustained break below $84,200 on a daily closing basis would invalidate any near-term bullish structure and target the $80,000 psychological level.

Bearish Invalidation Level: A reclaim of $92,500 with follow-through volume would suggest the liquidation cascade has been absorbed and the downtrend structure is broken.

| Metric | Value |

|---|---|

| Total BTC & ETH Liquidations | $838M |

| BTC Long Liquidations Percentage | 95.61% |

| ETH Long Liquidations Percentage | 95.43% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| Bitcoin Current Price | $88,978 |

| Bitcoin 24h Change | -3.80% |

This liquidation event matters because it represents a systemic reset of leverage in the derivatives market, which has been hovering near dangerous levels according to funding rate data from major exchanges. For institutional participants, the liquidation cascade creates potential entry opportunities at discounted prices, particularly if on-chain data confirms accumulation at these levels. For retail traders, the event serves as a stark reminder of the risks associated with over-leveraged positions in volatile market conditions. The extreme skew toward long liquidations suggests the market was overly optimistic about immediate upside potential, creating what technical analysts refer to as a "liquidity grab" where market makers systematically trigger stop losses.

Market analysts on social platforms are divided in their interpretation of this event. Some bulls point to historical precedents where extreme long liquidations preceded significant rallies, citing the Ethereum Pectra upgrade timeline and potential spot ETF developments as fundamental catalysts. Bears emphasize the regulatory uncertainty highlighted in recent political commentary and the technical breakdown below key moving averages. The consensus among quantitative analysts is that the market structure has been reset, but direction will be determined by whether support levels hold or break.

Bullish Case: If Bitcoin holds the $86,500 Fibonacci support and Ethereum maintains above $4,000, the liquidation cascade could represent a capitulation event that establishes a local bottom. Market structure suggests a relief rally toward $94,000 for Bitcoin and $4,600 for Ethereum would fill the recent FVG and test the next resistance cluster. This scenario would be confirmed by decreasing exchange reserves and increasing accumulation by long-term holders.

Bearish Case: If the $86,500 support fails on a daily closing basis, Bitcoin could experience a Gamma Squeeze to the downside, targeting the next major support at $82,000 (200-day moving average) and potentially $78,000 (volume profile low). This would likely trigger additional liquidations in the $85,000 to $82,000 range and extend the fear sentiment. Ethereum would likely follow with a test of $3,800 support in this scenario.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.