Loading News...

Loading News...

VADODARA, January 21, 2026 — Trend Research, a subsidiary of LD Capital, executed a $20 million Ethereum purchase on Binance, acquiring 6,656 ETH and depositing it into Aave. This daily crypto analysis reveals a systematic accumulation strategy that has amassed 651,310 ETH worth $1.91 billion since November 2025, when ETH traded at $3,400. Market structure suggests this represents a calculated liquidity grab during extreme fear conditions, with on-chain data indicating persistent borrowing of USDT to fund purchases.

This accumulation pattern mirrors institutional behavior observed during previous crypto cycles, where sophisticated entities deployed capital during periods of retail capitulation. According to on-chain data from Etherscan, Trend Research's strategy involves leveraging borrowed stablecoins to acquire ETH, creating a synthetic long position with embedded leverage. Underlying this trend is the broader macroeconomic uncertainty documented in the Federal Reserve's latest monetary policy statements, which have driven volatility across risk assets. Consequently, entities with deep liquidity pools are positioning for a potential mean reversion. Related developments include the recent $150 billion market cap decline and macro forecasts for Bitcoin, highlighting the interconnected nature of current market stress.

On January 21, 2026, Trend Research borrowed 20 million USDT and purchased 6,656 ETH on Binance at an average price of approximately $3,005, based on transaction timestamps. The firm immediately deposited these assets into the Aave lending protocol, according to wallet activity visible on Etherscan. This transaction increases their total ETH holdings to 651,310 ETH, valued at $1.91 billion at current prices. The accumulation campaign began in November 2025 when ETH was trading at $3,400, with continuous borrowing of USDT to execute purchases. This creates a visible order block on volume profile charts between $3,000 and $3,400.

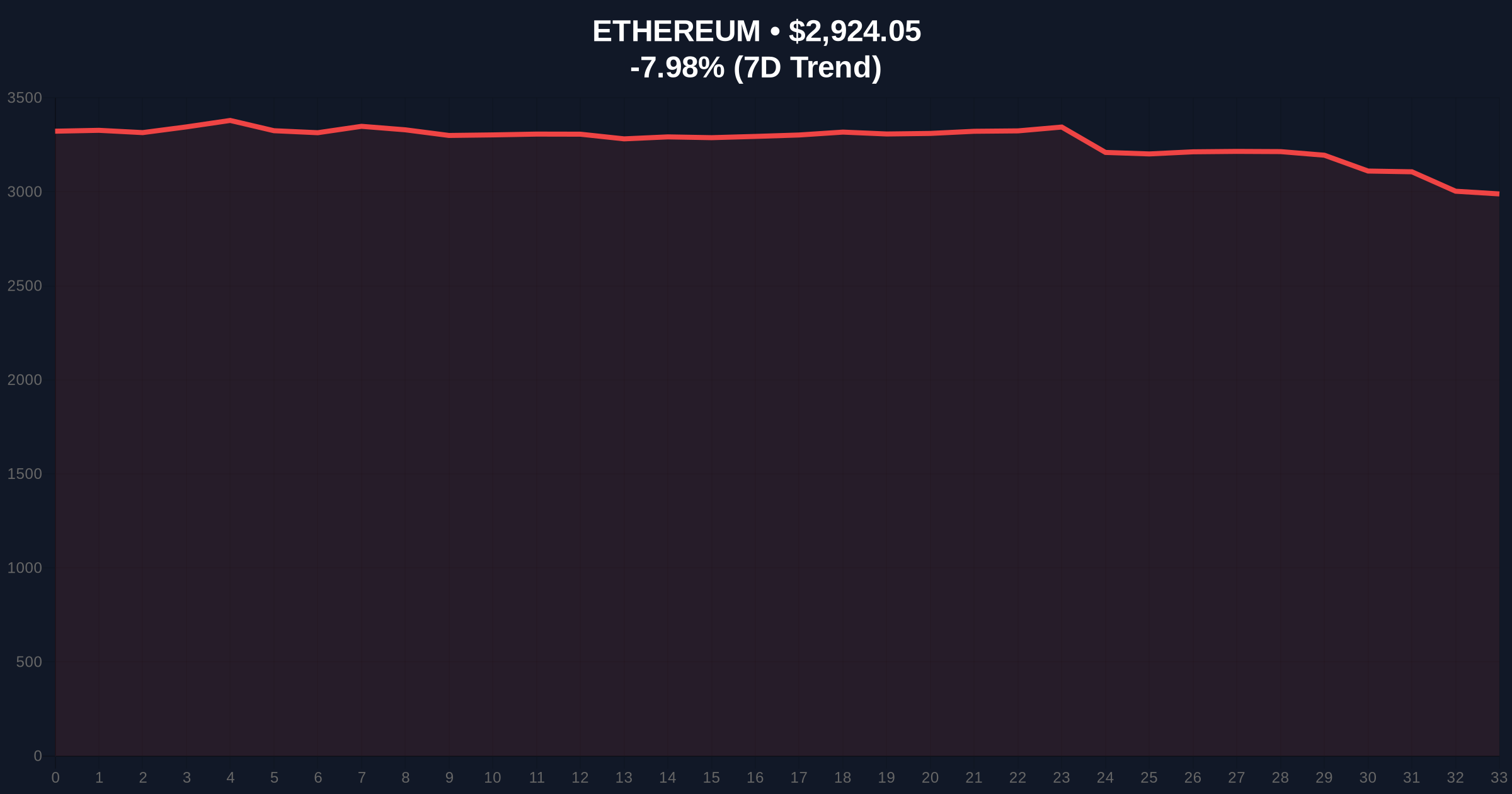

Ethereum's price action shows ETH currently trading at $2,923.58, down 8.15% in 24 hours. Market structure suggests critical support at the $2,850 level, which aligns with the 0.618 Fibonacci retracement from the 2025 high. The Relative Strength Index (RSI) sits at 32, indicating oversold conditions but not yet extreme capitulation. The 50-day moving average at $3,150 acts as dynamic resistance, creating a Fair Value Gap (FVG) between current prices and this level. A break above $3,150 would signal a potential gamma squeeze as short positions cover. Bullish Invalidation Level: $2,850 (break below suggests failed accumulation). Bearish Invalidation Level: $3,400 (break above confirms accumulation success and targets previous highs).

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| ETH Current Price | $2,923.58 |

| 24-Hour Price Change | -8.15% |

| Trend Research Total ETH Holdings | 651,310 ETH |

| Total Holdings Value | $1.91 billion |

This accumulation matters because it represents institutional capital deployment during extreme fear, potentially establishing a liquidity floor for Ethereum. For institutions, the use of borrowed USDT creates leveraged exposure without liquidating other assets, a strategy detailed in Ethereum's official documentation on decentralized finance mechanics. For retail traders, this signals that sophisticated players see value at current levels, though the high leverage employed increases systemic risk if prices decline further. The continuous borrowing pattern suggests confidence in Ethereum's post-merge issuance dynamics and the upcoming Pectra upgrade's technical improvements.

Market analysts on X/Twitter are divided. Bulls point to the sheer size of accumulation as a vote of confidence in Ethereum's long-term value proposition, particularly its transition to proof-of-stake. Bears highlight the leveraged nature of purchases, warning that forced liquidations could exacerbate downside volatility. One quantitative analyst noted, "The Aave deposits create recursive yield opportunities, but also concentration risk if lending markets become stressed." This skepticism aligns with concerns raised in reports on Ethereum's technical challenges.

Bullish Case: If ETH holds the $2,850 support and breaks above the $3,150 resistance, the Fair Value Gap could propel prices toward $3,400. Continued institutional accumulation would provide buying pressure, with a 12-month target of $4,200 based on historical mean reversion patterns after extreme fear readings.

Bearish Case: A break below $2,850 would invalidate the accumulation thesis, triggering stop-losses and potentially pushing ETH toward $2,600. The leveraged nature of Trend Research's position could force liquidations, creating a negative feedback loop. In this scenario, ETH could test the $2,400 level within 3-6 months.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.