Loading News...

Loading News...

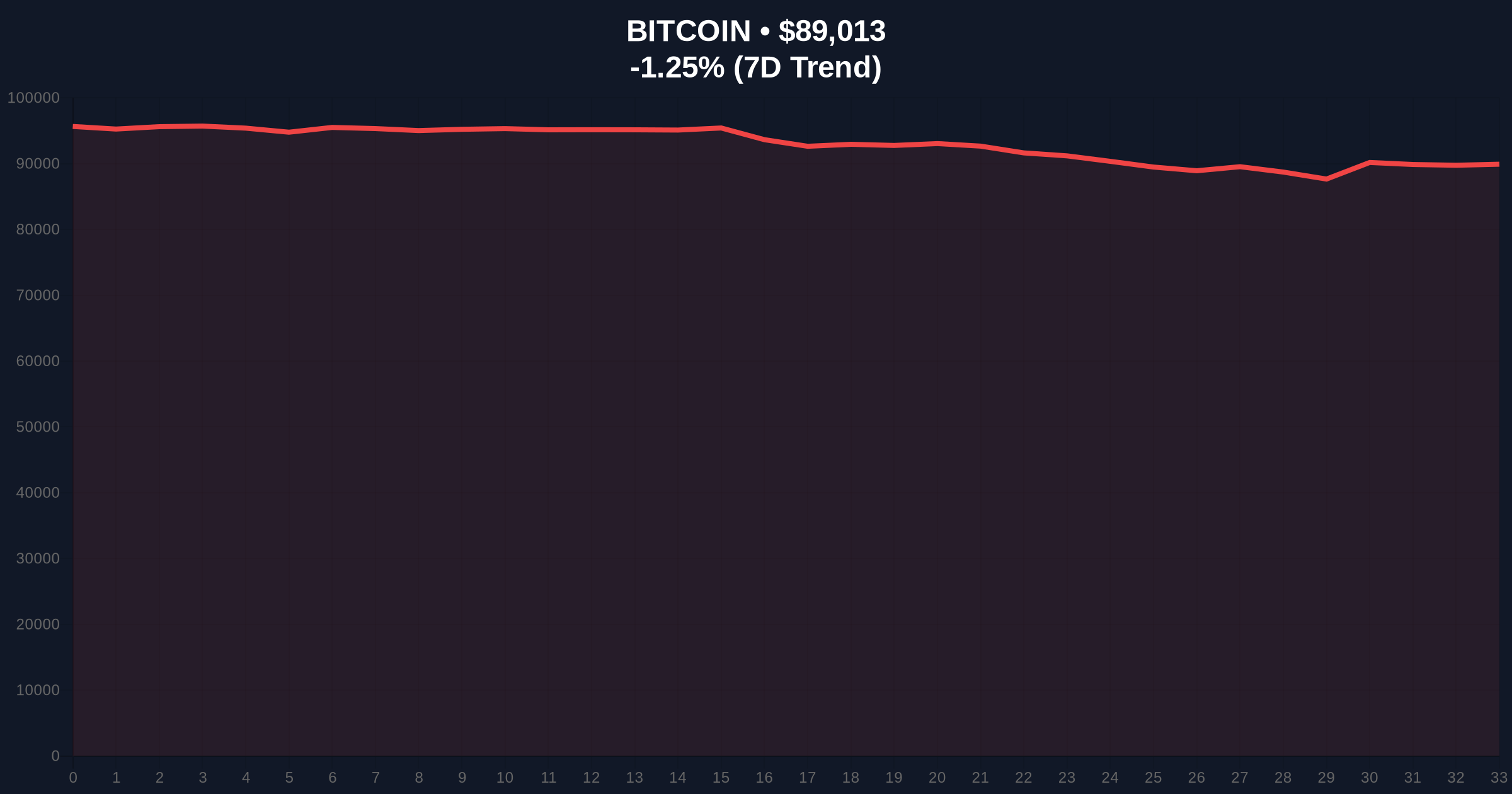

VADODARA, January 22, 2026 — Bitcoin is exhibiting severe price weakness against gold, challenging its core narrative as digital gold in today's daily crypto analysis. The BTC-to-gold ratio has collapsed approximately 55% from its December 2024 peak, according to CoinDesk data. This structural breakdown occurs amid extreme fear market sentiment and a critical test of Bitcoin's $89,000 support level.

Bitcoin's correlation breakdown with traditional risk assets has been a key bullish thesis since 2020. Market structure suggests the digital gold narrative gained traction during periods of monetary expansion. Historical cycles indicate similar ratio declines occurred in 2018 (-84%) and 2022 (-77%), per the CoinDesk analysis. The current downturn mirrors these liquidity grab events where capital rotates from crypto to perceived safe havens. Related developments include recent Bitcoin price action testing key support levels amid similar sentiment conditions.

The BTC-to-gold ratio currently sits at approximately 18.46. This represents a 55% decline from the December 2024 peak. Spot gold has gained 12% year-to-date, reaching as high as $4,900 per ounce. Over a five-year period, gold's 160% return has outpaced Bitcoin's 150%. On-chain data indicates this underperformance is creating a significant fair value gap in the ratio chart. The analysis points to historical precedents suggesting the current downturn may not have reached its floor.

Bitcoin currently trades at $89,039, down 1.22% in 24 hours. The daily chart shows a clear order block breakdown at the $92,000 level. Volume profile analysis indicates thinning liquidity above $90,500. The RSI sits at 38, suggesting oversold conditions but not extreme. The 50-day moving average at $91,200 acts as immediate resistance. Bullish invalidation occurs below the $87,500 Fibonacci support level (0.618 retracement from the 2024 low). Bearish invalidation requires a close above the $93,800 fair value gap.

| Metric | Value | Context |

|---|---|---|

| BTC/Gold Ratio | 18.46 | Down 55% from Dec 2024 peak |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Lowest reading in 3 months |

| Bitcoin Current Price | $89,039 | -1.22% 24h change |

| Gold Price (Spot) | $4,900/oz | +12% YTD gain |

| 5-Year Return (Gold vs BTC) | 160% vs 150% | Gold outperforming |

For institutions, this ratio breakdown questions Bitcoin's role in treasury reserve strategies. The Federal Reserve's monetary policy stance directly impacts both assets, but gold's recent outperformance suggests different beta characteristics. For retail, the narrative shift could impact long-term holding patterns. Market structure suggests sustained ratio weakness may trigger a gamma squeeze in gold derivatives while pressuring Bitcoin's miner revenue model.

Market analysts on X/Twitter highlight the ratio's technical breakdown. "The 55% decline mirrors previous cycle lows," noted one quantitative trader. Bulls point to Bitcoin's superior portability and programmability as long-term advantages. Bears emphasize gold's millennia-long store-of-value track record. The sentiment split reflects uncertainty about Bitcoin's monetary premium durability.

Bullish Case: Bitcoin holds the $87,500 Fibonacci support. The ratio finds a base near current levels as institutional adoption accelerates post-2026 regulatory clarity. Bitcoin resumes outperformance as digital scarcity narratives strengthen. Target: Ratio recovery to 25+ within 12 months.

Bearish Case: The ratio continues its descent toward historical 77-84% decline levels. Bitcoin breaks $87,500 support, triggering a liquidity grab toward $82,000. Gold maintains momentum amid geopolitical uncertainty. Target: Ratio falls to 12-15 range, testing Bitcoin's digital gold thesis validity.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.