Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

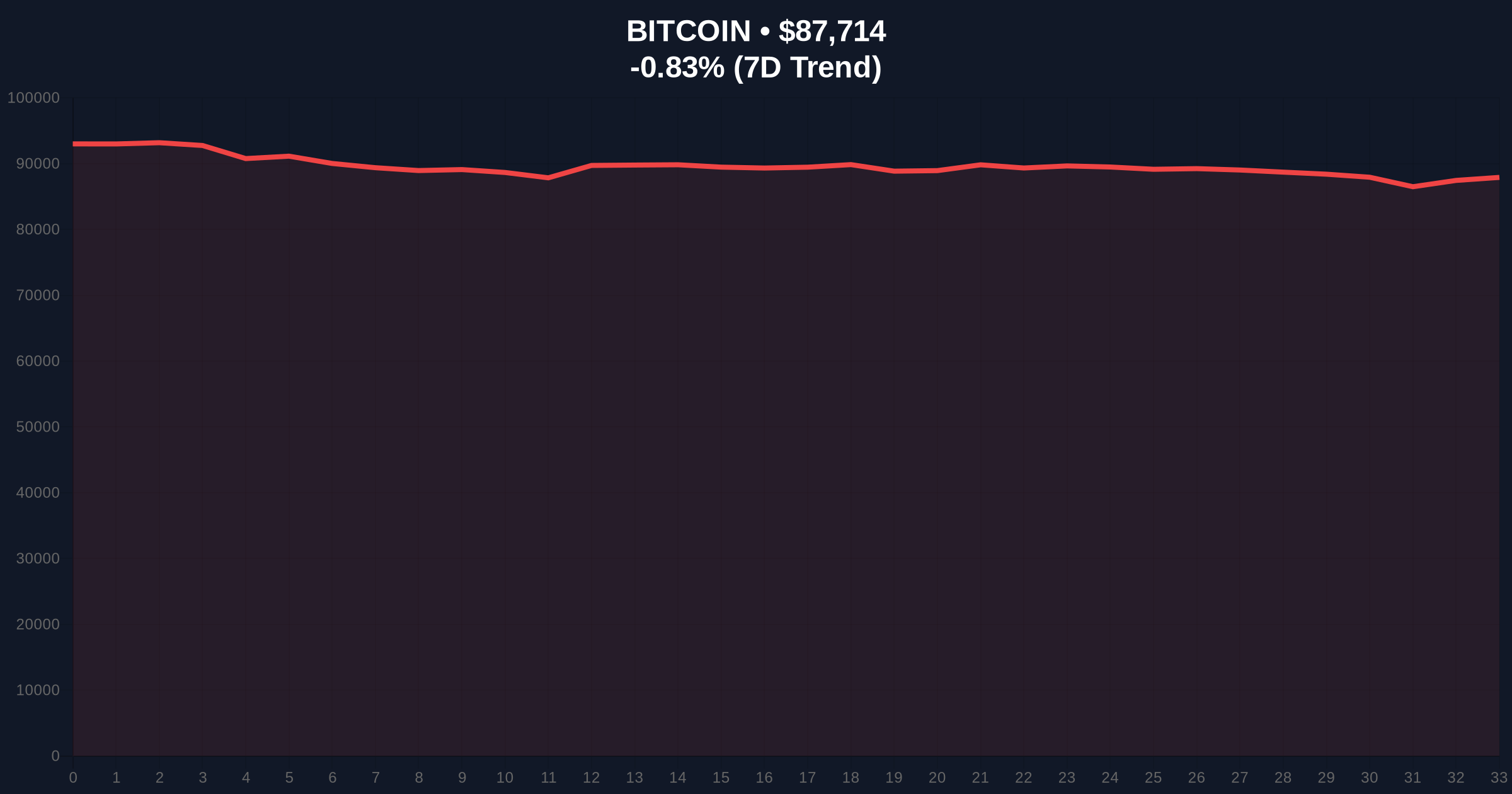

VADODARA, January 26, 2026 — Bitcoin enters a week with four key factors threatening its market structure, according to a Cointelegraph analysis. This daily crypto analysis examines a potential breakdown below previous lows, the Federal Open Market Committee (FOMC) press conference on January 29, an inverse correlation with surging gold and silver, and a drop in BTC holder profitability to 62%. Market structure suggests these elements could converge to test critical support levels.

Cointelegraph identifies four immediate threats to Bitcoin's price action. First, a breakdown below previous lows following last weekend's decline risks invalidating recent consolidation. Second, the U.S. Federal Open Market Committee press conference on January 29 will dictate monetary policy sentiment. Third, gold and silver rallying to new highs raises concerns of a potential inverse correlation with cryptocurrencies. Fourth, on-chain data from Glassnode indicates the percentage of BTC holders in profit dropped to 62%. This decline in profitability often precedes capitulation events.

Historically, Bitcoin has shown sensitivity to FOMC decisions, with volatility spiking around rate announcements. In contrast, the inverse correlation with gold remains unproven over long cycles. Gold rallied during Bitcoin's 2021 bull run, contradicting the current narrative. Underlying this trend, the drop in profitable holders mirrors the June 2022 cycle low, where profitability fell below 50% before a sustained recovery. , recent outflows from digital asset funds, as detailed in our coverage of the $1.73 billion exodus, exacerbate selling pressure.

Market structure suggests Bitcoin is testing a key order block near $87,726. The 24-hour trend shows a -0.73% decline, indicating weak momentum. A critical Fibonacci 0.618 retracement level at $82,000 from the 2025 rally provides major support. Resistance sits at the 50-day moving average near $90,500. The Relative Strength Index (RSI) hovers at 35, approaching oversold territory but not yet signaling a reversal. Volume profile analysis reveals thinning liquidity below $85,000, which could accelerate a drop if breached.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Potential contrarian buy signal if sentiment reverses |

| Bitcoin Current Price | $87,726 | Testing key support zone |

| 24-Hour Price Change | -0.73% | Bearish short-term momentum |

| BTC Holders in Profit | 62% | Down from recent highs, indicating distribution |

| Market Rank | #1 | Maintains dominance amid altcoin weakness |

This convergence matters because it tests Bitcoin's role as a macro asset. The FOMC decision could tighten liquidity, pressuring risk assets. A drop in profitable holders suggests retail exhaustion, often a precursor to institutional accumulation phases. The inverse correlation debate challenges Bitcoin's "digital gold" narrative. If gold outperforms during risk-off periods, Bitcoin may face re-rating. Institutional cycles, like the recent SBI Holdings ETF filing in Japan, show continued long-term interest despite short-term fear.

Market analysts note the profitability metric is a lagging indicator. The CoinMarketBuzz Intelligence Desk states, "A 62% profitability rate aligns with mid-cycle corrections, not bear market lows. The critical watch is whether the FOMC hints at dovish pivot, which could trigger a short squeeze above $90,000."

Two data-backed scenarios emerge from current market structure. First, a bullish reversal requires holding the $85,000 support and a dovish FOMC tone. Second, a bearish continuation risks a liquidity grab toward $82,000 if support fails. The 12-month outlook depends on macroeconomic policy shifts, with institutional adoption, as seen in global ETF developments, providing a floor.

Historical cycles suggest Bitcoin often bottoms when profitability drops below 60% and fear peaks. The 5-year horizon remains positive due to technological adoption, but short-term volatility requires careful risk management.