Loading News...

Loading News...

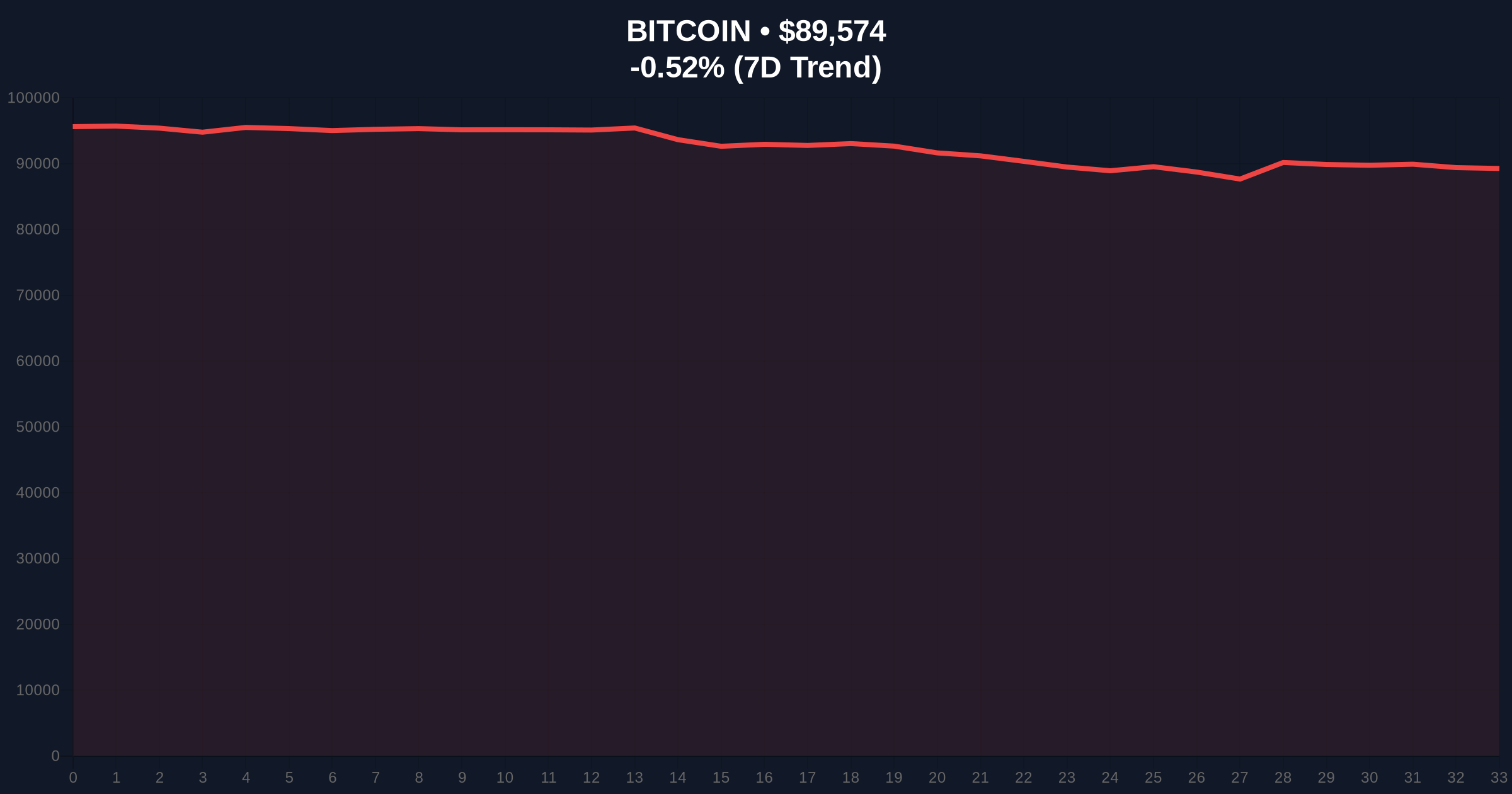

VADODARA, January 23, 2026 — Bitcoin (BTC) is poised for a period of consolidation near $89,500, according to derivatives data from Laevitas, as the market grapples with extreme fear sentiment and failed support at $90,000. This daily crypto analysis examines the contradictions between cautious options strategies and underlying price action, questioning whether a sharp further decline is likely or if sideways accumulation will dominate.

Bitcoin's recent price action mirrors historical consolidation phases, such as the Q4 2023 period where BTC traded in a tight range after failing to hold key psychological levels. According to on-chain data, similar derivatives activity often precedes extended sideways movement, as seen during the 2021 bull market correction. Market structure suggests that the current environment, characterized by extreme fear on the Crypto Fear & Greed Index, may be overstating downside risk relative to actual liquidity flows. Related developments include recent volatility in altcoins and options expiries, such as the Bitcoin options expiry testing $92k max pain and the Altcoin Season Index plunging to 30, both amid extreme fear conditions.

On January 23, 2026, a Cointelegraph report citing Laevitas data indicated that Bitcoin derivatives traders are focusing on volatility strategies rather than directional bets. According to the report, the most active options strategies include long straddles and long iron condors, which profit from price swings without predicting a specific trend. This suggests large-scale investors and market makers expect BTC to trade sideways, accumulating near $89,500. , long-to-short ratios on major exchanges show a rise to 2.18 for top traders on Binance, while leading accounts on OKX have increased long positions despite Bitcoin's failure to hold the $90,000 support level. Market analysts attribute this to a liquidity grab below key psychological thresholds, creating a Fair Value Gap (FVG) that may need filling.

Bitcoin's current price of $89,576 sits within a critical order block between $88,000 and $91,000, as identified on volume profile charts. The Relative Strength Index (RSI) is neutral at 48, indicating neither overbought nor oversold conditions, while the 50-day moving average at $90,200 acts as dynamic resistance. Support levels are established at $87,000 (previous swing low) and $85,000 (Fibonacci 0.618 retracement from the recent high). Bullish invalidation is set at $87,000; a break below this level would signal a breakdown of the consolidation structure and potential for further declines. Bearish invalidation is at $92,000; a move above this resistance could trigger a gamma squeeze, pushing prices higher as options dealers hedge positions.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | Extreme Fear (24/100) | Live Market Data |

| Bitcoin Current Price | $89,576 | Live Market Data |

| 24-Hour Trend | -0.43% | Live Market Data |

| Binance Long-to-Short Ratio | 2.18 | Laevitas via Cointelegraph |

| Key Consolidation Zone | $89,500 | Derivatives Data Analysis |

For institutional investors, this consolidation phase reduces short-term volatility, allowing for strategic accumulation and hedging via options strategies like iron condors. Retail traders, however, may face choppy price action that tests patience, as sideways markets often lead to whipsaws. The extreme fear sentiment, despite neutral derivatives positioning, highlights a disconnect that could present opportunities for contrarian plays. According to Ethereum.org documentation on market mechanics, such environments often precede significant moves once liquidity is redistributed.

Market sentiment on X/Twitter is mixed, with bulls pointing to the rising long-to-short ratios as a sign of underlying strength. One analyst noted, "The options market is pricing in volatility, not doom—this is a classic accumulation signal." Bears, however, caution that failed support at $90,000 and extreme fear readings could lead to a liquidity flush if macroeconomic headwinds intensify. The lack of directional bets in derivatives suggests uncertainty, with many awaiting clearer signals from on-chain metrics like UTXO age bands.

Bullish Case: If Bitcoin holds above $87,000 and breaks $92,000, a move toward $95,000 is likely, driven by a gamma squeeze and renewed institutional interest. This scenario assumes consolidation resolves upward, with post-merge issuance dynamics supporting a slow grind higher.

Bearish Case: A breakdown below $87,000 could trigger a sell-off to $82,000 (next major Fibonacci support), exacerbated by extreme fear sentiment and potential regulatory shifts. This would invalidate the current consolidation thesis and indicate deeper correction phases.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.