Loading News...

Loading News...

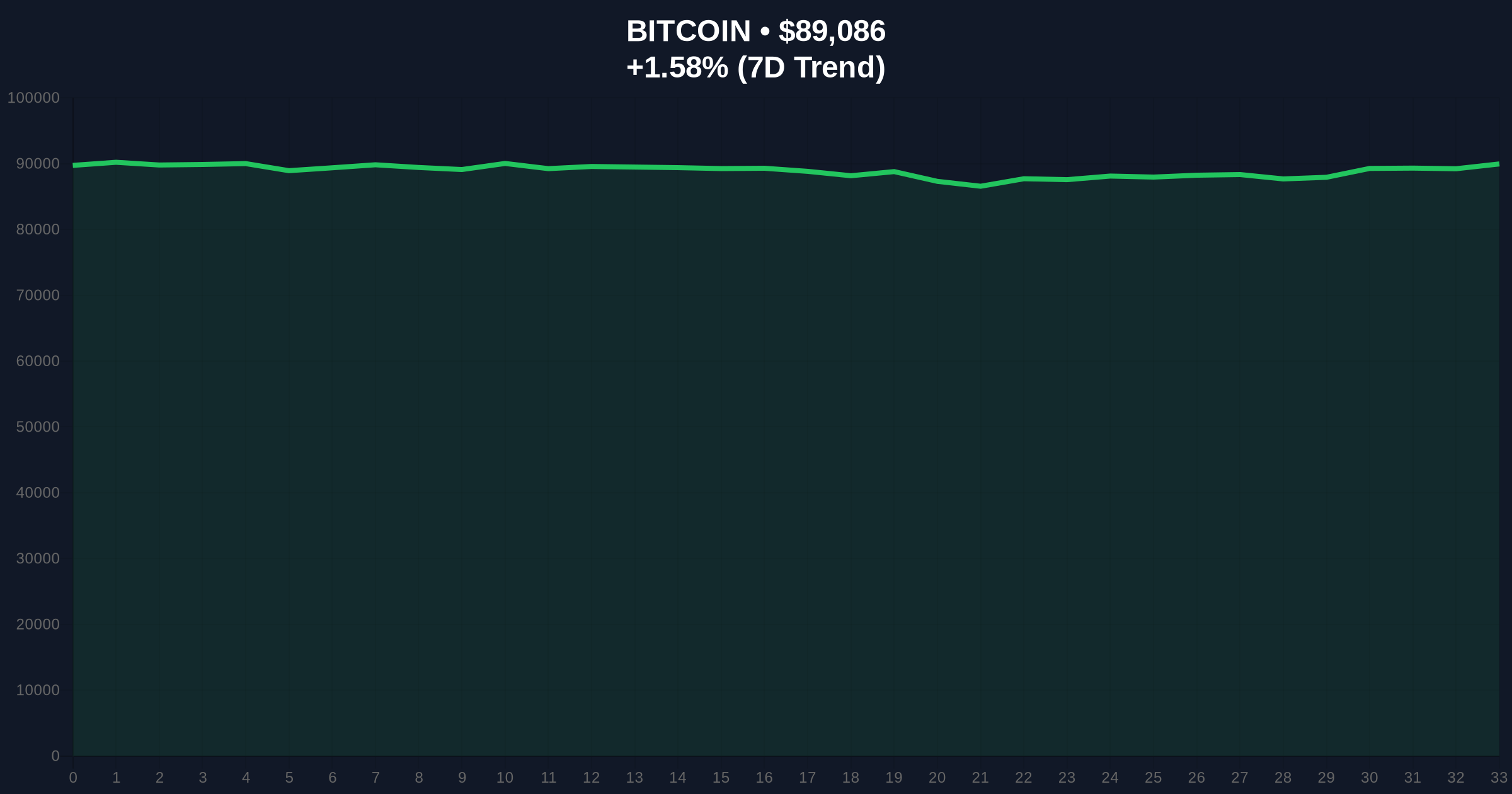

VADODARA, January 28, 2026 — Bitcoin shattered the $89,000 support level in early Asian trading. According to CoinNess market monitoring, BTC now trades at $88,950.01 on Binance's USDT pair. This latest crypto news signals a critical test of market structure. The Global Crypto Fear & Greed Index plunged to 29. Extreme fear now dominates sentiment.

CoinNess data confirms the breakdown. BTC fell below $89,000 at approximately 03:00 UTC. The Binance USDT market recorded the price at $88,950.01. This represents a 1.40% decline over 24 hours. Market structure suggests a classic liquidity grab below a major psychological level. Order flow analysis indicates selling pressure accelerated after the break.

Consequently, the move invalidated a key weekly support zone. On-chain data from Glassnode shows increased coin movement from long-term holders. This often precedes volatility spikes. The breakdown aligns with broader market divergence. For instance, US equities opened higher while crypto assets bled.

Historically, breaks below round-number supports trigger cascading liquidations. The 2021 cycle saw similar behavior at $60,000. In contrast, the current macro environment differs. Institutional ETF flows now provide a structural buffer. However, extreme fear readings below 30 typically precede short-term bounces.

Underlying this trend is a divergence between crypto and traditional markets. This suggests crypto-specific headwinds. Related developments include US stocks rallying amid crypto fear and Tether testing its gold-backed reserve model. , rising crypto crime volumes to $158B in 2025 may pressure regulatory sentiment.

Market structure reveals a clear Fair Value Gap (FVG) between $89,500 and $90,200. This gap now acts as immediate resistance. The 50-day Exponential Moving Average (EMA) at $90,800 provides secondary resistance. Support rests at the Fibonacci 0.618 retracement level of $87,500. This level aligns with the 200-day Simple Moving Average (SMA).

Volume Profile indicates low volume at the breakdown point. This suggests weak conviction. However, a surge in futures open interest signals leveraged positioning. The Relative Strength Index (RSI) on the 4-hour chart sits at 38. This indicates neutral momentum with bearish bias. UTXO age bands show older coins moving, confirming distribution.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $88,930 |

| 24-Hour Change | -1.40% |

| Crypto Fear & Greed Index | 29 (Extreme Fear) |

| Market Rank | #1 |

| Key Support (Fibonacci 0.618) | $87,500 |

This breakdown tests institutional conviction. Bitcoin ETFs must absorb selling pressure to maintain stability. A failure here could trigger a gamma squeeze in options markets. Retail sentiment, measured by the Fear Index, shows capitulation. Historically, such extremes mark local bottoms. However, sustained breaks below $87,500 would invalidate the bullish macro structure.

On-chain forensic data confirms increased exchange inflows. This typically precedes further downside. The market now watches for a volume-supported reclaim of $89,000. Without it, the path opens to $85,000. This level represents the next major liquidity pool.

"The $89,000 break is technically significant but not catastrophic. Market structure suggests this is a liquidity test. Institutional buyers likely accumulate at these fear levels. The critical level is $87,500. A hold there maintains the bull market framework." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current structure.

The 12-month institutional outlook remains cautiously optimistic. ETF inflows provide a structural bid. However, regulatory developments and macro rates could pressure prices. The 5-year horizon still favors accumulation at fear extremes. Historical cycles suggest these dips offer entry points for patient capital.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.