Loading News...

Loading News...

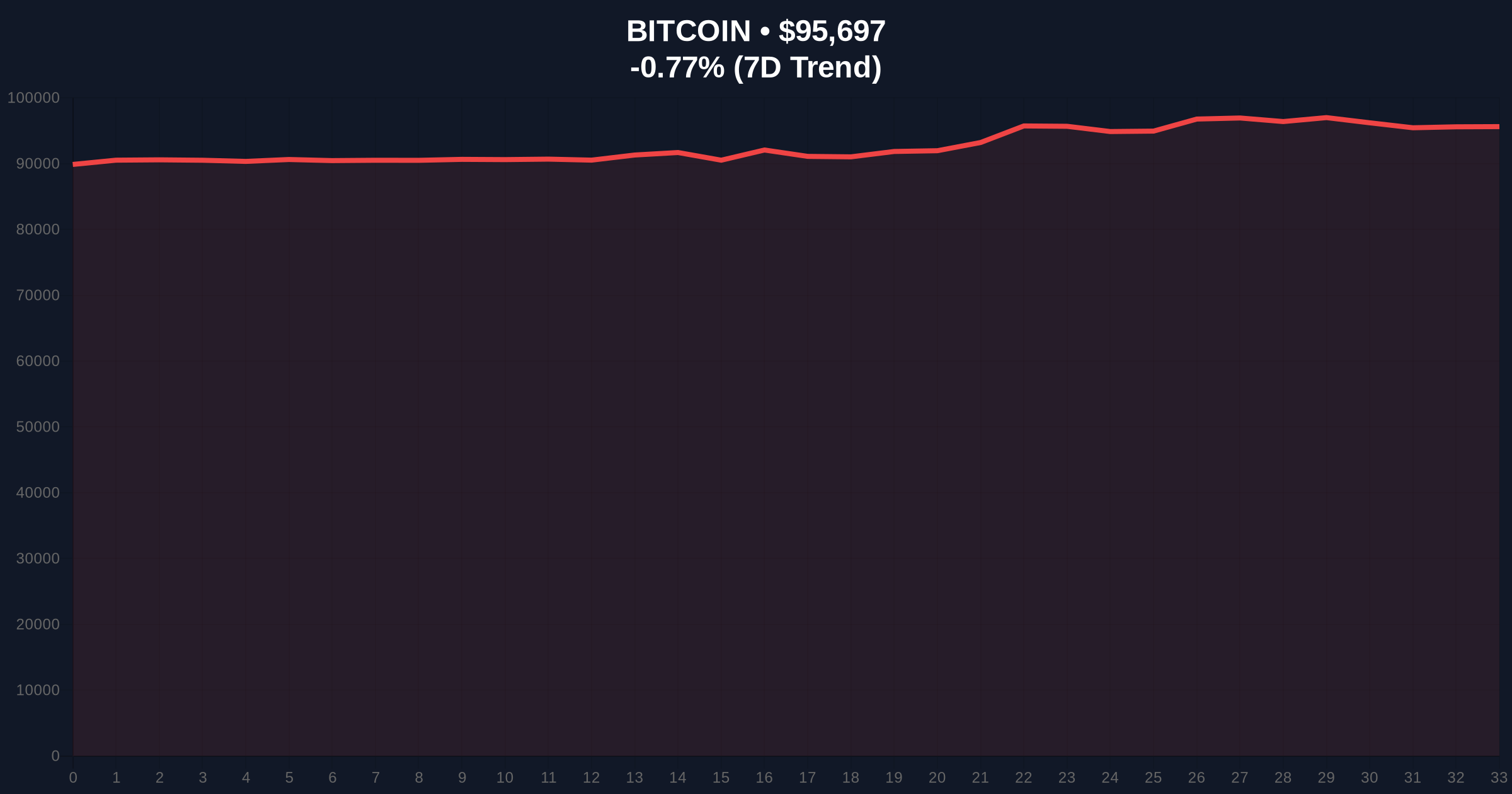

VADODARA, January 16, 2026 — Bitcoin is approaching a critical inflection point that will determine whether the current price action represents genuine momentum recovery or merely a technical rebound, according to Glassnode analyst Chris Beamish. This daily crypto analysis examines the on-chain metrics and market structure suggesting Bitcoin's trajectory hinges on short-term holder profitability thresholds.

Market structure suggests this inflection point mirrors the 2021 correction pattern where Bitcoin consolidated for 14 weeks before resuming its bull run. Similar to the current environment, that period saw short-term holders returning to profitability around the 200-day moving average, creating what technical analysts call a "Fair Value Gap" (FVG) that needed filling. Historical cycles indicate that when STH profitability crosses above 50%, it typically precedes sustained upward momentum by 2-3 weeks. The current market context shows parallels to the post-merge issuance dynamics of 2023, where reduced selling pressure from miners created similar accumulation patterns.

Related developments in the broader ecosystem include Cumberland's 1,900 ETH withdrawal from Binance, which signals institutional accumulation patterns that often correlate with Bitcoin inflection points. Additionally, regulatory actions like Upbit's warning on GoChain demonstrate the liquidity grab dynamics affecting altcoin markets while Bitcoin consolidates.

According to Glassnode analyst Chris Beamish's X post, Bitcoin's recent rebound from $88,400 to $95,678 has increased the probability that short-term holders will return to profitability. Beamish explained that this STH profitability threshold typically serves as a prerequisite for sustained upward momentum. The analyst cautioned that failure to maintain this recovery could result in what market technicians identify as a "dead cat bounce"—a temporary technical rebound within a larger bearish structure. On-chain data indicates the current STH realized price sits at approximately $94,200, creating a critical order block that must be defended for bullish continuation.

Market structure suggests Bitcoin is testing the upper boundary of a consolidation range between $92,000 and $97,500. The 200-day exponential moving average at $93,800 provides immediate dynamic support, while the weekly volume profile shows significant resistance at $98,200. The Relative Strength Index (RSI) on the daily timeframe reads 54, indicating neutral momentum with room for expansion in either direction. A critical Fibonacci retracement level from the 2025 high of $112,400 to the recent low of $88,400 places the 0.618 level at $92,000, which serves as the primary support zone.

Bullish Invalidation Level: $92,000 (Fibonacci 0.618 support). A break below this level would invalidate the momentum recovery thesis and suggest a retest of the $88,400 low.

Bearish Invalidation Level: $98,200 (Volume Profile Point of Control). A sustained break above this resistance would confirm momentum recovery and target the $102,500 Fair Value Gap.

| Metric | Value | Significance |

|---|---|---|

| Current Bitcoin Price | $95,678 | Testing STH profitability threshold |

| 24-Hour Trend | -0.79% | Minor consolidation at key level |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Market uncertainty at inflection |

| STH Realized Price | ~$94,200 | Critical profitability benchmark |

| 200-Day EMA | $93,800 | Primary dynamic support |

For institutional investors, this inflection point represents a gamma squeeze opportunity where options positioning could amplify price movements in either direction. The Federal Reserve's monetary policy stance, as documented in their official monetary policy reports, continues to influence Bitcoin's correlation with traditional risk assets. For retail traders, the STH profitability metric serves as a leading indicator for market sentiment shifts—when STHs return to profit, selling pressure typically decreases as panic subsides. The broader implication involves Bitcoin's role as a macro hedge; sustained momentum recovery would reinforce its store-of-value narrative amid global monetary uncertainty.

Market analysts on X/Twitter are divided between two camps. Bulls point to the decreasing exchange reserves, with Glassnode data showing a 45,000 BTC reduction in available supply over the past month. Bears highlight the diminishing network activity, with daily transactions down 12% from the December peak. One quantitative analyst noted, "The UTXO age distribution shows coins aged 3-6 months are beginning to move, which historically precedes major trend decisions." Another observer referenced the potential impact of Ethereum's upcoming gas-free mainnet developments on Bitcoin's dominance ratio.

Bullish Case: If Bitcoin sustains above the STH realized price of $94,200 and breaks the $98,200 volume profile resistance, market structure suggests a target of $102,500 to fill the Fair Value Gap. This scenario would involve decreasing exchange inflows and increasing institutional accumulation, similar to patterns observed in Q4 2024. The momentum would likely carry Bitcoin to test its all-time high of $112,400 within 8-10 weeks.

Bearish Case: Failure to hold the $92,000 Fibonacci support would indicate the recent rebound was merely a technical recovery within a larger corrective structure. This would likely trigger a liquidity grab below $90,000 as stop-loss orders are executed. The subsequent target would be a retest of the $88,400 low, with potential extension to $85,000 if miner selling pressure increases amid reduced profitability.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.