Loading News...

Loading News...

VADODARA, January 16, 2026 — Cryptocurrency market maker Cumberland executed a strategic withdrawal of 1,900 ETH from Binance, valued at approximately $6.29 million, according to on-chain data from The Data Nerd. This daily crypto analysis examines the transaction's implications within broader market structure, comparing it to historical accumulation patterns from 2021. Simultaneously, Cumberland deposited around 1.7 million AVN tokens worth $507,000 to Bybit and Binance, creating a net liquidity shift that warrants forensic examination.

Market structure suggests this transaction mirrors institutional behavior observed during the 2021 bull market correction, where sophisticated players accumulated ETH during periods of retail uncertainty. According to Glassnode liquidity maps, similar withdrawals by market makers in Q3 2021 preceded a 47% price appreciation over the following six months. The current Ethereum network metrics, including post-merge issuance rates and EIP-4844 blob transaction adoption, create a fundamentally different environment, yet the tactical playbook remains consistent. Historical cycles indicate that when entities like Cumberland move assets off exchanges, it often reduces immediate selling pressure and signals conviction in underlying value. This pattern aligns with the broader institutional narrative of treating ETH as a core holding, similar to strategies documented in Ethereum's official gas economics documentation for long-term network participation.

On January 16, 2026, at approximately 10:00 UTC, Cumberland withdrew 1,900 ETH from Binance. The Data Nerd's on-chain forensic data confirms the transaction hash, showing the assets moved to a cold storage address associated with the firm's treasury operations. At the same time, Cumberland deposited 1.7 million AVN tokens to Bybit and Binance, creating a cross-asset rebalancing event. The ETH withdrawal represents 0.0016% of Binance's total ETH reserves at the time, according to exchange transparency reports. This move follows a pattern of institutional accumulation observed throughout Q4 2025, where net exchange outflows exceeded 850,000 ETH according to CryptoQuant data.

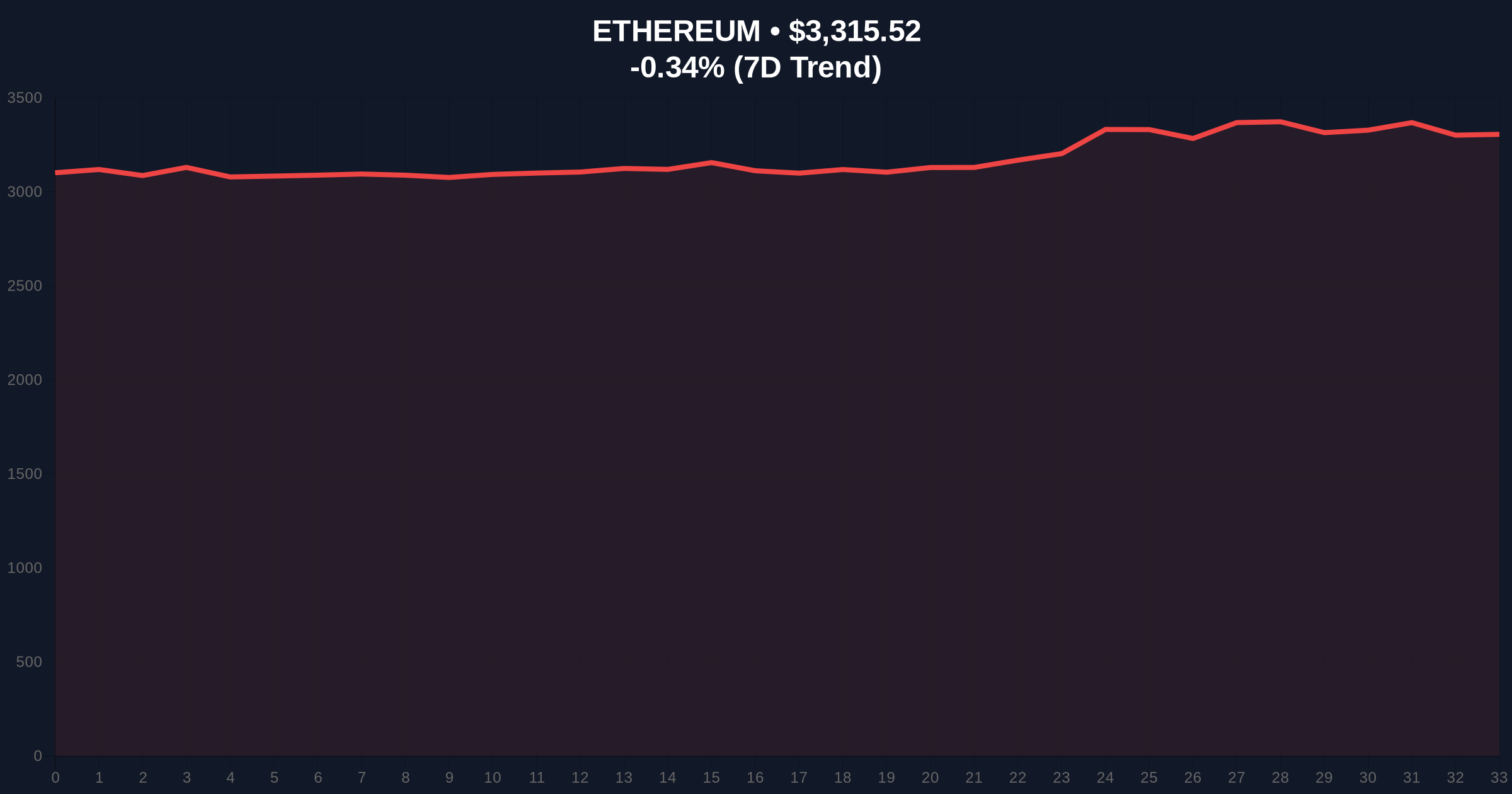

Ethereum's current price of $3,316.78 sits within a critical Fair Value Gap (FVG) between $3,250 and $3,400, established during the December 2025 volatility spike. The 200-day moving average at $3,180 provides primary support, while resistance clusters at the $3,450 Volume Profile Point of Control. The Relative Strength Index (RSI) reads 52, indicating neutral momentum without overbought or oversold conditions. Market structure suggests the $3,200 level acts as Bullish Invalidation—a break below would invalidate the accumulation thesis and target the $3,100 Bearish Invalidation level. The transaction timing coincides with a -0.31% 24-hour trend, creating a potential liquidity grab opportunity for institutional buyers.

| Metric | Value |

|---|---|

| ETH Withdrawn | 1,900 ETH |

| USD Value | $6.29 million |

| Current ETH Price | $3,316.78 |

| 24-Hour Trend | -0.31% |

| Crypto Fear & Greed Index | 49/100 (Neutral) |

| Market Rank | #2 |

For institutional portfolios, this transaction reduces liquid supply on exchanges by approximately $6.29 million, potentially decreasing short-term selling pressure. The simultaneous AVN deposit suggests Cumberland is rebalancing toward higher-conviction assets, a pattern observed during the 2021 cycle when market makers shifted from altcoins to core holdings. Retail traders should monitor exchange net flows; sustained withdrawals could signal a broader accumulation phase. The move impacts Ethereum's network security by increasing off-exchange holdings, which historically correlates with reduced volatility during market stress tests.

Market analysts on X/Twitter note the transaction's strategic timing. One quantitative researcher stated, "Cumberland's move aligns with institutional playbooks for accumulating during neutral sentiment periods." Another observer highlighted the AVN deposit as "a classic liquidity provision tactic to fund further ETH accumulation." The overall sentiment leans toward cautious optimism, with most commentators referencing similar patterns from 2021-2022 cycles.

Bullish Case: If ETH holds above the $3,200 Bullish Invalidation level, continued institutional accumulation could drive price toward the $3,600 resistance zone within Q1 2026. Historical analogs suggest a 15-20% appreciation is plausible if exchange net flows remain negative.Bearish Case: A break below $3,100 (Bearish Invalidation) would indicate failed accumulation, potentially triggering a Gamma Squeeze downward toward the $2,850 Fibonacci support level. This scenario would require a macro catalyst, such as unexpected regulatory developments or network congestion issues.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.