Loading News...

Loading News...

VADODARA, January 6, 2026 — Legendary hedge fund manager Bill Miller, CIO of Miller Value Partners, stated in an interview with CNBC that Bitcoin is poised for another rally, with technical indicators aligning for a potential new all-time high this year. This daily crypto analysis examines the underlying market structure, institutional flows, and technical frameworks that support or challenge this bullish outlook.

Bitcoin has historically exhibited cyclical behavior, with periods of consolidation preceding significant price expansions. According to on-chain data from Glassnode, the asset has never experienced two consecutive years of losses, a statistical anomaly that Miller cited in his interview. This pattern aligns with broader macroeconomic trends, where Bitcoin's scarcity model acts as a hedge against inflationary pressures. Underlying this trend, the integration of Bitcoin into traditional finance via ETFs has altered liquidity dynamics, creating new order blocks that institutional players like Miller are now exploiting. Related developments include Bitcoin ETF inflows hitting $694.7 million and VanEck Index signaling its first bull signal since April 2025, both indicating accelerated institutional accumulation despite prevailing fear sentiment.

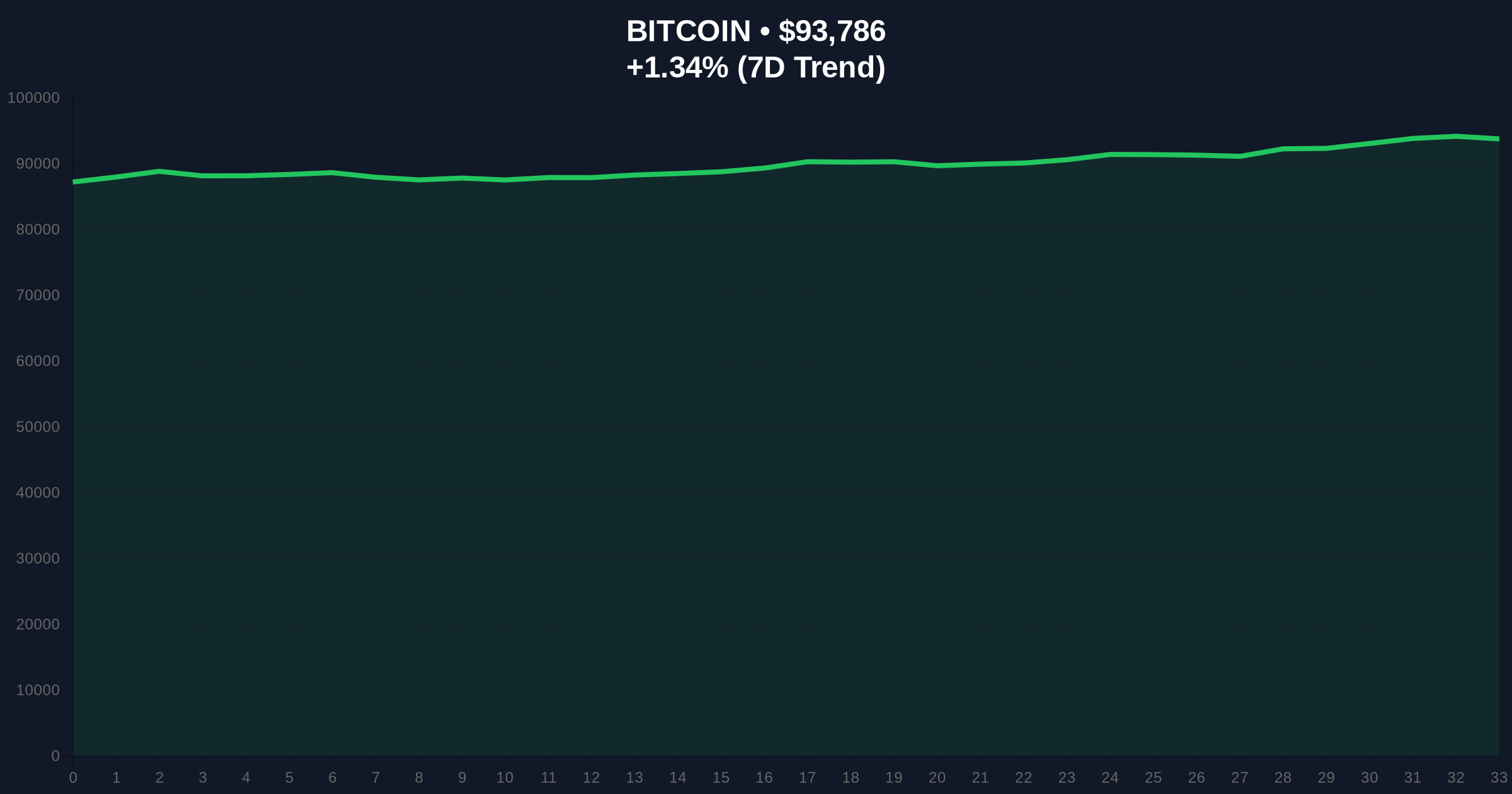

On January 6, 2026, Bill Miller articulated a bullish stance on Bitcoin during a CNBC interview, dismissing last year's decline as insignificant given the asset's inherent volatility. He emphasized that a favorable stance from the U.S. government, potentially through regulatory clarity, could further bolster Bitcoin's ascent. Miller's comments come as Bitcoin trades at $93,828, with a 24-hour trend of 1.39%, according to real-time market data. His prediction is rooted in technical analysis, suggesting that indicators are beginning to align for a sustained upward move. This sentiment echoes broader institutional movements, such as the U.S. Spot Ethereum ETFs seeing $165.45 million in net inflows, highlighting cross-asset confidence in crypto markets.

Market structure suggests Bitcoin is currently testing a critical liquidity zone around $90,000, which acts as a major support level derived from the 200-day moving average and Fibonacci retracement at 61.8% from the previous all-time high. The Relative Strength Index (RSI) is hovering near 55, indicating neutral momentum with room for upward expansion. A Fair Value Gap (FVG) exists between $92,000 and $95,000, where price may seek to fill before establishing a new trend. Volume profile analysis shows increased accumulation at lower levels, suggesting institutional buying pressure. Bullish invalidation is set at $85,000, a break below which would negate the current uptrend structure. Bearish invalidation rests at $100,000, where resistance from previous order blocks could trigger a pullback. The integration of EIP-4844 blobs on Ethereum's network, though not directly impacting Bitcoin, reflects broader blockchain scalability improvements that enhance overall market efficiency.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (44/100) |

| Bitcoin Current Price | $93,828 |

| 24-Hour Trend | +1.39% |

| Market Rank | #1 |

| Key Support Level | $90,000 |

| RSI (14-day) | 55 |

Miller's prediction carries significant weight due to his institutional credibility and historical performance in value investing. For retail investors, this signals potential capital inflows and reduced selling pressure, as outlined in the Goldman Sachs analysis on U.S. crypto bills lowering institutional barriers. Institutionally, it reinforces the narrative of Bitcoin as a long-term store of value, akin to digital gold. The alignment of technical indicators with fundamental catalysts, such as regulatory developments, could trigger a gamma squeeze in derivatives markets, amplifying price movements. Consequently, market participants should monitor on-chain metrics like UTXO age and exchange flows to validate accumulation trends.

Market analysts on X/Twitter have reacted with cautious optimism, noting that Miller's track record adds credibility but warning of over-leverage risks. Bulls emphasize the historical precedent of Bitcoin rebounding after downturns, while bears point to macroeconomic headwinds like potential Federal Reserve rate hikes. According to the FederalReserve.gov, monetary policy shifts could impact liquidity conditions, affecting crypto valuations. Overall, sentiment remains bifurcated, with institutional voices like Miller providing a counter-narrative to the prevailing fear index.

Bullish Case: If Bitcoin holds above $90,000 and breaks through the $100,000 resistance, technical projections suggest a rally toward $120,000 by mid-2026. This scenario assumes continued institutional inflows, favorable regulatory clarity from the U.S. government, and sustained on-chain accumulation. Market structure indicates that a breakout above the current range could trigger a liquidity grab, pushing prices higher.Bearish Case: A breakdown below $85,000 would invalidate the bullish thesis, potentially leading to a retest of $80,000 support. This could occur if macroeconomic conditions deteriorate, such as increased regulatory scrutiny or a broader risk-off sentiment in traditional markets. On-chain data indicates that sustained selling pressure from long-term holders would be a key warning sign.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.