Loading News...

Loading News...

VADODARA, January 10, 2026 — Binance founder Changpeng Zhao reports US banks are accumulating Bitcoin while retail investors panic-sell. This latest crypto news highlights a critical divergence in market behavior. According to Zhao, Wells Fargo Bank purchased $383 million worth of Bitcoin. Market structure suggests a classic liquidity grab.

Historical cycles indicate institutional accumulation during retail capitulation often precedes major rallies. The 2021 cycle saw similar patterns before Bitcoin's ascent to $69,000. Current on-chain data shows UTXO age bands shifting, with short-term holders selling. This mirrors the 2018-2019 accumulation phase. Related developments include crypto futures liquidations hitting $112 million amid extreme fear.

On January 10, 2026, Changpeng Zhao cited a report detailing Wells Fargo's Bitcoin purchase. The bank acquired $383 million worth of the asset. Retail investors are panic-selling, according to exchange flow data. This creates a Fair Value Gap (FVG) between institutional buying pressure and retail selling. The divergence is stark.

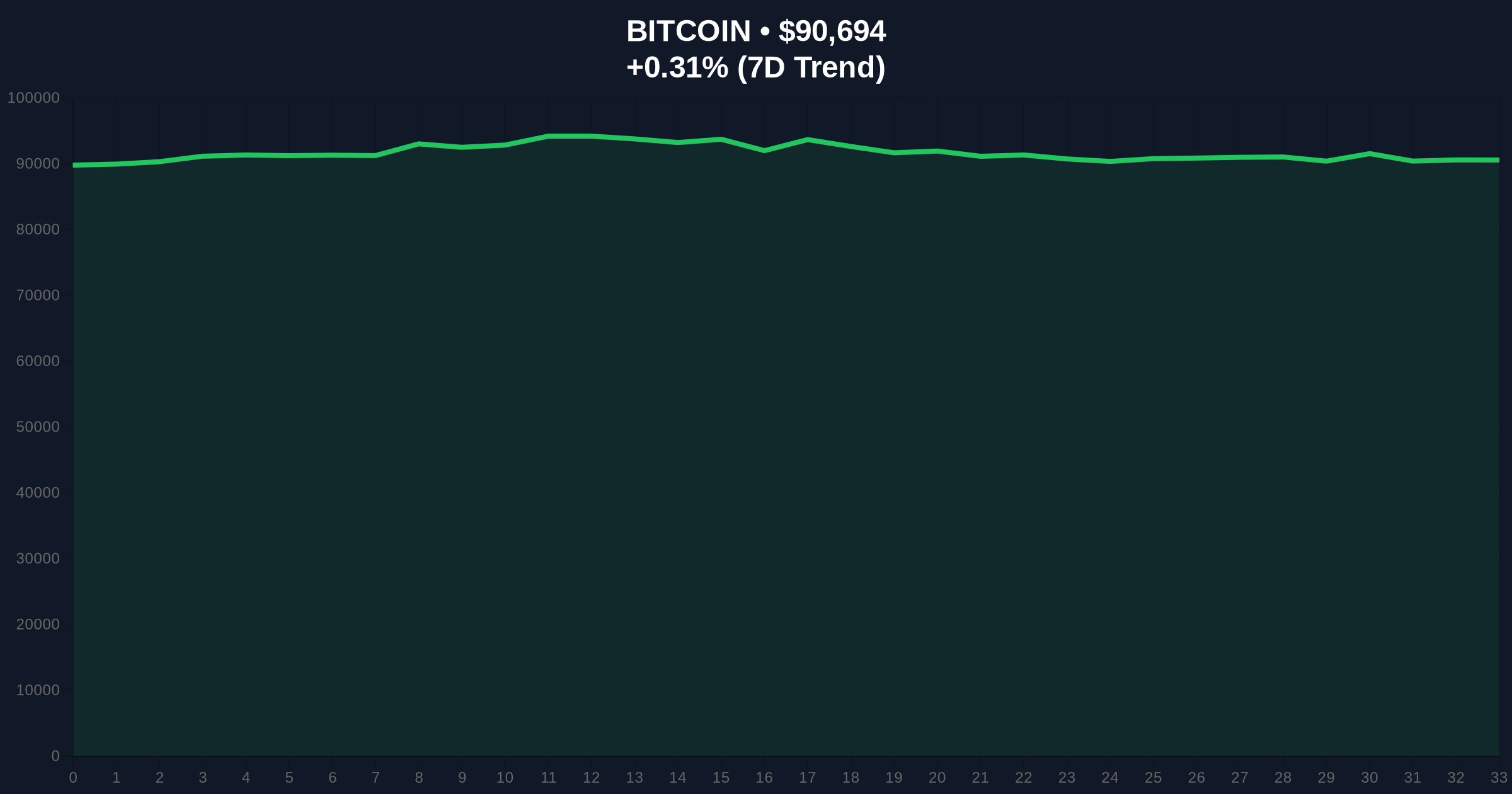

Bitcoin currently trades at $90,690, up 0.30% in 24 hours. The 200-day moving average sits at $85,200. RSI is at 42, indicating neutral momentum. Key support forms at the $88,500 order block, a level tested multiple times in Q4 2025. Resistance is at $93,800, the previous weekly high. Bullish Invalidation: A break below $88,500 invalidates the accumulation thesis. Bearish Invalidation: A close above $93,800 confirms bullish continuation. Volume profile shows increased selling at $91,000.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) |

| Bitcoin Current Price | $90,690 |

| 24-Hour Trend | +0.30% |

| Wells Fargo Purchase | $383 million |

| Market Rank | #1 |

Institutional impact is profound. Banks like Wells Fargo signal regulatory acceptance, potentially easing future ETF approvals. Retail impact is psychological; panic-selling often marks local bottoms. The Federal Reserve's monetary policy, detailed on FederalReserve.gov, influences liquidity flows. This divergence could lead to a gamma squeeze if options markets align.

Market analysts note the irony. Bulls argue this is smart money accumulation. Bears point to macroeconomic headwinds. No direct quotes from figures like Michael Saylor are available, but sentiment on X/Twitter is polarized. The extreme fear reading of 25/100 suggests maximum pessimism.

Bullish Case: Institutional buying supports a move to $100,000. A break above $93,800 resistance could trigger short covering. The 5-year horizon includes Bitcoin's next halving in 2028, reducing issuance.

Bearish Case: Retail selling overwhelms banks. A break below $88,500 support targets $82,000 Fibonacci level. Macroeconomic factors like interest rates could pressure risk assets.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.