Loading News...

Loading News...

VADODARA, January 10, 2026 — U.S. Bitcoin spot exchange-traded funds recorded a net outflow of $252.09 million on January 9, marking the fourth consecutive trading day of capital withdrawal according to data compiled by TraderT. This daily crypto analysis examines the structural implications of persistent institutional selling pressure amid a market gripped by extreme fear.

Market structure suggests this outflow pattern mirrors the distribution phases observed during previous Bitcoin cycles, particularly the 2021 Q4 correction. Underlying this trend is a broader liquidity squeeze, as evidenced by the Altcoin Season Index dropping to 40 and Bitcoin dominance absorbing market liquidity. The current environment reflects a classic risk-off rotation, where institutional capital exits leveraged ETF positions to de-risk portfolios. Consequently, the sustained outflows create a Fair Value Gap (FVG) between ETF NAV and spot price, which typically resolves through either price compression or renewed buying pressure.

According to TraderT's compiled data, BlackRock's IBIT experienced the largest single-day outflow at $254.07 million, while Fidelity's FBTC recorded a modest net inflow of $7.87 million. Bitwise's BITB saw a net outflow of $5.89 million. This marks the fourth consecutive trading day of aggregate net outflows, totaling approximately $850 million over the period. The divergence between fund flows indicates selective institutional repositioning rather than broad-based abandonment. Market analysts attribute this to profit-taking following Bitcoin's recent test of the $95,000 resistance level, combined with macroeconomic uncertainty surrounding Federal Reserve policy.

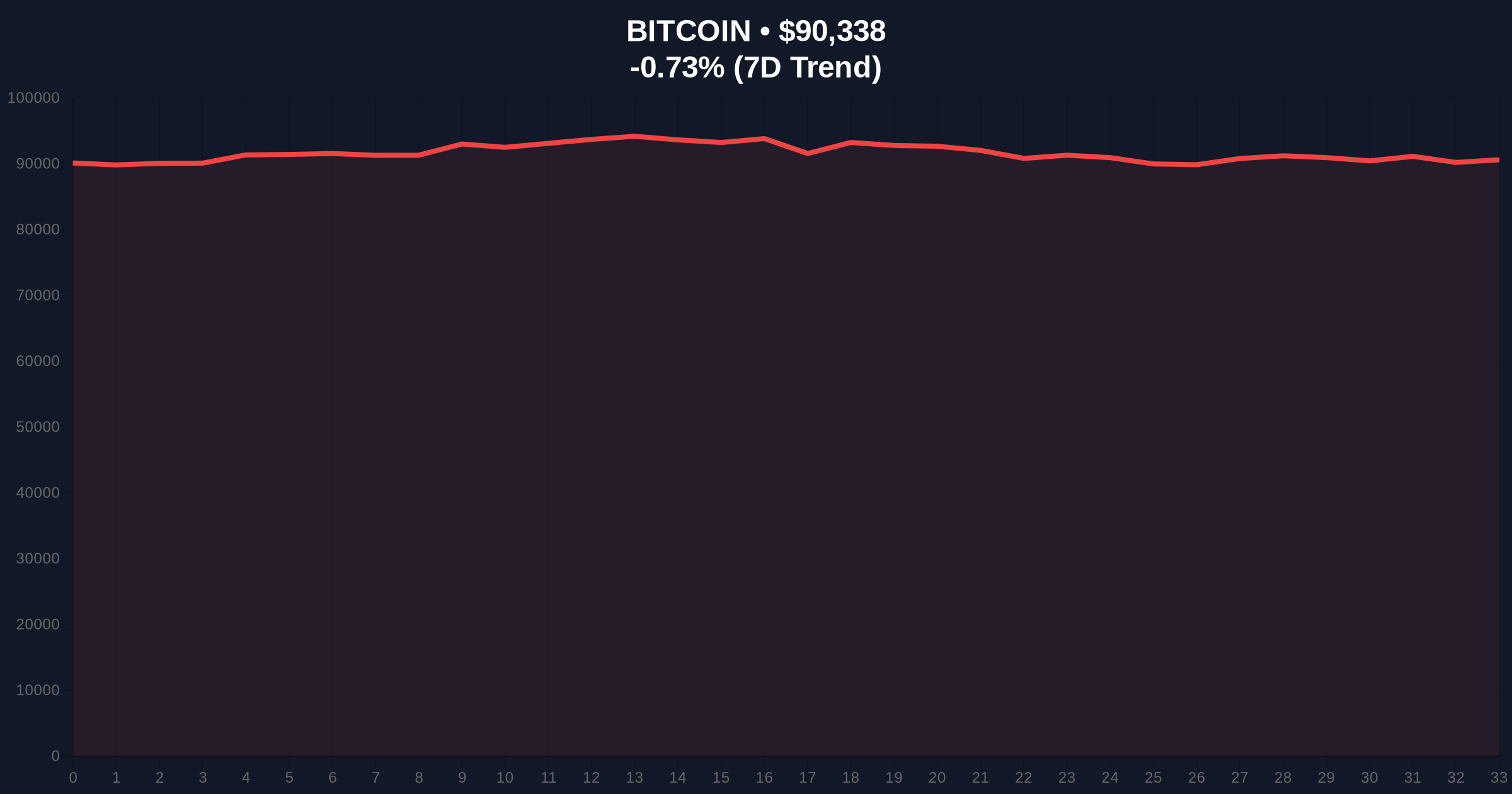

Bitcoin currently trades at $90,332, representing a 24-hour decline of 0.66%. The price action shows consolidation within a descending channel, with immediate support at the $88,500 order block—a critical level where previous accumulation occurred. The 50-day moving average at $89,200 provides dynamic support, while resistance sits at $92,500, corresponding to the volume profile high. RSI readings at 42 indicate neutral momentum with bearish bias. The sustained ETF outflows create selling pressure that tests these technical levels, potentially triggering a liquidity grab below $88,000 if institutional flows continue negative. Bullish invalidation occurs below $88,500, while bearish invalidation requires a close above $92,500 with confirmed volume increase.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 25 (Extreme Fear) |

| Bitcoin Current Price | $90,332 |

| 24-Hour Price Change | -0.66% |

| ETF Net Outflow (Jan 9) | $252.09M |

| Consecutive Outflow Days | 4 |

For institutional investors, sustained ETF outflows signal reduced exposure to Bitcoin's volatility ahead of potential macroeconomic shifts, particularly regarding the Fed Funds Rate. The Federal Reserve's official meeting calendar shows upcoming policy decisions that could impact risk assets. For retail traders, this creates a divergence between spot market sentiment and derivative positioning, increasing the likelihood of a gamma squeeze if volatility spikes. The outflow pattern suggests institutions are harvesting liquidity from the ETF structure, which could pressure Bitcoin's price until a new equilibrium forms between spot buyers and ETF sellers.

Market participants on X/Twitter express concern about the outflow persistence. One quantitative analyst noted, "Four days of consecutive outflows typically precede a test of major support levels." Another observer highlighted the connection to broader market fear, referencing the Crypto Fear & Greed Index plunging to 25. Bulls argue this represents healthy profit-taking after Bitcoin's 30% rally from November lows, while bears point to potential contagion from traditional market risk-off sentiment.

Bullish Case: If ETF outflows decelerate and Bitcoin holds the $88,500 support, a reversal toward $95,000 becomes probable. This scenario requires Fidelity's FBTC to maintain positive flows while BlackRock's outflows stabilize. Historical cycles suggest that four-day outflow streaks often resolve with sharp rebounds when fear metrics reach extreme levels.

Bearish Case: Continued outflows exceeding $200 million daily could break the $88,500 support, targeting the next significant order block at $85,000. This would confirm distribution phase continuation and potentially trigger stop-loss cascades. The bearish scenario gains credibility if the Fear & Greed Index remains below 30 for multiple weeks.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.