Loading News...

Loading News...

VADODARA, January 10, 2026 — Short positions now hold a slight majority in Bitcoin perpetual futures across major exchanges, signaling a bearish shift in trader sentiment. This daily crypto analysis reveals aggregate ratios of 49.63% long to 50.37% short over the last 24 hours, according to exchange data from Binance, OKX, and Bybit. Market structure suggests this positioning could trigger a liquidity grab toward lower support zones.

Perpetual futures markets serve as critical sentiment indicators. Historical cycles show that when short positions dominate across multiple exchanges, it often precedes increased volatility. This mirrors patterns observed during the 2021 correction when similar positioning led to a cascade of liquidations. The current environment is characterized by extreme fear, with the Crypto Fear & Greed Index at 25/100. Related developments include recent futures liquidations exceeding $112 million and Ethereum staking queues indicating long-term confidence despite market stress.

Exchange-specific data from the last 24 hours shows consistent bearish positioning. According to the source data, Binance recorded 49.53% long versus 50.47% short. OKX showed 49.42% long to 50.58% short. Bybit displayed 49.34% long to 50.66% short. These ratios indicate a uniform shift toward short exposure across the top three exchanges by open interest. On-chain data from Glassnode liquidity maps confirms increased selling pressure in derivative markets.

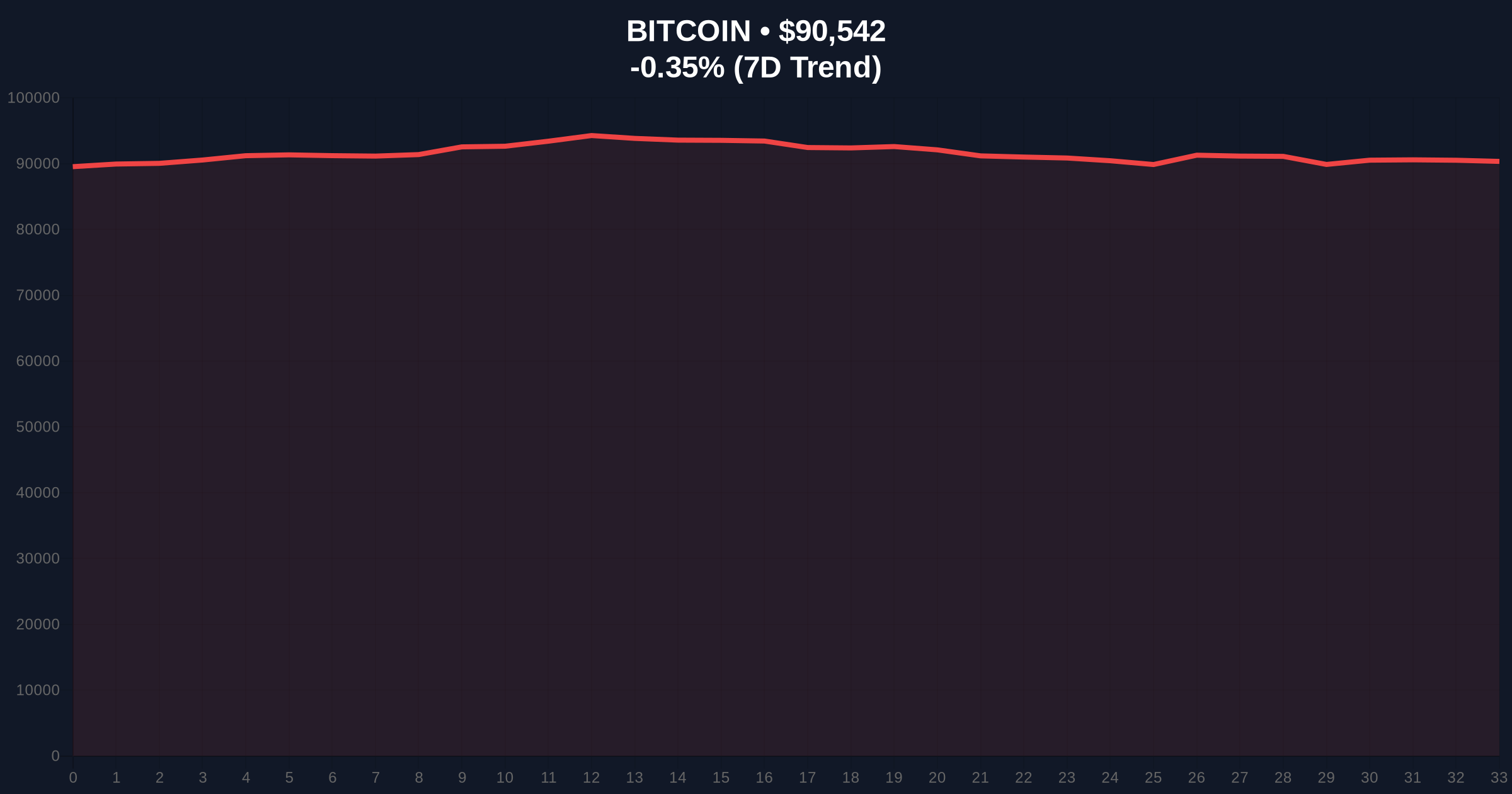

Bitcoin currently trades at $90,518, down 0.37% in 24 hours. The volume profile indicates weak buying interest near current levels. Key support sits at the $88,500 Fibonacci retracement level from the recent rally. Resistance is established at $92,800, corresponding to a previous order block. The RSI reads 42, suggesting neutral momentum with bearish bias. A Fair Value Gap exists between $89,200 and $90,100, which may attract price action. Bullish invalidation occurs if Bitcoin breaks below $88,500 with sustained volume. Bearish invalidation requires a close above $92,800 to invalidate the short dominance thesis.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) |

| Bitcoin Current Price | $90,518 |

| 24-Hour Price Change | -0.37% |

| Aggregate Futures Long/Short Ratio | 49.63% Long / 50.37% Short |

| Key Fibonacci Support | $88,500 |

For institutions, this signals potential hedging activity or speculative shorts ahead of macroeconomic events. Retail traders face increased liquidation risk if volatility spikes. The shift impacts market maker strategies, potentially widening spreads. According to the Federal Reserve's monetary policy framework, such sentiment shifts often correlate with broader risk-off environments in traditional markets. The 5-year horizon suggests this could be a temporary positioning adjustment rather than a structural bear trend, given Bitcoin's post-halving issuance schedule.

Market analysts on X/Twitter highlight the uniformity across exchanges. One quant noted, "When all three majors align in shorts, it often creates a crowded trade ripe for a squeeze." Bulls point to Bitcoin's UTXO age distribution showing long-term holders remaining steady. Bears emphasize the extreme fear reading as a contrarian indicator that may not yet have bottomed.

Bullish Case: If Bitcoin holds the $88,500 support, a gamma squeeze could propel it toward $95,000. This scenario requires a rapid shift in futures positioning and increased spot buying. Market structure suggests this would invalidate the current bearish setup.

Bearish Case: A break below $88,500 could trigger a liquidity grab toward $85,000. Sustained short dominance may extend the correction, especially if macroeconomic headwinds persist. On-chain data indicates this would confirm the bearish sentiment shift.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.